- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Juniper Networks (JNPR) Jumps: Stock Rises 5%

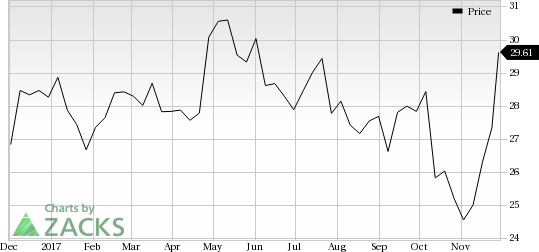

Juniper Networks, Inc. (NYSE:JNPR) was a big mover last session, as the company saw its shares rise 5% on the day. The move came on solid volume too with far more shares changing hands than in a normal session. This breaks the recent trend of the company, as the stock is now trading above the volatile price range of $24.40 to $28.19 in the past one-month time frame.

The upside was driven by rumors of a potential buyout of the company by Nokia (HE:NOKIA) worth $16 billion. However, Nokia has denied such acquisition talks with Juniper Networks.

The company has not seen any estimate revisions in the past one month, while the Zacks Consensus Estimate for the current quarter has also remained unchanged. The recent price action is encouraging though, so make sure to keep a close watch on this firm in the near future.

Juniper Networks currently has a Zacks Rank #4 (Sell), while its Earnings ESP is negative.

A better-ranked stock in the Wireless Equipment industry is Harris Corporation (NYSE:HRS) , which currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Is JNPR going up? Or down? Predict to see what others think: Up or Down

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Juniper Networks, Inc. (JNPR): Free Stock Analysis Report

Harris Corporation (HRS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

With 2 full months of the year completed, the S&P 500 (SPY) is up +1.38% while the Barclay’s Aggregate is +2.76% YTD, leaving a 60% / 40% balanced portfolio up +1.93% YTD as...

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

The market has taken a turn this past month, with volatility picking up and key technical indicators signaling caution. The S&P 500, which had been trading within a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.