- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Host Hotels (HST) Beats Q2 FFO Estimates, Raises Outlook

Host Hotels & Resorts, Inc. (NYSE:HST) reported second-quarter 2017 adjusted funds from operations ("FFO") of 49 cents per share, beating the Zacks Consensus Estimate of 46 cents. Adjusted FFO per share also matched the year-ago tally.

Results reflect growth in comparable hotel revenue per available room (RevPAR) and improvement in margin. The company also raised its full-year 2017 outlook.

The company posted total revenue of nearly $1.44 billion, which surpassed the Zacks Consensus Estimate of $1.43 billion. However, the figure was down 1.2% from the prior-year number, as a result of revenue loss from sale of 12 hotels in 2016 and 2017.

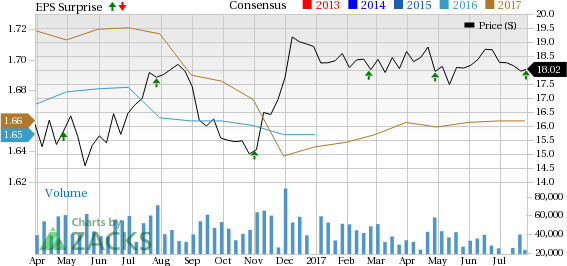

Note: The EPS numbers presented in the above chart represent funds from operations (“FFO”) per share.

Quarter in Details

During the reported quarter, comparable hotel revenues remained nearly flat year over year at $1.3 billion. Although, the company witnessed improvements in RevPAR, it was marred by a decline in food and beverage revenues.

Comparable RevPAR (on a constant dollar basis) was up 1.7% year over year, driven by a 0.8% increase in average room rate and 70 basis points (bps) expansion in occupancy to 83.2%. At its domestic properties, comparable hotel RevPAR inched up 1.8%. However, the same at its comparable international properties was down 3.1% on a constant-dollar basis.

Nevertheless, improvements in RevPAR aided GAAP operating profit margin growth of 50 bps for the quarter.

During the quarter under review, the company invested around $16 million for redevelopment, and return on investment (ROI) capital expenditures. It also deployed approximately $47 million on renewal and replacement capital expenditures.

In the second quarter, the company accomplished the sale of the Sheraton Memphis Downtown for $67 million, recording a gain of around $28 million.

Finally, the company exited second-quarter 2017 with around $644 million of unrestricted cash and $775 million of available capacity remaining under the revolver part of its credit facility. Moreover, as of Jun 30, 2017, total debt was $4.0 billion, having an average maturity of 5.5 years and an average interest rate of 3.9%. Notably, the company did not buy back any shares in 2017. It has $500 million of capacity available under its current repurchase program.

Outlook

Host Hotels raised its outlook for full-year 2017. The company now expects adjusted FFO per share in the range of $1.64–$1.68 compared to the prior guidance of $1.60–$1.68. The Zacks Consensus Estimate for the same is currently pegged at $1.66.

This is backed by comparable hotel RevPAR (constant U.S. dollar basis) growth expectations of 1.00–1.75%, against the prior outlook of 0.0–2.0%.

In Conclusion

We are encouraged with the better-than-expected performance of Host Hotels in the second quarter. The company’s solid portfolio of upscale hotels across lucrative markets, strategic capital-recycling program and a healthy balance sheet bode well for long-term growth. However, supply growth, specifically in the company’s key markets, remains a concern. In addition, dilutive impact of asset sales cannot be bypassed. Also, rate hike add to its woes.

Host Hotels currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The stock has declined 4.3% year to date, underperforming the 3.8% gain of the industry it belongs to.

Let us now look forward to the earnings releases of AvalonBay Communities, Inc. (NYSE:AVB) , Alexandria Real Estate Equities, Inc. (NYSE:ARE) and Extra Space Storage Inc. (NYSE:EXR) , all of which are expected to report quarterly figures in the next week.

Note: FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

AvalonBay Communities, Inc. (AVB): Free Stock Analysis Report

Host Hotels & Resorts, Inc. (HST): Free Stock Analysis Report

Extra Space Storage Inc (EXR): Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.