- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

KeyCorp (KEY) Cheers Investors With An 11% Dividend Hike

KeyCorp’s (NYSE:KEY) board of directors has approved an 11% hike in the company’s quarterly common stock dividend. The revised quarterly dividend now comes in at $0.105 per share versus the previous figure of $0.095. The dividend will be paid on Dec 15 to its shareholders of record as of Nov 28, 2017.

Prior to this hike, the company had raised its dividend by 12% to $0.095 per share in May 2017.

Along with the common stock dividend, the company will also pay a per share dividend of $312.50 on the corporation's outstanding Fixed-to-Floating Rate Perpetual Non-Cumulative Preferred Stock, Series D on Dec 15 to its shareholders of record as of Nov 30, 2017 for Sep 15 to Dec 15, 2017.

Also, the company announced its plan to payout a dividend of $15.3125 on the corporation's outstanding Fixed-to-Floating Rate Perpetual Non-Cumulative Preferred Stock, Series E on Dec 15 to its shareholders as of Nov 30, 2017 for the period, Sep 15 to Dec 15, 2017.

We remain optimistic about its potential to continue enhancing shareholder value, driven by its strong cash generation capabilities.

Considering Friday’s closing price of $18.31 per share, the dividend yield is currently valued at 2.3%.

Investors interested in this Zacks Rank #3 (Hold) stock can have a look at its fundamentals and growth prospects.

Earnings Strength: KeyCorp depicts stable earnings picture. In the past three to five years, the bank witnessed earnings per share (EPS) growth of 7.8%. Also, the company’s earnings are projected to grow at the rate of 18% for 2017 compared with 13.6% for the industry.

Further, the company’s earnings are projected to grow at a rate of 8% over the long term.

Revenue Growth: Organic growth remains a key strength at KeyCorp, as displayed by its revenue story. Revenues witnessed a CAGR of 5.1%, over the last five years (2012–2016), with the trend continuing in first nine months of 2017.

The company’s projected sales growth (F1/F0) of 25.16% (against 5.99% industry average) indicates constant upward momentum in revenues.

Credit Quality: Improving credit quality continues to be a growth catalyst at KeyCorp. The bank has been witnessing a decline in provision for loan losses over the past several quarters. For 2017, management anticipates the net charge-offs (NCOs) rate to be lower than the target range, while provisions are expected to modestly exceed NCOs, given the loan growth.

Stock is Undervalued: KeyCorp has a P/E ratio and P/B ratio of 13.84x and 1.38x compared with the industry’s average of 14.77x and 1.43x, respectively. Based on these ratios, the stock seems undervalued.

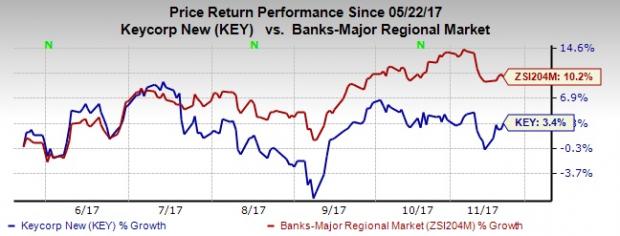

However, the company’s shares have gained 3.4% in the last six months against 10.2% growth for the industry it belongs to.

Stocks to Consider

Shares of Stifel Financial (NYSE:SF) have gained more than 16% over the past six months. The Zacks Consensus Estimate for the stock has moved 1.4% higher over the last 30 days, for 2017. Stifel Financial sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of KB Financial (NYSE:KB) have gained over 9.8% over the past six months. The Zacks Consensus Estimate for the stock has been revised 11.1% upward over the last 30 days, for 2017. It carries a Zacks Rank #1.

Shares of Zacks Ranked #1 First Bancorp (NASDAQ:FBNC) have gained over 28.6% over the past six months. The Zacks Consensus Estimate for the stock has climbed 8.6% upward over the last 30 days, for 2017.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

KeyCorp (KEY): Free Stock Analysis Report

KB Financial Group Inc (KB): Free Stock Analysis Report

First Bancorp (FBNC): Free Stock Analysis Report

Stifel Financial Corporation (SF): Free Stock Analysis Report

Original post

Related Articles

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

When the market narrative becomes too widely accepted, excess seems to be created in some areas of the economy as businesses prepare for what’s coming their way. Today’s stock...

Markets are bouncing back as investors bet on technical support, tariff relief, and Germany’s stimulus plans. But with ISM and NFP data ahead, Fed rate cut bets could shift,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.