- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Breaking News

J&J Signs Another Collaboration To Develop Coronavirus Vaccine

Janssen, a subsidiary of Johnson & Johnson (NYSE:JNJ) , announced that it has entered into a collaboration with the Beth Israel Deaconess Medical Center ("BIDMC"), a teaching hospital of Harvard Medical School, to support development of a vaccine candidate for coronavirus outbreak, COVID-19.

Both entities have initiated pre-clinical testing of prospective vaccine candidates. They aim to identify a potential candidate for clinical study by the end of March.

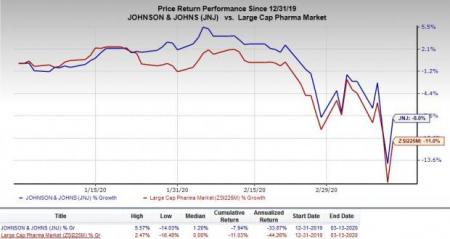

J&J’s stock has declined 8% so far this year compared with a decrease of 11% recorded by the industry. Global stock markets have seen major sell-off in the last three weeks amid the coronavirus pandemic.

J&J had announced its intention to develop a COVID-19 vaccine in late January. The company stated that it will have a multi-pronged approach to address the outbreak, which is spreading like wildfire globally, led by a few European countries. It has already expanded its collaboration agreement with the Biomedical Advanced Research and Development Authority (“BARDA”), part of the U.S. Department of Health and Human Services (“HHS”) last month to accelerate its investigational vaccine program.

J&J will leverage Janssen's AdVac and PER.C6 technologies for development of a coronavirus vaccine. These technologies have previously supported the development of Ebola, Zika, RSV and HIV vaccine candidates by J&J. The company is also working with its global partners to search its library of antiviral molecules for rapid discovery of a potential candidate. It expects to initiate an early-stage clinical study to evaluate a potential vaccine candidate by the end of 2020.

Other COVID-19 Programs

Currently, there are no FDA-approved treatments for COVID-19. However, as the infection spreads rapidly, several pharma bigwigs as well as smaller biotechs are actively pursuing development of a vaccine or therapy for the deadly disease. Gilead Sciences (NASDAQ:GILD) , a pioneer in antiviral therapies, seems to be leading the race with two late-stage studies evaluating its Ebola candidate, remdesivir, in COVID-19 patients. Meanwhile, AbbVie (NYSE:ABBV) is working with global health authorities to determine the efficacy of its HIV medicine, Kaletra/Aluvia against COVID-19. The company had stated that some sources have claimed that Kaletra has been effective in treating COVID-19 in China. However, it does not have clinical data to support the claim.

The HHS is also actively supporting development of COVID-19 vaccine. It has signed new deals or expanded existing collaborations with several other companies including Sanofi (NASDAQ:SNY) and Regeneron Pharmaceuticals to accelerate vaccine development.

We note that accelerated development of a treatment for COVID-19 will be favorable for these companies as well as people and economies worldwide. However, a safe and tested treatment option seems several months away, raising concerns related to the impact of COVID-19 on people and economies. Moreover, delay in availability of a treatment also increases uncertainty of any financial gain for these companies as significant decline in new infection cases and majority of people getting cured, as evident from the data from China, will lead to significantly lower demand for such treatments compared to current expectations.

Zacks Rank

J&J currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Johnson & Johnson (JNJ): Free Stock Analysis Report

Sanofi (SNY): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

With 2 full months of the year completed, the S&P 500 (SPY) is up +1.38% while the Barclay’s Aggregate is +2.76% YTD, leaving a 60% / 40% balanced portfolio up +1.93% YTD as...

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

The market has taken a turn this past month, with volatility picking up and key technical indicators signaling caution. The S&P 500, which had been trading within a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.