- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Intel (INTC) Halts Share Buyback On Coronavirus Concerns

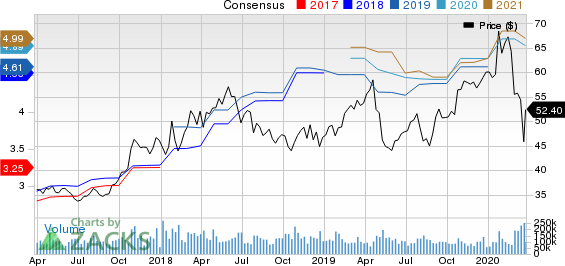

Intel (NYSE:T) becomes the latest S&P 500 company to bear the brunt of ongoing coronavirus pandemic. Per the 8K filed with the SEC, the chipmaker revealed that it is suspending stock repurchases temporarily on account of the COVID-19 crisis. However, the company will continue its dividend payment plans.

Notably, in October 2019, Intel had announced plans to repurchase shares worth $20 billion over the next 15-18 months. The company noted that prior to the stock buyback suspension announcement; it has repurchased shares worth $7.6 billion in fourth-quarter 2019 and first-quarter 2020.

The semiconductor giant also amended its “Risk Factors” section, adding that the uncertainty around COVID-19 pandemic could hurt its financial position. The company also anticipates that the crisis “will cause an economic slowdown”, and “a global recession.”

Given the rising possibility of recession in 2020, cash is the king for businesses and investors. Further, lower buybacks imply stronger liquidity position allowing room for investment into product development & business, which is the need of the hour. We believe that the decision will aid Intel, currently carrying a Zacks Rank #3 (Hold), to tide over the crisis. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Coronavirus Wreaks Havoc on Buybacks

Per the latest report by S&P Dow Jones Indices, during full year 2019, S&P 500 companies spent $728.7 billion in buybacks, down 9.6% from $806.4 billion in 2018. Nevertheless, the figure ranks second highest in the index’s history.

However, the coronavirus crisis has triggered suspension of share repurchase programs and shelving of dividend payouts in 2020.

Markedly, pre-COVID-19 estimates had projected that 2020 share buybacks “would come close to or exceed the $806 billion record set in 2018,” which ranked highest in the index’s history.

As of now, first-quarter 2020 buybacks are expected to decline sharply. In fact, second quarter 2020 buyback scene is anticipated to be “dismal.” For 2020, it is now estimated that stock-buybacks may witness “a complete reversal of the 2018 buyback bonanza.”

Coronavirus Crisis Triggers Stock Buyback Suspension

The coronavirus outbreak has not only claimed human lives but is also wreaking havoc on the global economy. It is affecting global trade, investment, travel and tourism, and supply chain.

To preserve cash and maintain ample liquidity, various companies are resorting to dividend cuts and stock-buyback suspensions. Major Aerospace-Defense player, The Boeing Company (NYSE:BA) scraped its quarterly dividend payments and suspended share repurchase program until further notice, last week.

Notable telecommunication company, AT&T (NYSE:T) also withdrew plans to repurchase $4 billion worth of stock due to the coronavirus pandemic.

Citing the uncertainty regarding the coronavirus pandemic, major U.S. banks, including JPMorgan Chase (NYSE:JPM) , America’s biggest bank by assets, has also suspended share buybacks temporarily.

Companies across the globe are facing unprecedented challenges and taking stringent measures to tackle the crisis. Suspension of production and forced leaves/layoffs and cost cutting are becoming commonplace. Despite policymakers’ best efforts, companies are finding it difficult to stay afloat amid such trying times.

Therefore, amid the coronavirus crisis, many companies might be forced to take rigorous measures for cash preservation. So, until the fog clears, investors should brace for more dividend and share-buyback suspensions.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

AT&T Inc. (T): Free Stock Analysis Report

The Boeing Company (BA): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Original post

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.