- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Installed Building (IBP) Buys Royals Commercial For Expansion

In a bid to expand presence in the greater Baltimore and mid-Atlantic markets, Installed Building Products, Inc. (NYSE:IBP) has acquired Royals Commercial Services, Inc. ("Royals Commercial"). Headquartered in Millersville, MD, Royals Commercial serves commercial customers with spray foam insulation and thermal barrier installation services throughout Maryland, Pennsylvania, Virginia, Delaware, as well as New Jersey.

In addition to Royals Commercial, this industry-leading installer of insulation and complementary building products announced that it has acquired a Chicago-based shower, shelving and mirror installer.

Acquisition Strategy to Drive Growth

Since 1999, the company has integrated more than 150 companies through its acquisition strategy. Notably, the buyout strategy has allowed it to diversify product offerings, while expanding into some of the most attractive markets within the United States.

In 2019, net revenues increased 13.1% year over year, primarily driven by increased selling prices, continued recovery in housing markets, strong contributions from acquisitions, and growth across end markets and products. Installed Building Products closed eight acquisitions. Of these, 1st State Insulation, LLC; Expert Insulation, Inc. and Expert Insulation of Brainerd, Inc. (collectively, “Expert Insulation”); as well as Premier Building Supply, LLC were the largest buyouts in 2019. Notably, acquisitions added $64 million to annual revenues during 2019.

The company had completed 10 acquisitions during 2018, excluding several small tuck-in buyouts merged into existing operations.

Commercial End Markets’ Prospects Look Good

Prospects of commercial end markets — which represented approximately 18% of total 2019 revenues — remain strong for 2020, given strong contribution from recent acquisitions, product diversification strategies, favorable pricing trends and stable end-market demand.

The company is well positioned to increase participation in these compelling markets through acquisitions and organic moves. During 2019, net sales grew nearly 25% year over year in the commercial end market.

Particularly in fourth-quarter 2019, its large commercial construction end market registered organic growth of 10.2%. Alpha insulation and waterproofing primarily aided the company to execute its growth strategy.

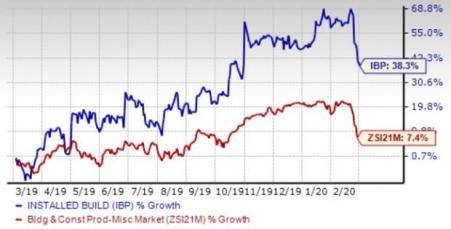

Shares of this Zacks Rank #2 (Buy) company have gained 38.3% compared with the industry’s 7.4% growth. We believe the above-mentioned strategies and positive housing market fundamentals will help the company to grow further.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Installed Building Products — which shares space with TopBuild (NYSE:BLD) , Arcosa, Inc. (NYSE:ACA) and Armstrong World Industries, Inc. (NYSE:AWI) in the same industry — is also a great pick in terms of growth investment, supported by a Growth Score of A.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Armstrong World Industries, Inc. (AWI): Free Stock Analysis Report

Installed Building Products, Inc. (IBP): Free Stock Analysis Report

TopBuild Corp. (BLD): Free Stock Analysis Report

Arcosa, Inc. (ACA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.