- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Koppers (KOP) Stock Up 25% YTD: What's Driving It?

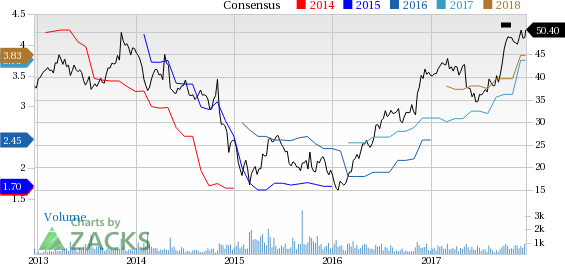

Shares of Koppers Holdings Inc. (NYSE:KOP) have gained around 25% year to date. The company has also outperformed its industry’s gain of roughly 24% to over the same time frame.

Koppers has a market cap of roughly $1 billion and average volume of shares traded in the last three months is around 140.2K. The company has an expected long-term earnings per share growth of 18%, higher than the industry average of 10.1%.

Let’s take a look into the factors that are driving this Zacks Rank #1 (Strong Buy) stock.

Driving Factors

Forecast-topping earnings performance in the first three quarters of 2017 and upbeat prospects have contributed to a rally in Koppers’ shares. The company delivered positive earnings surprise of 94.3%, 28.3% and 62.5% in the first, second and third quarter of 2017, respectively.

Koppers, last month, raised its earnings outlook for 2017 factoring in solid performance year to date. The company now sees adjusted earnings in the range of $3.70 to $3.80 per share for 2017, up from its prior view of $3.10 to $3.30 per share. The revision is partly due to lower than expected effective tax rate.

The company also raised its adjusted EBITDA forecast for 2017 to around $195 million from roughly $185 million expected earlier. The guidance also reflects an increase from $174 million recorded in the prior year.

Koppers should gain from sustained strong performance of its Carbon Materials and Chemicals (CMC) and Performance Chemicals (PC) units. The CMC unit is benefiting from favorable market conditions and savings benefits from the company’s restructuring actions.

While the PC division faces headwinds from raw material cost inflation, it is likely to gain from continued strong demand. The unit is expected to benefit from positive trends in the repair and remodeling market.

Other Stocks to Consider

Other top-ranked companies in the basic materials space include FMC Corporation (NYSE:FMC) , Kronos Worldwide, Inc. (NYSE:KRO) and Westlake Chemical Corporation (NYSE:WLK) , all sporting a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

FMC has an expected long-term earnings growth of 11.3%. The stock has gained around 66% year to date.

Kronos has an expected long-term earnings growth of 5%. The stock has gained around 117% year to date.

Westlake has an expected earnings growth of 10.6% for the current year. Its shares are up roughly 85% year to date.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

FMC Corporation (FMC): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Koppers Holdings Inc. (KOP): Free Stock Analysis Report

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.