- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Intercontinental Up On Initiatives & Solid Capital Position

Intercontinental Exchange, Inc. (NYSE:ICE) is currently riding on actions intended to upgrade the product portfolio and a solid capital position.

The company has a decent surprise history. It surpassed estimates in three of the trailing four quarters, the average positive surprise being 4.3%. The Zacks Consensus Estimate for current-quarter earnings has been revised 1.9% upward over the past 30 days.

Factors Driving Intercontinental Exchange

The company continues to benefit from a solid product portfolio equipped with a wide variety of risk management services. As a result, revenues have witnessed a CAGR of 9.3% in the last five years (2014-2019). Revenues are also likely to benefit from existing strength in global data services.

Intercontinental Exchange reported strong volume growth for February. Average daily volumes (ADV) in the month increased 39% to 7.6 million, largely backed by improved Financial ADV, Commodities ADV and Energy ADV.

Furthermore, Intercontinental Exchange is on track to enhance its product portfolio on a continual basis. Last month, the company revealed plans to extend ties with S&P Global (NYSE:SPGI) Platts for introducing a version of its market data platform. The platform — ICE Connect — is aimed at improving the risk management capabilities of customers. Also, it announced plans in January to launch a data service in the second half of 2020, intended to assist investors in assessing environmental, social and governance (ESG) risks.

Intercontinental Exchange also enjoys a robust capital position. Evidently, the company’s operating cash flow witnessed a CAGR of 12.9% in the last two years (2017-2019). The metric also improved 5% year over year in 2019 on the back of operational excellence. Notably, it generated free cash flow of $2.3 billion in 2019 and returned more than 90% of that cash to shareholders via dividends and share repurchases.

However, elevated operating expenses due to several initiatives are significantly concerning.

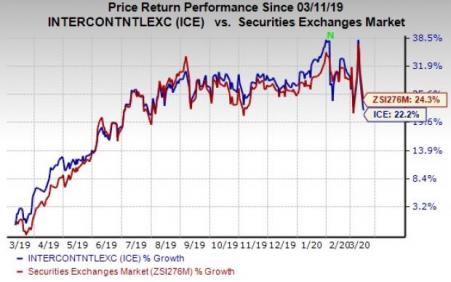

Shares of this Zacks Rank #3 (Hold) company have gained 22.2% in the past year, underperforming the industry’s rise of 24.3%. Nonetheless, we believe that the company’s strong fundamentals will drive its shares, going forward.

Stocks to Consider

Some better-ranked stocks from the same space are Cboe Global Markets, Inc. (NYSE:CBOE) , MarketAxess Holdings Inc. (NASDAQ:MKTX) and Nasdaq, Inc. (NASDAQ:NDAQ) . All three stocks beat the Zacks Consensus Estimate in the last reported quarter by 9.01%, 1.54% and 1.57%, respectively.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Cboe Global Markets, Inc. (CBOE): Free Stock Analysis Report

Intercontinental Exchange Inc. (ICE): Free Stock Analysis Report

Nasdaq, Inc. (NDAQ): Free Stock Analysis Report

MarketAxess Holdings Inc. (MKTX): Free Stock Analysis Report

Original post

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.