- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

EUR Lurches Lower As Greek Talks Break Down, US Growth To Rebound

Greek debt talks break down Talks between Greece and its EU creditors collapsed on Sunday, with lenders saying that the gap between the two parties may be too wide to bridge. With no deal being reached on a technical level, it is up to politicians to take difficult decisions. The focus now turns to a June 18th Eurogroup meeting and the Eurozone leaders’ summit on June 25. A final agreement on Thursday’s Eurogroup meeting seems unlikely, and therefore I would expect tough decisions to be made by the bloc’s leaders. The EUR lurched lower on Asian opening session, as the deadline to reach a bailout deal fast approaches. We expect the common currency to remain under selling pressure. This could also weigh on DAX and Eurostoxx 50 and could push them a bit lower, as the uncertainty over a solution on Greek debt is building up.

Today’s highlights: Eurozone’s trade surplus for April is due to be released.

From Sweden, we get the official and PES unemployment rate for May. Following the unexpected rise of the CPI on Thursday, this is likely to take same pressure off the Riksbank to cut rates deeper into the negative territory. A decline in the unemployment rate could add to these.

In the US, industrial production for May is expected to rebound from the month before, while the Empire State manufacturing index is expected to show that business conditions for NY manufacturers have improved in June. A rebound in industrial production could prove USD-positive.

We have several ECB speakers on Monday’s agenda: President Draghi, Governing Council member Ewald Nowotny, Governing Council member Jens Weidmann and Executive Board member Peter Praet. All speakers could some volatility in the markets.

As for the rest of the week, the highlight will be the Federal Open Market Committee (FOMC) meeting on Wednesday. The last three statements from Fed officials were all unanimous, but that could have been only the calm before the storm. The policy statement to be released on Wednesday could bring an end to this quiet period, with a few dissenters voting for a rate hike. In such a case, the dollar would be likely to strengthen and to regain its glamour. On the other hand, no dissenters would probably cause the greenback to weaken against its peers.

Even though we had some disappointing US job data and soft retail sales in recent months, the former seem to have improved recently and the latter rose on Thursday, with April’s figure being revised up moderately. These add to evidence that the US growth is likely to rebound in Q2.

The Committee will also give new forecasts for the economy, inflation and interest rates, including the famous “dot plot” of Fed funds rate expectations. Fed Chair Yellen holds a press conference following the decision. The market will be looking for hints if the September meeting, which is also accompanied by a press conference, could be the month that they start normalization. Already, FOMC days tend to be more volatile than the average day, and FOMC days with a press conference tend to be more volatile than FOMC days without one. Therefore, get ready for some big moves.

On Tuesday, during the Asian day, the Reserve Bank of Australia releases the minutes of its June policy meeting. At this meeting, the Bank kept its cash rate unchanged as was expected and the statement accompanying the decision was neutral, with no clear bias with regards to the direction of the next move in rates. The minutes will probably have a similar tone to the statement and to the recent speech of RBA Governor Stevens, who showed readiness to adjust policy if needed.

As for the indicators, in the UK, we get the CPI for May. In April, the nation slipped into deflation as the headline CPI rate fell to -0.1% yoy, in line with BoE expectations of a negative rate. What is more, the core inflation rate slowed, printing the lowest core rate since 2001. GBP/USD tumbled on the news, as the decline in the core rate suggests low inflation is not merely a matter of low oil prices, and prices may not rise even when the effects of low oil prices fade from the data. Anything that increases the risk that the BoE is likely to miss its inflation target pushes back expectations of a rate hike and leaves GBP vulnerable, in my view.

The German ZEW survey for June is coming out. The survey for May added to the weak data from the country with both indices falling below market expectations. A strong survey is needed to confirm that Germany, Europe’s largest economy, is still gaining momentum.

In the US, housing starts and building permits for May are to be released. Housing starts are forecast to decline a bit but to remain above 1mn, while building permits, the more forward-looking of the two indicators, are forecast to moderate somewhat. Nevertheless, the overall strength in the housing sector supports the view that growth in Q2 could rebound somewhat and this could strengthen the greenback a bit.

On Wednesday, besides the FOMC meeting, the Bank of England releases the minutes of its June meeting. It will be interesting to see if there were any discussions of how the dip into deflation has affected wage negotiations, and if any of the MPC members who previously voted for a rate hike are likely to resume their hawkish stance any time soon, given the “range of views” in the previous statement, or if the decision was again “finely balanced.” The MPC members could also repeat their well-known phrase that “it is more likely than not that the Bank rate would rise over the three-year forecast period.”

As for the indicators, the UK unemployment rate for April is coming out. Another decline in the rate and acceleration in the growth of average weekly earnings, along with an optimistic statement, could strengthen GBP somewhat.

On Thursday, we get the US CPI for May. Coming a day after the FOMC meeting and the new projections, a strong surprise is needed for investors to alter their view on the inflation outlook.

From New Zealand, GDP for Q1 is coming out. Following the recent rate cut by the RBNZ, the market reaction on GDP figures on Thursday is likely to be limited.

On Friday, during the Asian day, the Bank of Japan ends its two-day policy meeting. Market expectations are for no change in policy at this meeting. The focus will most likely be on Governor Haruhiko Kuroda press conference afterwards, especially after his recent comments in the Diet that Japan’s real effective exchange rate is already very weak and it’s hard to see it falling more. All in all, with the Bank being unable to reach its inflation target and with a JPY reluctant to weaken further according to Gov. Kuroda, the only way they could weaken their currency further is by increasing their massive QE program. Even so, we would expect them to wait to take any more action at least until July, when the results of this year’s wage negotiation should be known and the MPC members update their forecasts again.

From Canada, we get the CPI for May.

The Market

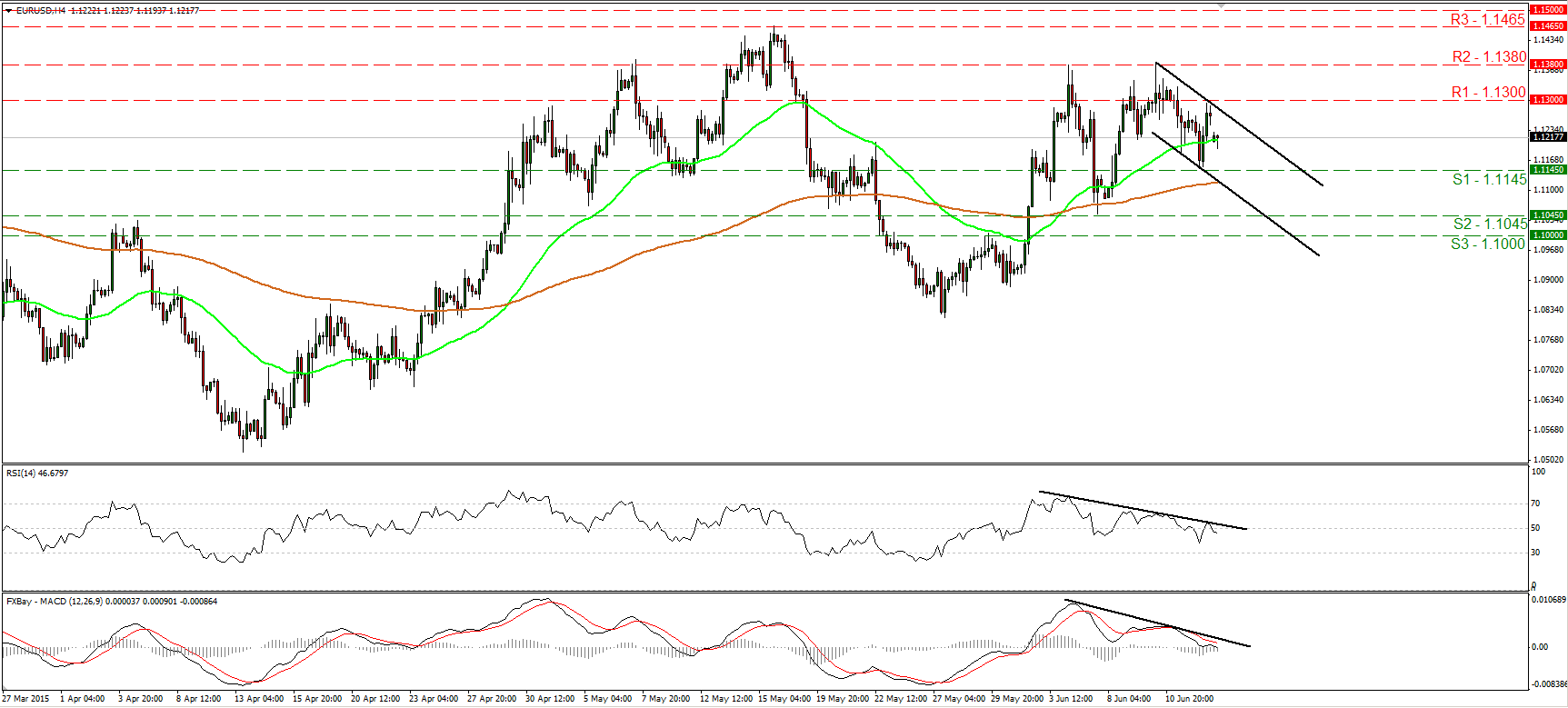

EUR/USD gaps down

EUR/USD gapped down on Monday, after it hit resistance at 1.1300 (R1) on Friday. The rate failed to reach the key resistance of 1.1380 (R2) and formed a lower high. Bearing this in mind, and that there is still negative divergence between both our short-term oscillators and the price action, I would see a cautiously negative picture. A break below the 1.1145 (S1) line will confirm a forthcoming lower low and perhaps pull the trigger for our next support line of 1.1045 (S2), defined by the low of the 5th of June. The RSI is back below its 50 line, while the MACD, already below its trigger line, has just turned negative. These momentum signs amplify the case that further declines could be on the cards. As far as the bigger picture is concerned, I would adopt a neutral stance, since there is no clear trending structure on the daily chart.

• Support: 1.1145 (S1), 1.1045 (S2), 1.1000 (S3)

• Resistance: 1.1300 (R1), 1.1380 (R2), 1.1465 (R3)

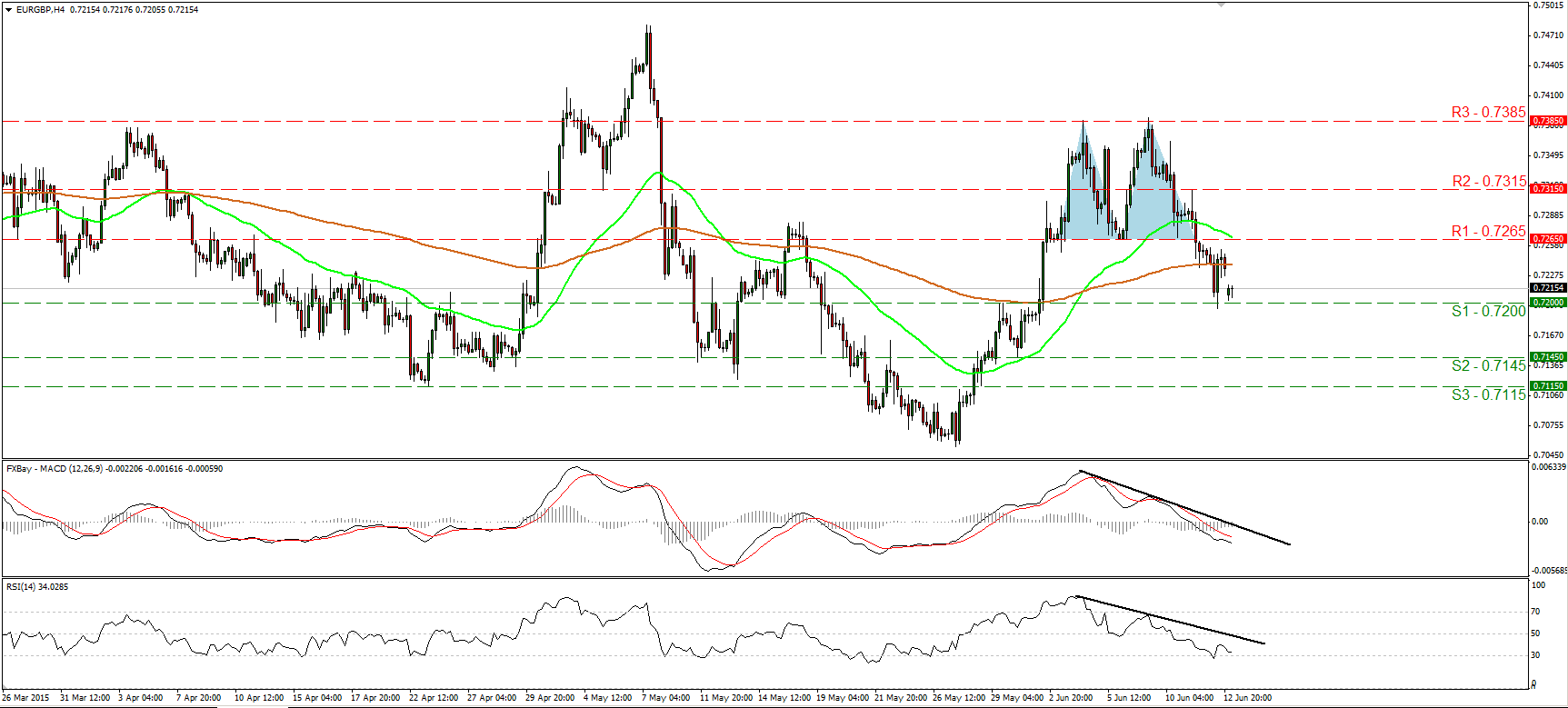

EUR/GBP near the support line of 0.7200

EUR/GBP opened the day with a gap down as well, but the decline stayed limited near the 0.7200 (S1) support barrier. Last Thursday, the pair fell below the support (turned into resistance) barrier of 0.7265 (R1) and completed a double top formation on the 4-hour chart. This has shifted the short-term outlook to the downside in my view and therefore, I would expect a decisive move below 0.7200 (S1) to pave the way for our next support area of 0.7145 (S2). Our short-term oscillators detect downside speed and support the aforementioned scenario. The RSI, already below 50, turned down again, while the MACD stands below both its zero and trigger lines and points down. On the daily chart, the pair has been trading in a non-trending mode since mid-March. Therefore, although we may see some near-term declines in the short run, I would consider the overall outlook to be neutral.

• Support: 0.7200 (S1), 0.7145 (S2), 0.7115 (S3)

• Resistance: 0.7265 (R1) 0.7315 (R2), 0.7385 (R3)

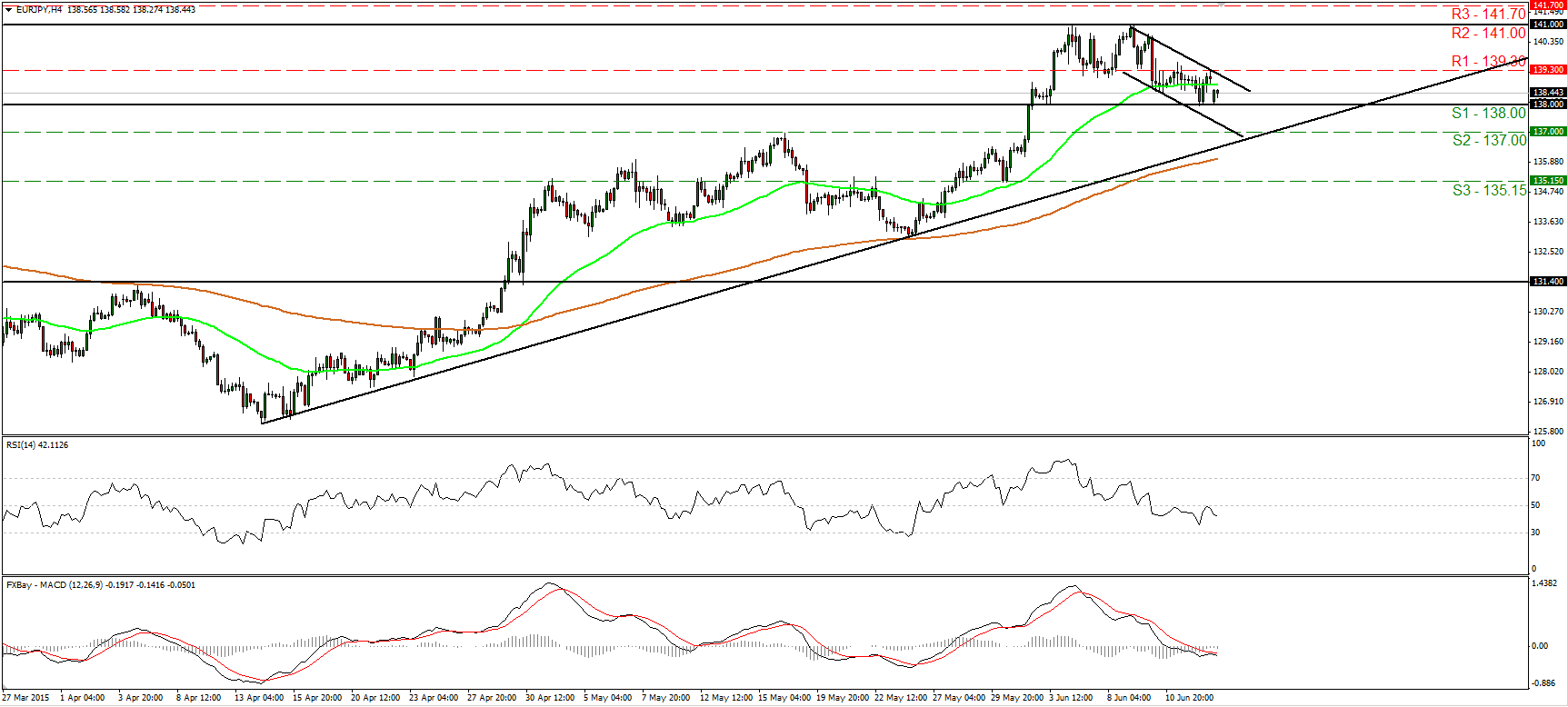

EUR/JPY hits support at 138.00

EUR/JPY gapped down on Monday, after it hit resistance at 139.30 (R1) on Friday. However, the rate found support at 138.00 (S1) and rebounded somewhat. A clear and decisive move below 138.00 (S1) would confirm a forthcoming lower low on the 4-hour chart and perhaps pave the way for the next support at 137.00 (S2). Our short-term oscillators detect negative momentum and corroborate that view. The RSI hit resistance at its 50 line and turned down, while the MACD stands below both its zero and signal lines, pointing south as well. On the daily chart, the break above 131.40 on the 29th of April signaled a possible trend reversal in my view. As a result, I would consider the medium-term trend of EUR/JPY to be positive, and I would treat any near-term declines as a corrective phase of the longer-term uptrend.

• Support: 138.00 (S1), 137.00 (S2), 135.15 (S3)

• Resistance: 139.30 (R1), 141.00 (R2), 141.70 (R3)

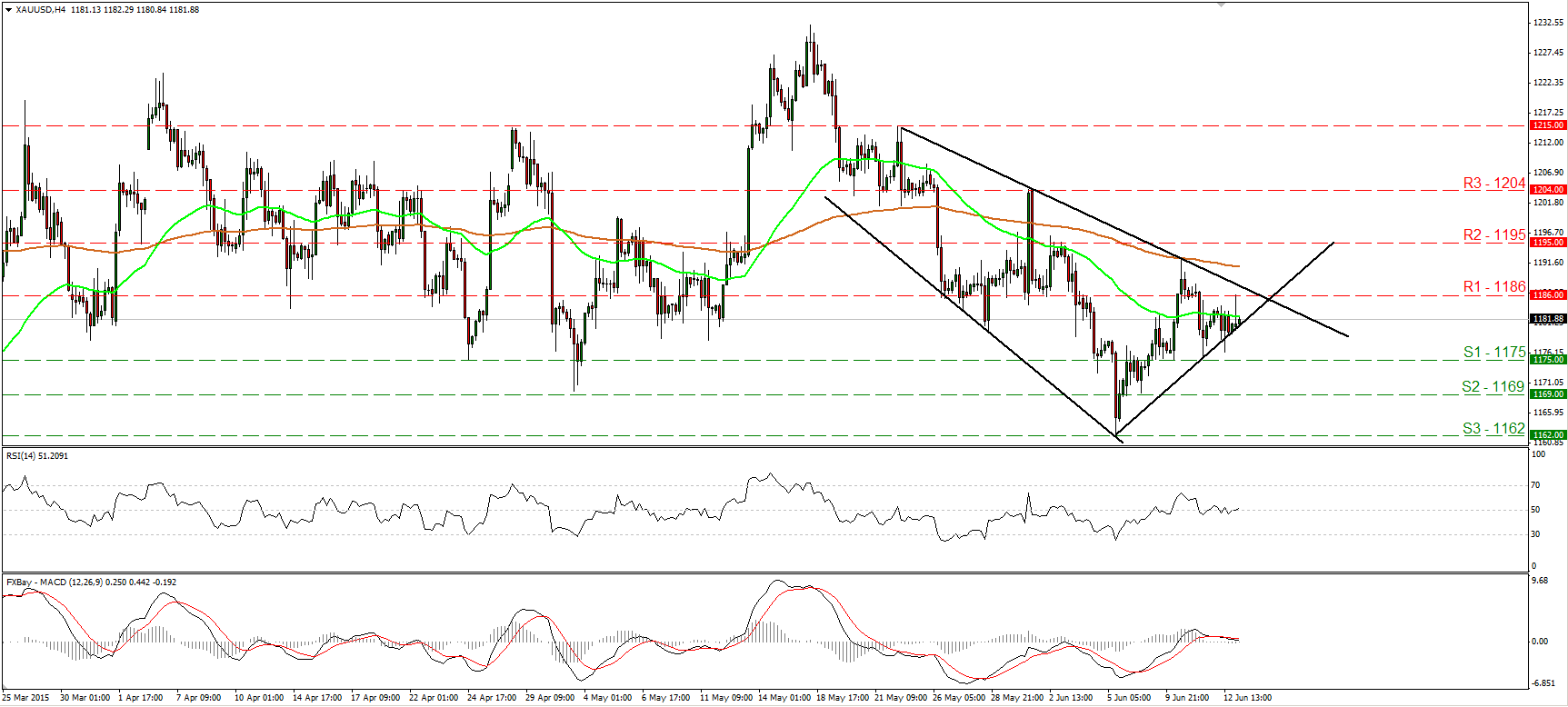

Gold trades virtually unchanged

Gold traded in a consolidative manner on Friday, trading between the support barrier of 1175 (S1) and the resistance of 1186 (R1). The precious metal is still trading above the short-term uptrend line taken from the low of the 5th of June, but below the downtrend line drawn from the peak of the 22nd of May. Having these technical signs in mind, I would take the sidelines for now, as far as the short-term picture is concerned. My stance is also supported by our oscillators. Both the RSI and the MACD lie near their equilibrium lines and point sideways. On the daily chart, the move below 1169 (S2) on the 5th of June gives a first sign that the overall outlook has probably turned negative. As a result, I would treat any further short-term advances as a corrective phase.

• Support: 1175 (S1), 1169 (S2), 1162 (S3)

• Resistance: 1186 (R1), 1195 (R2), 1204 (R3)

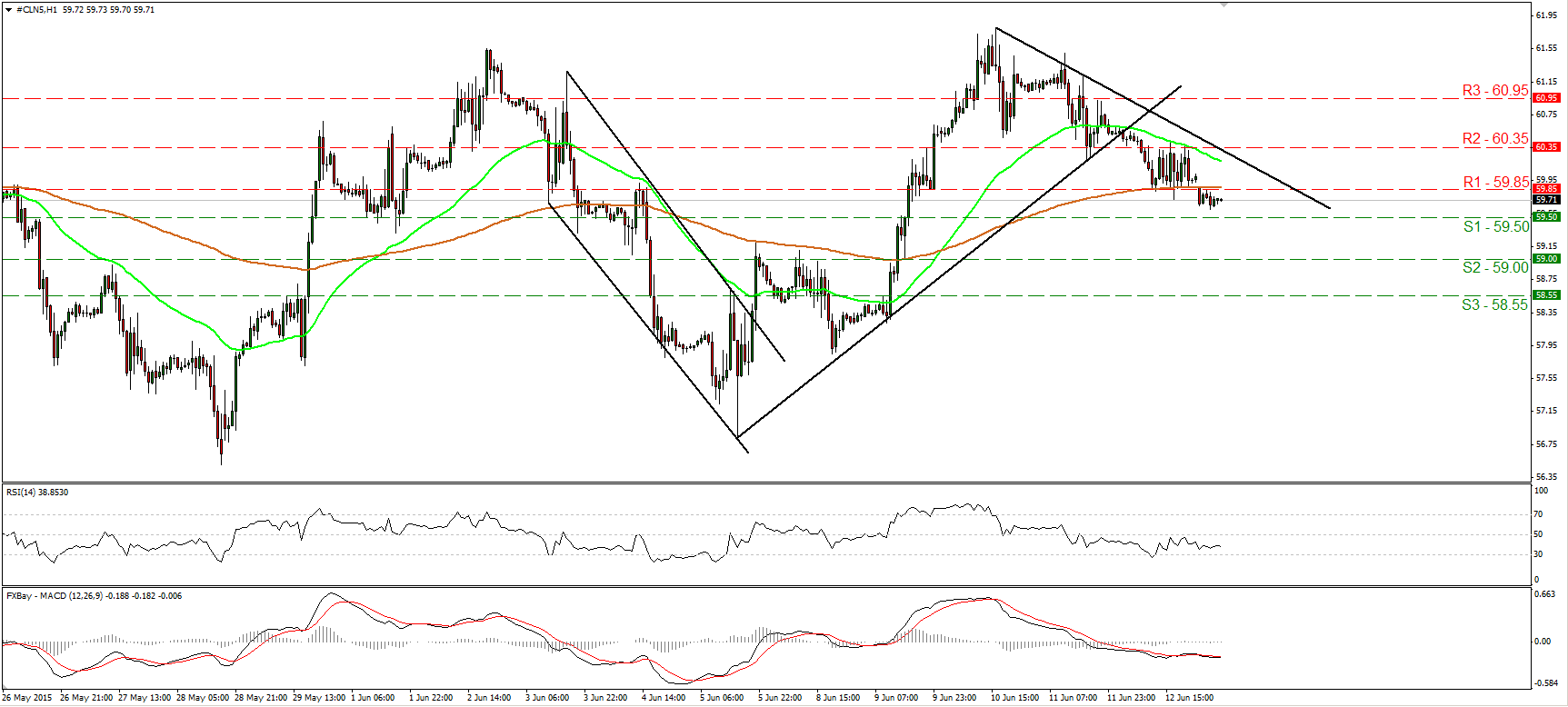

WTI falls back below 60.00

WTI traded lower on Friday and is now trading back below the 60.00 figure. The price structure on the 1-hour chart suggests a short-term downtrend, and therefore I would expect a clear break below the 59.50 (S1) hurdle to open the way for the next support, at 59.00 (S2). As for the broader trend, the break above 55.00 on the 14th of April signaled the completion of a double bottom formation, something that could carry larger bullish implications in the not-too-distant future. However, WTI has been trading in a sideways mode since the 6th of May, and this is supported by our daily oscillators as well. Both the 14-day RSI and the daily MACD lie near their equilibrium lines and point sideways. I also see negative divergence between the oscillators and the price action, something that leaves the door open for further short-term declines. Nevertheless, I would treat any possible further declines as a corrective phase of the overall upside path.

• Support: 59.50 (S1), 59.00 (S2), 58.55 (S3)

• Resistance: 59.85 (R1) 60.35 (R2), 60.95 (R3)

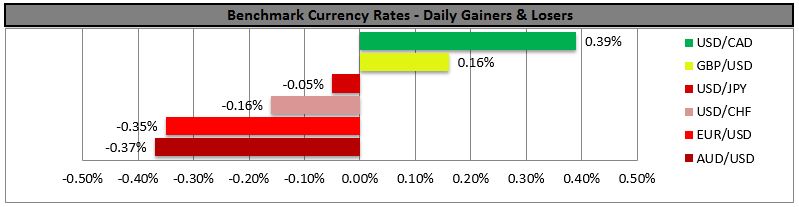

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

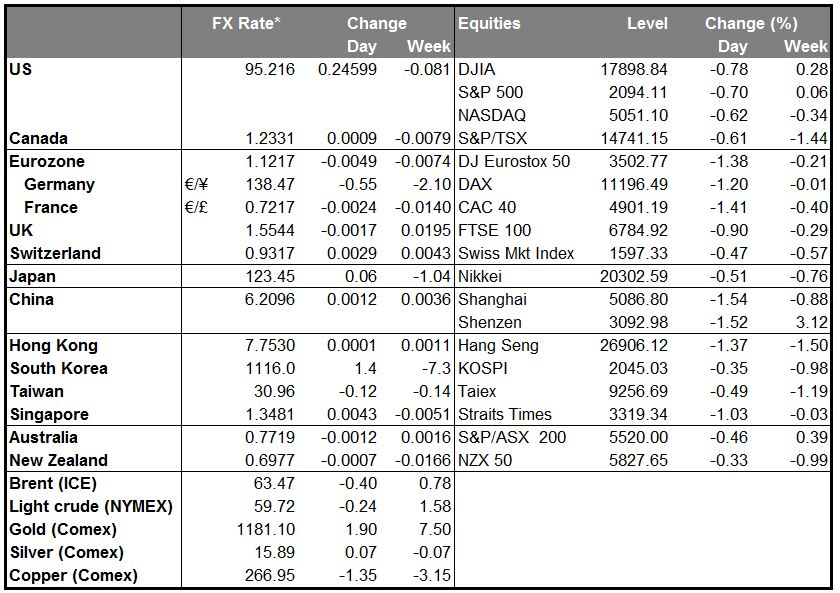

MARKETS SUMMARY

Related Articles

Investor’s bearish sentiment has surged to levels that generally align with server market corrections and crashes. While concerns about the recent market correction have risen,...

The latest economic indicators aren’t supporting our resilient-economy thesis. Nevertheless, we are sticking with it for now. Consider the following: The Atlanta Fed’s GDPNow...

Economic resilience has held up, but emerging signs of weakness suggest investors should stay vigilant. Market volatility is creeping higher, hinting at a potential shift from...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.