- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Boeing Hikes 20-Year Jetliner Demand Forecast By 6.7% To $16T

The Boeing Company (NYSE:BA) recently raised its 20-year global forecast for jetliner demand by 6.7% at the ongoing Paris Air show. Impressive traffic numbers and growing need for new jets, as increasing number of planes are set to retire soon, contribute to the overall improvement in airplane fleet internationally.

Also, steady growth in demand for commercial aviation services is instrumental in boosting the global commercial jet market. Cumulatively, these factors have led to a total market opportunity of $16 trillion compared with the last year’s outlook of $15 trillion.

About the 20-Year Forecast

Per Boeing’s latest Commercial Market Outlook (CMO), the world will need 44,040 new planes, worth $6.8 trillion, between 2019 and 2038. This estimate came 3.1% above previous year's projected demand of 42,730 jets, valued at $6.35 trillion, for the 2018-2037 period. Of the total units, 44% of the demand will be for the replacement of old aircraft, while the rest will support future growth.

Meanwhile, the company continues to identify cost-effective single-aisle jets as the major demand driver, accounting for 73.6% of the total projection. This translates into worldwide demand for 32,420 single-aisle jets, worth $3.48 trillion, mirroring a 3.4% increase over last year's projection.

Such increasing demand for jets will boost the aviation services market. Boeing expects commercial aviation services market to grow 4.2% annually, reaching a value of $9.1 trillion over the next 20 years.

Competition in the Single-Aisle Space

The projected improvement in the single-aisle airplane space can be primarily attributed to the global popularity of the low-cost carrier models. With increasing demand for jets in the emerging Asia-Pacific markets, major airlines in this region are compelled to accelerate the replacement of less-efficient airplanes. Notably, these single-aisle jets have long been the main area of competition between Boeing and its arch rival, Airbus Group (PA:AIR).

Outlook for Other Aircraft Categories

Trailing behind single-aisle jetliners are Boeing’s large wide-body, twin-aisle counterparts. The company expects wide-body jets to also witness solid demand — projecting addition of 8,340 new planes during the 2019-2038 period. Although the figure appears unimpressive compared to the earlier one, for single-aisle category, the price of these planes is adequate to compensate for the difference in volume. Boeing estimates that the total value of all wide-body planes (comprising small, medium or large) sold over the period will be more than $2.6 trillion, while regional jets will account for $105 billion in global sales.

As airlines are increasingly shifting to small and medium/large wide-body airplanes like the 797, 787 and 777X aircraft, the primary demand for larger aircraft will be in the cargo market moving ahead. Boeing projects the requirement for 1,040 new wide-body freighters over the next 20-year period compared with the prior projection of 920 jets.

Boeing Versus Airbus

Of late, Boeing has been able to edge over its arch rival and put sustained pressure on Airbus SE by winning major contracts pertaining to commercial airplanes on a global scale. Per a recent report published by CNN, Airbus has edged out Boeing in terms of order wins at the ongoing Paris Air Show. While Airbus has already received orders for 100 new jets, Boeing secured none. It is struggling due to the 737 Max issue.

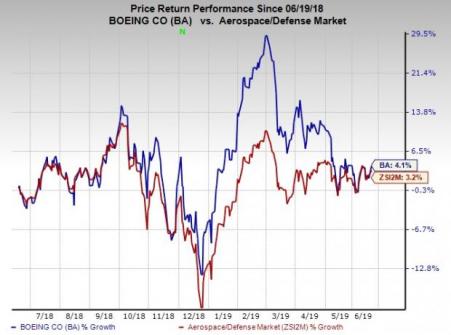

Price Movement

In a year’s time, shares of Boeing have gained 4.1% compared with the industry’s 3.2% growth.

Zacks Rank & Key Picks

Boeing currently carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the same industry are Wesco Aircraft Holdings (NYSE:WAIR) , Northrop Grumman Corp. (NYSE:NOC) and Leidos Holdings (NYSE:LDOS) , each of which carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wesco Aircraft’s long-term growth is estimated to be 12%. The Zacks Consensus Estimate for 2019 earnings has increased 3.7% to 84 cents over the past 60 days.

Northrop Grumman came up with average positive earnings surprise of 18.50% in the last four quarters. The Zacks Consensus Estimate for 2019 earnings has climbed 2.26% to $19.42 over the past 60 days.

Leidos Holdings delivered average positive earnings surprise of 6.81% in the last four quarters. The Zacks Consensus Estimate for 2019 earnings has risen 1.54% to $4.60 over the past 60 days.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Wesco Aircraft Holdings, Inc. (WAIR): Free Stock Analysis Report

The Boeing Company (BA): Free Stock Analysis Report

Leidos Holdings, Inc. (LDOS): Free Stock Analysis Report

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

Original post

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.