- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Kroger's (KR) Q4 Earnings Surpass Estimates, Increase Y/Y

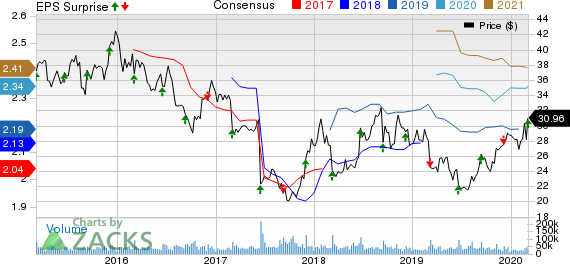

After witnessing a negative earnings surprise in the third quarter of fiscal 2019, The Kroger Co. (NYSE:KR) has reported a beat in the fourth quarter. The company has posted adjusted earnings of 57 cents a share that surpassed the Zacks Consensus Estimate by a penny and increased 18.8% from the prior-year quarter.

This Cincinnati, OH-based company continues to envision fiscal 2020 earnings between $2.30 and $2.40 per share, which indicates an increase from adjusted earnings of $2.19 reported in fiscal 2019. The Zacks Consensus Estimate for earnings for fiscal 2020 currently stands at $2.34.

Total sales of $28.89 billion almost came in line with the Zacks Consensus Estimate, following a miss in the preceding two quarters. The metric increased 2.1% from the prior-year quarter. Excluding fuel and dispositions, the top line improved 2.3% from the year-ago period. The company’s digital sales rose 22%, while identical sales, excluding fuel, grew 2%. Management forecast identical sales, excluding fuel, to be above 2.25% in fiscal 2020.

We note that gross margin contracted 30 basis points to 22.1%. FIFO gross margin, excluding fuel, expanded 6 basis points from the year-ago period on account of improvement in costs of goods and accelerating alternative profit streams, partly offset by investments in price and personalization, and continued industry-wide lower gross margin rates in pharmacy. Adjusted FIFO operating profit increased 20.7% to $758 million. Kroger anticipates adjusted operating profit of $3-$3.1 billion for 2020.

Strategic Endeavors

The grocery industry has been undergoing a fundamental change, with technology playing a major role and the focus shifting to online shopping. Kroger, which faces stiff competition from bellwethers such as Walmart (NYSE:WMT) and Amazon (NASDAQ:AMZN) , has taken stock of the situation and is in the process of giving itself a complete makeover.

The company’s “Restock Kroger” program, involving investments in omnichannel platform, identifying margin-rich alternative profit streams, merchandise optimization, and lowering of expenses, has been gaining traction. The company is expanding store base, introducing new items, digital coupons, and the order online, pick up in store initiative.

Management informed that “Our Brands” sales exceed $23.1 billion. The company also introduced 39 new Our Brands Plant-Based products in 2019. Pickup or Delivery reached 97% of Kroger households (expanded to 1,989 Pickup locations and 2,385 Delivery locations). Management is also targeting “margin-rich alternative profit streams”, which contributed more than $100 million in operating profit this fiscal year versus the prior year. Alternative profit streams are anticipated to contribute an incremental $125-$150 million in operating profit in fiscal 2020.

Other Financial Aspects

Kroger ended the quarter with cash of $393 million, total debt of $14,076 million, and shareowners’ equity of $8,573 million. Net total debt decreased $1,141 million over the last four quarters. Kroger returned $951 million to shareholders in fiscal 2019. The company bought back shares worth $400 million during the fourth quarter as part of its authorization of $1 billion. It forecast free cash flow generation of $1.6-$1.8 billion in fiscal 2020. The company expects to make share repurchases of $500-$1,000 million in fiscal 2020.

Wrapping Up

We believe that Kroger’s customer-centric business model provides a strong value proposition. However, intensifying price war among grocery stores to lure budget-constrained consumers poses concern.

Kroger carries a Zacks Rank #3 (Hold) at present. We note that the stock has advanced 12.6% against the industry’s decline of 1.9% in the past three months. A better-ranked stock is US Foods Holding Corp. (NYSE:USFD) . This Zacks Rank #1 (Strong Buy) company has a long-term earnings growth rate of 10%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

The Kroger Co. (KR): Free Stock Analysis Report

US Foods Holding Corp. (USFD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Palantir Technologies (NASDAQ:PLTR) continues to sell off. On March 6, PLTR stock fell over 10% on nearly double the daily volume, bringing its 30-day decline to over 27%. A drop...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.