- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Is It Gold's Time To Shine?

Gold futures are trading at their highest levels in over 6 years as interest rates plummet. Gold is up roughly 12% as the US 10-year Treasury yield falls 12% in the past 30 days.

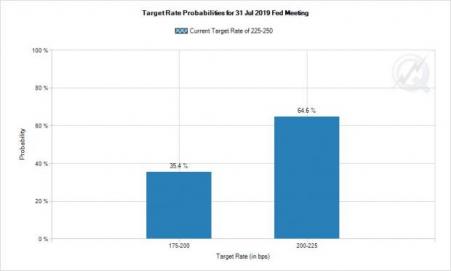

The Federal Reserve is on thin ice with every syllable Jerome Powell utters being overly scrutinized. They are now taking a flexible stance with interest rate as uncertainty in trade disputes increase. The market has taken this as a sign that the only option for the Fed in the upcoming July meeting is a rate cut. The market has completely priced in a rate cut in the benchmarked, Fed Funds rate, with a more than 1/3 chance of a 50 basis point cut.

There is also quite a bit of ambiguity surrounding the tensions building between the US and Iran. The geopolitical tension was started with US sanctions on Iran due to concerns over nuclear and other military stockpiles. The pressure has been escalated since then, with six US oil tankers and a US spy drown being attacked near the Strait of Hormuz. These attacks are being blamed on Iran and further verbal attacks have ensued between the US and Iranian Presidents.

This geopolitical tension is concerning investors and they are flocking to gold as a safe haven to protect against the uncertainty of potential war.

Not Convinced

This conviction that the trade war can go nowhere but south in the next month or so is miss placed, I speculate. Still, investors are flocking to gold as a temporary inflationary safe haven for their funds. The question that investors need to be asking themselves is, what happens if the trade disputes deescalate and a rate cut does not occur? This is going to spike US 10-year Treasury yield and sink gold prices as these “safe haven investors” move their money to more profitable securities.

Fast moves in commodities like this make me think the distorted buyer-to-seller ratio is causing this commodity to have a short-lived spike that will quickly retract once the buyers dry up.

Gold Could Still Have Further Upside

It is quite hard to say how much of this rate cut and geopolitical risk is already priced into gold and gold mining stocks. The uncertainty is clearly enough to send this commodity flying. If tensions between Iran and the US begin to escalate to a hostile level, gold will have more room to run. If the trade tariffs are escalated further and the Fed does indeed cut rates the same gold runway will likely appear.

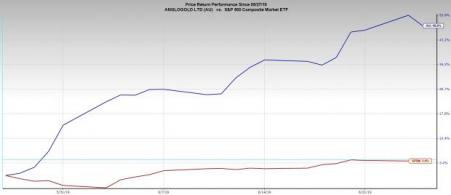

Some solid Gold stocks and ETFs to keep an eye as gold finds its equilibrium include AngloGold Ashanti (NYSE:AU) which has already seen a 48.6% jump in the past month. AU also has a strong negative beta which will help hedge your portfolio in the case of an equity market downturn. Analysts have been increasing their EPS estimates propelling this stock to a Zacks Rank #1.

A gold ETF like the SPDR Gold Trust (TSXV:GLD) will track gold more closely because it is back by physical gold bullion. This ETF hasn’t seen the same strong returns as AU but could provide a safer gold investment.

Vaneck Vectors Gold Miners ETF (TSXV:GDX) will give you a nice diversified portfolio of gold miners, so you don’t have to worry about systemic risks with any one firm. This ETF has seen 27.3% returns over the past month.

Take Away

The uncertainty in the trade dispute combined with the escalating tensions between the US and Iran have caused investors to flock to the gold safety net. Gold is trading at a level it hasn’t seen in over 6 years, whether or not the gold rally will continue remains to be seen. I will add that when this level was hit back in 2010 the price rallied another 25% to its high of $1773 an ounce in mid-2012. If you believe in the gold bull market, I would look to invest in one of the options I mentioned above.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

SPDR Gold Shares (NYSE:GLD): ETF Research Reports

VanEck Vectors Gold Miners ETF (GDX (NYSE:GDX)): ETF Research Reports

AngloGold Ashanti Limited (AU): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.