- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Coca-Cola European (CCE) Reports 1H16, Offers 2017 View

Newly formed Coca-Cola European Partners plc or CCEP (NYSE:CCE) , formerly known as Coca-Cola Enterprises Inc., reported first-half 2016 results wherein earnings of €0.83 per share were up 10.5% year over year.

Revenues

Total revenue in the period, however, declined 3% year over year. Volumes also declined 1.5% on a comparable basis. The company highlighted the fact that soft consumer environment and persistent economic challenges continue to impact its results. Again, poor weather conditions throughout its territories during the second quarter added to the woes.

Regionally, Iberia witnessed a 1.5% revenue growth in the first half. However, Germany (down 0.5%), Great Britain (10.5%) and France (4.5%) registered a fall in revenues. Again, revenues in the Northern European territories (Belgium, the Netherlands, Norway and Sweden) were down 0.5% due to lower revenues in Belgium. Lower tourist travel in Belgium was partly offset by revenue growth in Norway and Sweden.

Operating Highlights

First-half 2016 cost of sales was up 9% due to the inclusion of Germany and Iberia during the later part of the second quarter. The same drove the company’s operating expenses by 29.5% during the first half of 2016.

Dividend

CCEP declared an initial quarterly dividend of €0.17 per share and maintained its prior commitment to have an initial dividend pay-out ratio of 30% to 40% of profit after taxes.

Guidance

For 2016, CCEP expects revenues to remain flat. Operating profit is expected to grow in a modest mid-single-digit range and earnings in a mid-teen range.

The company also reaffirmed its pre-tax savings target at the €315 million to €340 million range through synergies by mid-2019.

Coca-Cola European Partners plc or CCEP was formed on May 28, 2016 through the combination of Coca-Cola Enterprises or CCE, Coca-Cola Iberian Partners or CCIP and CCEG or Coca-Cola Erfrischungsgetränke AG.

Based on revenues, CCEP is the world’s largest independent Coca-Cola bottler. It serves over 300 million consumers across Western Europe, including Andorra, Belgium, continental France, Germany, Great Britain, Luxembourg, Monaco, the Netherlands, Norway, Portugal, Spain and Sweden.

Zacks Rank & Key Picks

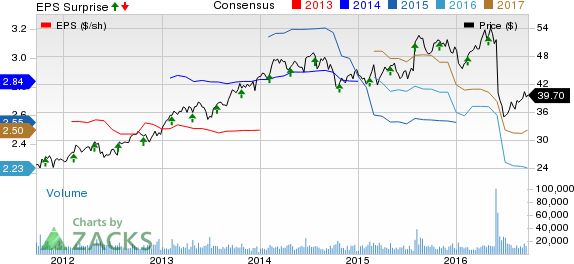

Coca-Cola European Partners currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the beverage sector are Coca-Cola Amatil Limited (OTC:CCLAY) , Dr Pepper Snapple Group, Inc. (NYSE:DPS) and Primo Water Corporation (NASDAQ:PRMW) , all carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

COCA-COLA EU PT (CCE): Free Stock Analysis Report

DR PEPPER SNAPL (DPS): Free Stock Analysis Report

COCA-COLA AMATI (CCLAY): Free Stock Analysis Report

PRIMO WATER CP (PRMW): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.