- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Is Beijing Losing Its Nerve For Economic Restructuring?

Stephen Roach had long been a booster for China and her growth. His recent Project Syndicate article complaining about China's strategic incoherence was therefore a little surprising. In the article, Roach acknowledged that the long term goal of reform and changing the nature of economic growth from a quantity to quality focus involves tradeoffs. One of the negative consequences is a slowdown (also see my previous post Where's the short-term pain in China?). However, Chinese policy makers remain intensely focused on near-term economy wide growth targets, seemingly unwilling or unable to implement the long-term goal of rebalancing growth. Is this a sign that Beijing is losing its nerve for restructuring?

As an example of the intense focus on short-term growth goals, Chinese premier Li Keqiang stated in November 2013 that the economy's stall speed is a GDP growth rate of 7.2%:

In one of the few occasions when a top official has specified the minimum level of growth needed for employment, Li said calculations show China's economy must grow 7.2 percent annually to create 10 million jobs a year.

That would cap the urban unemployment rate at around 4 percent, he said.

"We want to stabilize economic growth because we need to guarantee employment essentially," Li was quoted by the Workers' Daily as saying on Monday. His remarks were made at a union meeting two weeks ago but were only published in full this week, just days before a pivotal Communist Party plenum to set policy opens.

A 7.2% growth rate doesn't leave much room for a slowdown. Indeed, every time China experiences a growth scare, it seems that the authorities engineer a revival using the same-old-same-old tools of credit fueled infrastructure growth. The signs of this sort of unbalanced, credit-driven, infrastructure growth are clear. An audit of local government debt had ballooned by about 67% in three years. A Bloomberg story suggested that shadow banking risks have been exposed by a local debt audit, because more local government lending is getting pushed out of the official banking system into the shadow banking system of wealth management products, which has the result of increasing credit risk to the entire system:

“As banks tightened their purse strings, local governments had no choice but to resort to shadow banking and incur more expensive borrowing costs,” said Tang Jianwei, a Shanghai-based economist at Bank of Communications Co., the nation’s fifth-largest lender. “That will further constrain their repayment ability and eventually overwhelm some lower-level entities which have borrowed way beyond their means. I won’t rule out some defaults in 2014.”

The government's solution is to play the whack-a-mole game of clamping down on the shadow banking system:

Premier Li Keqiang is cracking down on less-regulated shadow banking activities, estimated by JPMorgan Chase Co. at $6 trillion in May last year, while the central bank engineered a cash crunch in June 2013 to push deleveraging in the world’s second-largest economy. China’s borrowing spree since 2008 has evoked comparisons to debt surges that tipped Asian nations into crisis in the late 1990s and preceded Japan’s lost decades.

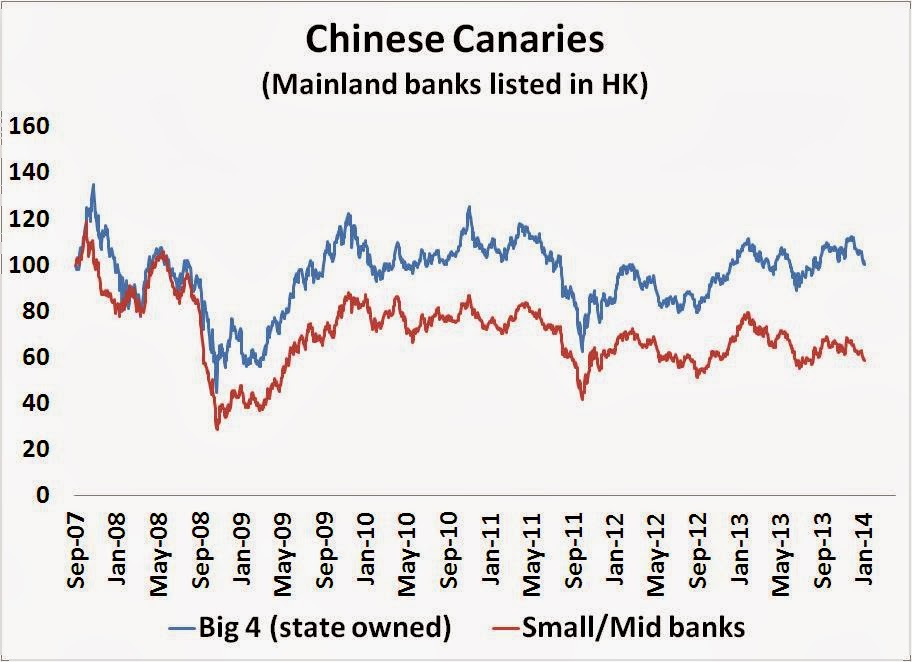

Despite all the talk about a crackdown on the shadow banking system, stresses in the financial system remain contained. My so-called Chinese canaries, which are indices of Mainland banks listed in HK, remain relatively stable for now:

Similarly, the relative performance of the Chinese Yuan Dim Sum Bond ETF, (DSUM) (yuan denominated bonds issued in HK) compared to the iShares Barclays 7-10 Year Treasury Bond ETF, (IEF) remains in a relative uptrend, indicating little signs of financial stress.

So far, so good? Well, sort of.

Pain now or later?

It seems that Beijing is acting like a patient who knows he has to take a bitter pill, but can't bring himself to swallow the medicine. Bloomberg rhetorically asked Did Soros just predict a China crash? [emphasis added]:

In a Jan. 2 op-ed for Project Syndicate, Soros didn't say whether he's shorting China. But he did connect the dots in a way that can't make President Xi Jinping happy. To Soros, the main risk facing the world isn't the euro, the U.S. Congress or a Japanese asset bubble, but a Chinese debt disaster that's unfolding in plain sight.

“There is an unresolved self-contradiction in China’s current policies: restarting the furnaces also reignites exponential debt growth, which cannot be sustained for much longer than a couple of years," Soros wrote.

In the op-ed, Soros echoed Stephen Roach's concerns over "policy incoherence" in response to past growth slow downs:

Aware of the dangers, the People’s Bank of China took steps starting in 2012 to curb the growth of debt; but when the slowdown started to cause real distress in the economy, the Party asserted its supremacy. In July 2013, the leadership ordered the steel industry to restart the furnaces and the PBOC to ease credit. The economy turned around on a dime. In November, the Third Plenum of the 18th Central Committee announced far-reaching reforms. These developments are largely responsible for the recent improvement in the global outlook.

Soros and Roach are right. How Beijing rids itself of the addiction to credit-fueled infrastructure growth will determine the long term growth path of China. The authorities can choose to take a little pain now or a lot of pain later.

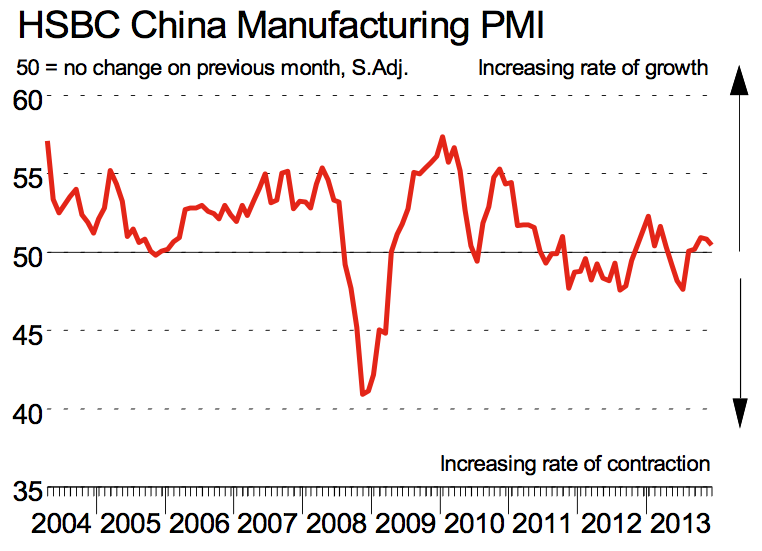

I am watching this chart of the HSBC China Manufacturing PMI closely. As the pace of growth decelerates and the line gets closer to 50, which indicates a slowdown, will Beijing lose its nerve and "restart the furnaces" and choose the path of a lot more pain later?

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (“Qwest”). The opinions and any recommendations expressed in the blog are those of the author and do not reflect the opinions and recommendations of Qwest. Qwest reviews Mr. Hui’s blog to ensure it is connected with Mr. Hui’s obligation to deal fairly, honestly and in good faith with the blog’s readers.”

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this blog constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or I may hold or control long or short positions in the securities or instruments mentioned.

Related Articles

Markets have been through another week where tariffs have been the driving force behind market moves. The PCE data which I had thought would be the major event for the week failed...

NFP take center stage amid DOGE layoffs ECB decides monetary policy after CPI data Canada jobs report and RBA minutes also on tap Will DOGE layoffs weigh on NFP? The US dollar...

US Dollar's Strength Triggers a Sell-Off in Gold The gold (XAU/USD) price plunged by more than 1.3% on Thursday as the US Dollar Index (DXY) moved sharply higher after a strong US...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.