- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

JetBlue Withdraws Q1 & 2020 Guidance On Coronavirus Scare

JetBlue Airways Corporation (NASDAQ:JBLU) withdrew its first-quarter 2020 and full-year outlook amid uncertainty surrounding the novel coronavirus’ impact on air travel demand. Following this announcement, shares of the company declined 3.5% at the close of business on Mar 9.

Plagued by virus-related fears, the company was experiencing “significant deterioration” in forward bookings since late February. The airline is taking substantial measures to counteract the effect of this decrease in travel demand. Earlier in the month, JetBlue announced plans to cut capacity by approximately 5% in the near term. The carrier is also making cost-control efforts, such as "delaying or canceling upcoming events and meetings" and "reducing hiring for frontline and support center positions".

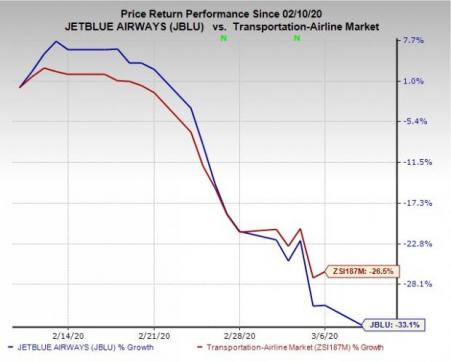

Shares of the company have plunged more than 33% in a month compared with the industry’s 26.4% decline due to the coronavirus-induced weak demand.

The rapid spread of the coronavirus hit the airline industry quite hard with numerous airlines slashing capacity as demand drops relentlessly. Due to ambiguity concerning the duration of this ongoing crisis, last month, United Airlines (NASDAQ:UAL) with greater international exposure among U.S. airlines, withdrew its 2020 view. Being gravely affected, the carrier also took some drastic actions like putting a halt to hiring (except for crucial roles), delaying 2019 merit salary hikes and giving employees the option to apply for unpaid leave of absence voluntarily.

Zacks Rank & Key Picks

JetBlue carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same space are Spirit Airlines, Inc. (NYSE:SAVE) and Azul S.A. (NYSE:AZUL) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

While Spirit’s earnings surpassed estimates in three (in-line EPS in one) of the last four quarters, the average beat being 2.8%, Azul’s bottom line outperformed the Zacks Consensus Estimate in each of the preceding four quarters, the average being 199%.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

JetBlue Airways Corporation (JBLU): Free Stock Analysis Report

United Airlines Holdings Inc (UAL): Free Stock Analysis Report

Spirit Airlines, Inc. (SAVE): Free Stock Analysis Report

AZUL SA (AZUL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.