- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Is A Beat In Store For ABM Industries' (ABM) Q1 Earnings?

ABM Industries Inc. (NYSE:ABM) is scheduled to report first-quarter fiscal 2020 results on Mar 4, after market close.

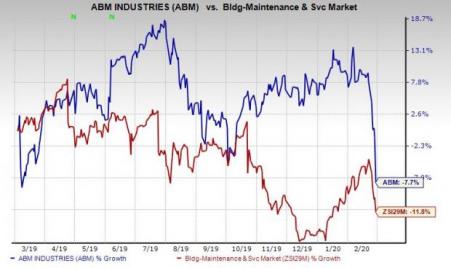

Over the past year, shares of ABM Industries have declined 7.7% compared with the industry’s loss of 11.8%.

Let's see how things have shaped up for the announcement.

Top-Line Expectations

Organic growth is likely to have driven ABM Industries’ first-quarter fiscal 2020 revenues, the Zacks Consensus Estimate for which is pegged at $1.61 billion, indicating year-over-year increase of 0.1%.

In fourth-quarter fiscal 2019, revenues of $1.65 billion decreased 0.1% year over year.

Bottom-Line Expectations

Higher revenue contribution from the Technical Solutions segment, higher margin revenue mix and improved labor management primarily within the Business & Industry segment, and favorable impact of the adoption of Accounting Standards Codification ("ASC") 606 are likely to have benefited ABM Industries’ first-quarter fiscal 2020 earnings. The Zacks Consensus Estimate for earnings is pegged at 31 cents per share, in line with the year-ago quarter.

In fourth-quarter fiscal 2019, adjusted earnings per share were 66 cents, up 13.8% from the year-ago quarter.

What Our Model Says

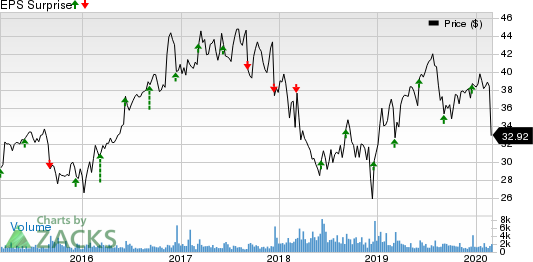

Our proven model predicts an earnings beat for ABM Industries this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

ABM Industries has an Earnings ESP of +10.87% and a Zacks Rank #3.

Other Stocks to Consider

Here are a few other stocks, which investors may consider as our model shows that these too have the right combination of elements to beat on earnings in their upcoming releases:

Limoneira Company (NASDAQ:LMNR) has an Earnings ESP of +2.7% and a Zacks Rank #3.

Eaton (NYSE:ETN) Vance Corp. (NYSE:EV) has an Earnings ESP of +0.77% and a Zacks Rank #3.

The Cooper Companies, Inc. (NYSE:COO) has an Earnings ESP of +0.63% and a Zacks Rank #3.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

ABM Industries Incorporated (ABM): Free Stock Analysis Report

The Cooper Companies, Inc. (COO): Free Stock Analysis Report

Eaton Vance Corporation (EV): Free Stock Analysis Report

Limoneira Co (LMNR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.