- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Japanese Yen Stays Adrift, Core CPI Falls Below 3%

- Japanese core CPI falls below 3%

- Fed’s Powell says inflation too high, economy too strong

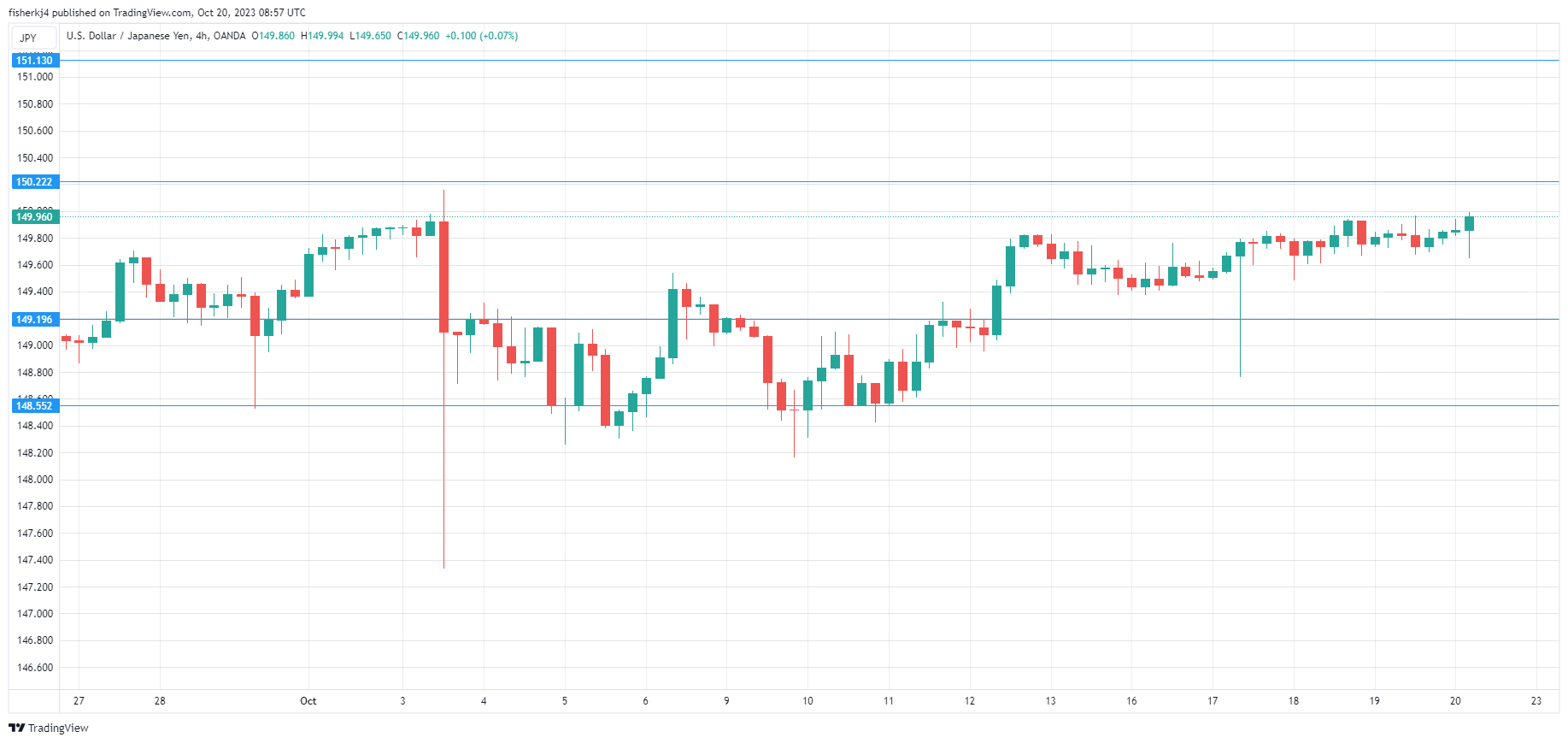

- 150.22 is a weak resistance line, followed by resistance at 150.86.

- 149.19 and 148.55 are providing support

The USD/JPY is slightly lower on Friday. In the European session, USD/JPY is trading at 149.96, up 0.12%. The yen has shown little movement this week and continues to hover just shy of the symbolic 150 level. In early October, the yen breached 150 and then spiked sharply lower. It’s looking very likely that the yen will again breach 150 shortly.

Japan’s Core Inflation Eases Below 3%

Japanese core CPI, which excludes fresh food, slowed to 2.8% y/y in September, versus 3.1% in August but above the market consensus of 2.7%. The print fell below the 3% level for the first time since August 2022 but has now exceeded the Bank of Japan’s 2% target for 18 straight months. The “core-core” rate, which excludes fresh food and energy prices and is considered by the BoJ a better gauge of inflation trends, dropped from 4.3% to 4.2% in September, higher than the market consensus of 4.1%.

Inflation has been slowly easing, but the downtrend faces some possible headwinds. The yen continues to lose ground and tensions in the Middle East have raised fears that oil prices could hit $100 or higher. If oil prices rise or the yen continues to decline, the result will be higher inflation.

How will the Bank of Japan react to potential oil inflation and the weakening yen? The central bank holds a two-day meeting ending on October 31st and may have to revise its quarterly inflation and growth forecasts. The markets are on alert for the BoJ to phase out its massive stimulus but BoJ policymakers haven’t shown signs of shifting policy.

In the US, it’s a very light data calendar, highlighted by a speech from FOMC member Patrick Harker. On Thursday, Fed Chair Jerome Powell said that inflation was still too high and that growth would need to slow if inflation is to fall to the 2% target. Powell noted that further hikes might not be needed, as the rise in Treasury yields could help dampen growth and lower inflation.

USD/JPY Technical

Related Articles

The German election results initially boosted optimism, but uncertainty over coalition talks is keeping pressure on EUR/USD. Trump's confirmation of tariffs on Mexico and Canada...

The US Dollar’s recovery on tariff talk is causing the USD/CAD pair to bounce. The main events to watch out for this week are the US PCE data and Canadian GDP for Q4. A close...

The Japanese yen continues to have a quiet week. In the European session, USD/JPY is trading at 149.68, down 0.01% on the day. The yen has shown recent strength against the US...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.