- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Jack In The Box (JACK) To Sell Qdoba Brand For $305 Million

Jack in the Box Inc. (NASDAQ:JACK) announced yesterday that it’s selling its Qdoba subsidiary to private equity firm Apollo Global Management, LLC for $305 million. The all-cash deal, subject to customary closing conditions and adjustments, is expected to be completed by April 2018.

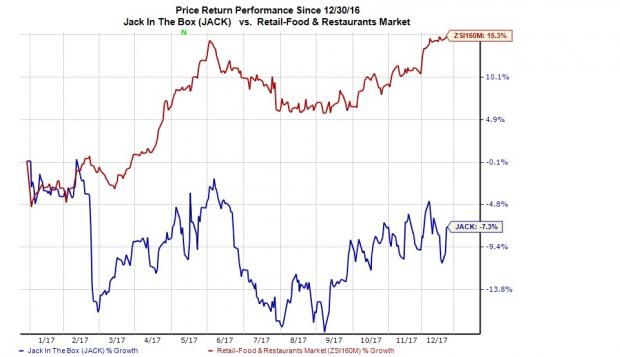

Shares of the company closed 3.1% higher at 103.45 yesterday. However, year to date, shares have lost 7.3% against the industry’s gain of 15.3%.

Numerous Challenges Mar Qdoba’s Growth

At the time of its acquisition by Jack in the Box in 2003, this fast-casual Mexican food chain had 85 locations across 16 states. Since then, this number has increased to 700 and spread across 47 states, the District of Columbia and Canada. It is currently the second largest fast-casual Mexican food brand in the United States with more than 700 locations.

Despite this notable growth, Jack in the Box decided to get rid of Qdoba probably because of the fact that the fast-casual Mexican space has been slowing down in recent years with rising avocado prices dampening profits.

In fact, in the last reported quarter, revenues declined 15% on a year-over-year basis owing to lower Jack in the Box and Qdoba brand sales. Comps at company-owned Qdoba restaurants were down 4%, reflecting 6.4% decrease in transactions.

Jack In The Box Inc. Revenue (TTM)

Also, at the Qdoba restaurants, operating margin contracted 610 basis points (bps) due to costs associated with new restaurant openings, an increase in food and packaging costs, impact of wage inflation and sales deleverage as well as commodity inflation.

The company has been exploring strategic alternatives regarding Qdoba for the past several months.

Seeking a Less Capital Intensive Business Model

Jack in the Box stated that it will use the proceeds from the sale to pay off outstanding debt under its term loan. We believe that this sale is in line with Jack in the Box’s efforts to shift to a less capital-intensive business model and focus more on core operations.

Additionally, asset sales will help the company in terms of strengthening its liquidity and protecting its current liabilities with a combination of cash and liquid assets.

Zacks Rank and Stocks to Consider

Jack in the Box has a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the same space are Famous Dave's of America, Inc. (NASDAQ:DAVE) , Arcos Dorados Holdings Inc. (NYSE:ARCO) and Good Times Restaurants, Inc. (NASDAQ:GTIM) .

While Famous Dave's of America sports a Zacks Rank #1 (Strong Buy), Arcos Dorados and Good Times Restaurants carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

One estimate for the current year moved north over the past 60 days versus no southward revisions in case of each of the three companies.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Jack In The Box Inc. (JACK): Free Stock Analysis Report

Famous Dave's of America, Inc. (DAVE): Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO): Free Stock Analysis Report

Good Times Restaurants Inc. (GTIM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.