- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Intuit (INTU) Unveils Accountant Apps Program On QuickBooks

Intuit Inc. (NASDAQ:INTU) recently unveiled QuickBooks Accountant Apps Program for better management of applications by accounting professionals on behalf of their clients.

The applications selected for the program are the ones that have been hugely recommended by people related to the accounting domain. Further, these are in sync with QuickBooks Online and per the press release, “support single sign on via QuickBooks Online Accountant”.

The company plans to roll out the new program this month and willing to make it available for users across the United States, UK, Canada and Australia pretty soon.

Per, Rich Preece, head of the company’s Accountant Segment, Small Business and Self Employed Group, the addition of this program will be extremely beneficial to the professionals related to the accounting field. This will equip the professionals to provide effective recommendations for the selection and implementation of the applications required by their clients.

The accounting professionals will have the option of using preferred pricing for the applications which have been selected for the program. Per the press release, “they can also receive one consolidated, itemized bill each month for all the apps they provision through the program.”

According to the company, the applications that will be available initially are “Circulus, Expensify, Float, Method: CRM, Excel Transaction Importer, ServiceM8, SOS Inventory and Tsheets by QuickBooks.” Additional applications are expected to be incorporated going ahead.

Intuit Gaining on QuickBook Online’s Popularity

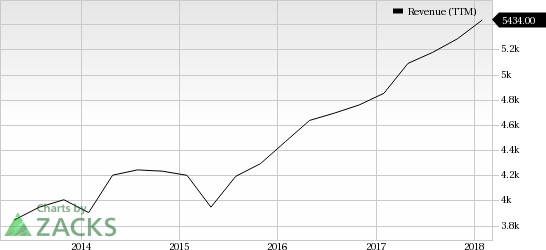

In the last reported second-quarter fiscal 2018 results, this tax-preparation related software maker delivered revenues of $1165 million, outpacing the Zacks Consensus Estimate of $1156 million and portraying a 15% year-over-year gain.

The company’s Small Business and Self-Employed Group witnessed 19% year-over-year growth. This was primarily driven by 51% subscriber growth rate for Quickbooks Online, which brought the count to 2.8 million at the end of the quarter. Hence, we believe Intuit is winning largely on the accelerated adoption of QuickBooks Online.

Additionally, the shift in its business model from selling software to cloud-based subscription providing via QuickBooks is a major tailwind in the long term. Per a recent report by Gartner, the cloud based application services (Saas) is expected to generate around $99.7 billion of revenues by 2020 from $58.6 billion in 2017.

With its SaaS-based QuickBooks and Online Tax applications, Intuit is well-positioned to make the most of the growth opportunity in the SaaS market.

Zacks Rank and Other Stocks to Consider

Intuit carries a Zacks Rank #2 (Buy).

Other top-ranked stocks worth considering the broader technology sector are Paycom Software, Inc. (NYSE:PAYC) , Facebook, Inc. (NASDAQ:FB) , both sporting a Zacks Rank #1 (Strong Buy) and Automatic Data Processing, Inc. (NASDAQ:ADP) with a Zacks Rank #2 .

You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term expected EPS growth rate for Paycom, Facebook and Automatic Data Processing is projected to be 25.75%, 26.51% and 11% respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Facebook, Inc. (FB): Free Stock Analysis Report

Paycom Software, Inc. (PAYC): Free Stock Analysis Report

Intuit Inc. (INTU): Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.