- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Infosys (INFY) Commences Autonomous Technology Training

Infosys Limited (NYSE:INFY) recently announced that it has entered into a partnership with the global online learning company Udacity to train employees in Self-Driving Car Engineer Nanodegree program. This deal will offer Infosys’s employees a combined in-person and online training. With Infosys focusing on autonomous technology across a range of industries, including manufacturing, automotive as well as mining, the Udacity Connect program will help the employees learn the required skills.

Per the agreement, the 20-week program will offer training services on engineering technologies for self-driving vehicles, including machine learning as well as advanced courses in deep learning. Moreover, the program participants will engage in six-week apprenticeships, to work for the company clients’ solutions for most of their critical challenges.

The program aims to train 500 engineers by the end of next year. Additionally, the company will hold a competition to identify the company’s finest talent who will select the first 100 participants for the program.

Our Take

In recent times, Infosys has been strengthening its core competencies by pursuing strategic collaborations and acquisitions. Over the past few quarters, Infosys have collaborated with biggies for fortifying its portfolio and market share. To fortify engineering services, it has teamed up with General Electric (NYSE:GE) to deliver solutions in the field of automation, digital trends and Internet of Things.

Moreover, the company’s Renew New strategy has helped reap multiple benefits, including renewal of traditional services, winning deals, introduction of services, monetization from key initiatives such as Zero Distance and improvement of employee engagement. Infosys’ continued focus on commitment to execution has helped it deliver constant currency revenue growth, margin improvement, record cash generation and high revenue per worker over last several quarters.

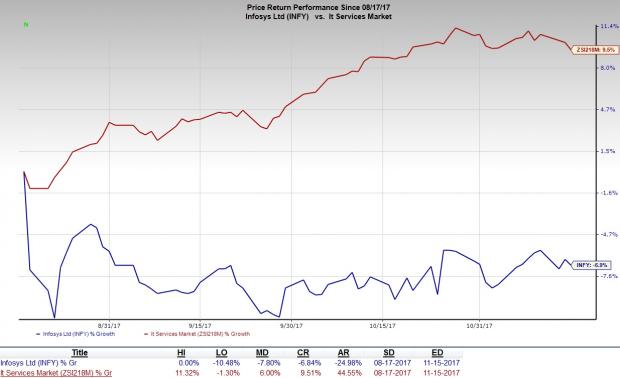

However, the fact remains that President Trump’s anti-immigration stance, unfavorable political climate and escalating costs are likely to dent the company’sperformance. Moreover,the company’s stock has yielded a negative return of 6.8% in the past three months as against the industry’s gain of 10.1%.

Nevertheless, we believe the Zacks Rank #3 (Hold) company’s Renew New program, strong innovation as well as greater operational efficacy will offer the company growth opportunities going forward.

Stocks to Consider

Some better-ranked stocks from the same space are Axcelis Technologies, Inc. (NASDAQ:ACLS) , AppFolio, Inc. (NASDAQ:APPF) and Advanced Energy Industries, Inc. (NASDAQ:AEIS) . While Axcelis Technologies and AppFolio sport a Zacks Rank #1 (Strong Buy), Advanced Energy Industries carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Axcelis Technologies has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 25.2%.

AppFolio has outpaced estimates in the preceding four quarters, with an average earnings surprise of 238.1%.

Advanced Energy Industries has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 13.5%.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Axcelis Technologies, Inc. (ACLS): Free Stock Analysis Report

AppFolio, Inc. (APPF): Free Stock Analysis Report

Infosys Limited (INFY): Free Stock Analysis Report

Advanced Energy Industries, Inc. (AEIS): Free Stock Analysis Report

Original post

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.