- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

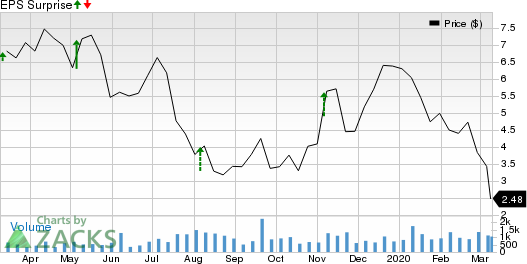

Is Earthstone (ESTE) Likely To Beat Q4 Earnings Estimates?

Earthstone Energy, Inc. (NYSE:ESTE) is expected to beat earnings estimates when it releases fourth-quarter 2019 results on Mar 12, before the opening bell.

In the last reported quarter, the company reported earnings per share of 18 cents, beating the Zacks Consensus Estimate of 13 cents and rising from the year-ago quarter’s 17 cents, primarily due to strong production volumes. Notably, the upstream energy company beat earnings estimates thrice and met the same once in the trailing four quarters, with the average positive surprise being 122%.

Let’s see how things have shaped up prior to the upcoming announcement.

Tread in Estimate Revision

The Zacks Consensus Estimate for fourth-quarter earnings of 30 cents has seen four upward revisions and no downward movement over the past 60 days. The figure indicates a 130.8% year-over-year rise.

The Zacks Consensus Estimate for fourth-quarter revenues is pegged at $65.2 million, suggesting a rise of 58% from the year-ago reported figure.

What the Quantitative Model Suggests

Our proven model predicts an earnings beat for Earthstone this time around. This is because it has the right combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold).

Earnings ESP: Earthstone has an Earnings ESP of +4.20%. This is because the Most Accurate Estimate for the quarter of 31 cents is currently pegged higher than the Zacks Consensus Estimate of 30 cents per share.

You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: Earthstone currently carries a Zacks Rank #2.

Factors Driving the Better-Than-Expected Earnings

Fourth-quarter pricing scenario of West Texas Intermediate crude was much weaker than the year-ago period. Moreover, natural gas prices followed a similar pathway, with lower year-over-year figures. Given that oil contributes the most (almost 58%) to the upstream company’s quarterly production volumes, the year-over-year decline in crude price may have hurt the bottom line.

However, Earthstone is expected to have recorded an increase in production volumes in fourth-quarter 2019 on the back of Midland Basin and Eagle Ford Shale strength. The Zacks Consensus Estimate for overall production is pegged at 1,591 thousand barrels of oil equivalent (MBoe), indicating a significant rise from 962 MBoe in the year-ago period.

Also, the consensus mark for oil production is pegged at 1,044 thousand barrels (MBbls), indicating a surge from the year-ago level of 674 MBbls. The higher production volumes are expected to have offset the negative impact of lower commodity prices in the to-be-reported quarter.

Other Stocks to Consider

Some other stocks with the perfect mix of elements to beat on earnings in the upcoming quarterly releases are:

Abeona Therapeutics Inc. (NASDAQ:ABEO) has an Earnings ESP of +20.00% and is a Zacks #3 Ranked player. The company is set to release quarterly earnings on Mar 16. You can see the complete list of today’s Zacks #1 Rank stocks here.

Alector, Inc. (NASDAQ:ALEC) has an Earnings ESP of +2.83% and a Zacks Rank #3. The company is set to release quarterly earnings on Mar 24.

Darden Restaurants, Inc. (NYSE:DRI) has an Earnings ESP of +1.03% and a Zacks Rank #3. The company is scheduled to release quarterly earnings on Mar 19.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

Abeona Therapeutics Inc. (ABEO): Free Stock Analysis Report

Earthstone Energy, Inc. (ESTE): Free Stock Analysis Report

Alector, Inc. (ALEC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.