- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Jacobs Wins Contract From Enfield To Support $7.75B Program

In a bid to deliver exceptional infrastructure in Upper Edmonton, Jacobs Engineering Group Inc. (NYSE:J) has received a technical design and planning advisory services contract from Enfield Council.

Per the deal, Jacobs will offer multidisciplinary design and consultancy, including environmental, land quality and water catchment management services, at Meridian Water — a $7.75 billion, 20-year regeneration program in Upper Edmonton, which is located in the London Borough of Enfield, North London.

Also, in an effort to support integrated client/project team working and bring together a diverse range of datasets to enable testing of the master plan as it evolves in the coming years, Jacobs' People & Places Solutions (P&PS) will create a collaborative digital working environment.

In order to support Enfield Council and Meridian Water, Jacobs' team of planners, architects, designers and other specialists will associate with Avison Young, East, Knight Architects, Sound Diplomacy and Waugh Thistleton. Also, its partnership with Simetrica — a global leader in the field of social value measurement — will support Enfield's pursuit of inclusive growth opportunities.

Exceptional Project Execution Strategy to Support Growth

Jacobs’ P&PS business — which accounted for almost 65% of total revenues in first-quarter fiscal 2020 — serves clients of broad sectors like water, transportation, building and semiconductors.

On Mar 5, the company reported that the P&PS segment secured a framework contract from the Swedish Transport Administration (Trafikverket) to provide strategic consultancy services for the new high-speed railway lines planned between Stockholm, Gothenburg and Malmö in Sweden.

Efficient project execution has been primarily driving Jacobs’ performance over the last few quarters. The company’s ongoing contract wins are a testimony to the fact. Backlog at the end of first-quarter fiscal 2020 grew 11% from the year-ago period to $22.7 billion.

Long-Term Prospects & Impressive Fundamentals Bode Well

The P&PS segment has been a major growth driver of its revenues. Recently, the company reported strong results in the fiscal first quarter on the back of solid segmental performance, acquisitions and cost synergies.

Over the next three years (through 2021), management aims a 125-175 basis points (bps) expansion in adjusted operating margins. The company anticipates a 100-150 bps increase in Critical Mission Solutions or CMS margins and 110-140 bps growth in PPS margin, supported by the elimination of ECR.

It projects 3-5% net organic revenue growth, with P&PS leading the way with 4-6% top-line compound annual growth rate (CAGR) and CMS with 23% CAGR. The top-line growth is expected to be driven by recurring revenues that roughly occupy two-thirds of Jacobs’ total revenues, in turn reducing overall risks of market volatility.

Our Take

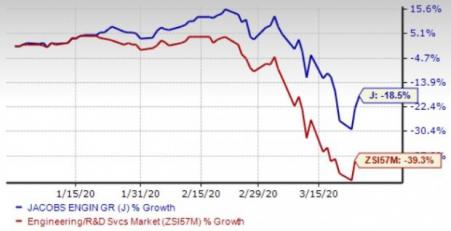

Jacobs’ shares have outperformed the industry so far this year. The outperformance is likely to continue in the near term, buoyed by strong backlog, inorganic moves, its transformed portfolio, and increased focus on infrastructure, aerospace, cybersecurity and technical building projects.

Although excessive contract pricing pressure, poor competency and extreme competition are concerns for the company, its contract winning spree and solid view are encouraging.

Zacks Rank

Jacobs — which shares space with AECOM (NYSE:ACM) , KBR, Inc. (NYSE:KBR) and Fluor Corporation (NYSE:FLR) in the same industry — currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

AECOM (ACM): Free Stock Analysis Report

KBR, Inc. (KBR): Free Stock Analysis Report

Fluor Corporation (FLR): Free Stock Analysis Report

Jacobs Engineering Group Inc. (J): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

At the end of February, Lululemon (NASDAQ:LULU), DoorDash (NASDAQ:DASH), and Ulta Beauty (NASDAQ:ULTA) were among the Most Upgraded Stocks tracked by MarketBeat. Investors should...

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

Often as dividend investors we buy stocks that provide us with income now. We take the current yield and happily collect the monthly or quarterly payout. Sometimes, though, it is...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.