- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Is Apple (AAPL) Eyeing To Buy Music Recognition App Shazam?

Apple Inc. (NASDAQ:AAPL) is reportedly in the process of acquiring U.K-based Shazam Entertainment. Per TechCrunch and also confirmed by recode, the iPhone maker may pay almost $400 million for the popular app that can identify any song, TV show, movie or advertisement.

However, the price is significantly lower compared with the $1.02-billion valuation that Shazam received during last funding, in 2015. Per TechCrunch’s other sources, the purchase price can be a nine figure. We believe this is improbable due to the significant competition the company faces in the music recognition market.

Launched in 1999, Shazam has raised $143 million from DN Capital Limited, Institutional Venture Partners and Kleiner Perkins Caufield & Byers, reportedly.

Why is Apple Interested?

Shazam was one of the first applications to be offered by Apple App store way back in 2008. The application reportedly crossed 1 billion downloads in September 2016, reflecting significant popularity. The company reported revenues of almost $54 million and statutory pre-tax loss of roughly $5.3 million in fiscal 2016.

Shazam’s music recognition app already works with Apple’s digital assistant Siri. The acquisition will now allow Apple to offer features like television show recognition as well as augmented reality (AR) brand marketing service to App store users.

Moreover, Apple will not pay the commissions related to the traffic that Shazam redirects to its iTunes store. This cost saving will ultimately boost profitability. Notably, gross margin and operating margin contracted 10 basis points (bps) each in the last reported quarter.

Further, if the company decides to close the service, it is expected to hurt competing streaming services like Spotify, Google Play Music and Snapchat. Although Apple Music has witnessed phenomenal success in recent times, its user base of 30 billion lags Spotify’s 140 million subscribers, including 60 million paying subscribers.

Apple to Benefit From AR Initiatives

According to The Verge, Apple will benefit from Shazam’s AR platform for brands that were launched earlier this year.

Apple is aggressively pushing into the AR market through acquisitions. The company has bought several smaller firms with expertise in AR hardware, 3D gaming and virtual reality (VR) software.

Apple recently acquired Canada-based AR headset maker, Vrvana for $30 million. Other acquisitions include SensoMotoric, Flyby Media, Emotient, TupleJump, Turi, Metaio and PrimeSense.

Moreover, Apple unveiled the ARKit at WWDC this year that will help third-party developers to work on creating AR experiences for the iOS platform.

We believe that the Shazam acquisition will strengthen Apple’s AR technology portfolio. Moreover, the addition will boost competitive prowess against the likes of Facebook (NASDAQ:FB) , Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) .

Competition Intensifies

Facebook has invested almost $3 billion to develop VR technology while Alphabet’s Google division is giving tough competition to Apple with its ARCore developer Kit.

Currently, Facebook’s Oculus Rift and HTC’s Vive are the most notable VR headsets in the market. On the other hand, based on their smartphone devices, Apple and Google are the major proponents of the AR technology.

Moreover, Microsoft has created the term “mixed reality,” which stands for a combination of AR and VR. The company’s latest Windows 10 upgrade supports both AR and VR technologies. Microsoft has also taken the inorganic route to boost position in the AR/VR market. The company has been relying on partners like Samsung (KS:005930), Dell, HP, Acer and Lenovo to provide it a push in the rapidly growing AR/VR market.

HoloLens is Microsoft’s other noteworthy mixed reality product, which is currently used by NASA and the U.S. military, per reports. The company doesn’t expect the commercial version of HoloLens to be launched before 2020.

According to market research firm IDC’s August report, quoted by Business Insider, total spending on AR/VR is expected to soar from $11.4 billion in 2017 to nearly $215 billion 2021 at a CAGR of 113.2%. This provides significant growth opportunity for these technology giants including Apple.

Zacks Rank

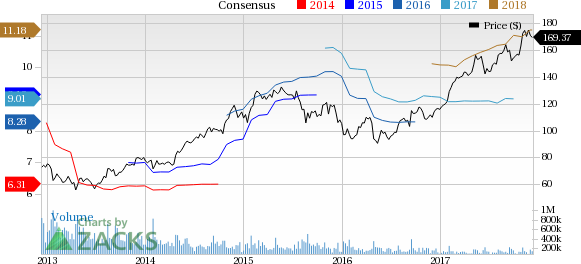

Currently, Apple has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Facebook, Inc. (FB): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.