- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Infineon (IFNNY) Q4 Earnings Lag Estimates, Power Demand Up

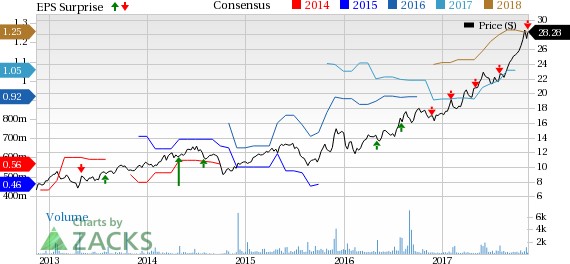

Infineon Technologies AG (OTC:IFNNY) reported fourth-quarter fiscal 2017 adjusted earnings of 26 cents per share, missing the Zacks Consensus Estimate by a nickel. However, the figure increased 4.8% on a year-over-year basis.

Revenues increased 8.7% year over year to $2.15 billion in the quarter, lagging the Zacks Consensus Estimate of $2.17 billion. The top-line growth came on the back of strong sales across all the four business segments. Power represents almost 60% of revenues in the reported quarter.

The quarterly results demonstrated Infineon’s strong growth prospects in the automotive market (40.4% of total revenues). The company’s products are currently used by eight of the top-10 electric vehicle makers including Tesla (NASDAQ:TSLA) , BMW and Renault (PA:RENA).

In fiscal 2017, Infineon reported earnings of $1, up 11.8% from fiscal-2016 level. The upside was primarily driven by 9.1% growth in revenues, which totaled $8.34 billion.

Infineon’s stock has returned 63.6% year to date, substantially outperforming the 35.6% rally of the industry.

Quarter Details

Automotive (ATV) revenues increased 6.5% year over year to $868.8 million. Management noted persistent high demand for driver assistance systems and electric drive train during the quarter.

Industrial Power Control (IPC) revenues increased 17.6% year over year to $387.2 million. The segment is benefiting from strong demand in home appliances, traction, electric drives, photovoltaics and wind power.

Power Management & Multi-market (PMM) revenues increased 7.5% on a year-over-year basis to $676.4 million. Strong demand in AC/DC and DC/DC conversion were noticeable in the quarter.

Moreover, Chip Card & Security (CCS) revenues increased 4% from the year-ago quarter to $213.6 million.

Segment-wise, IPC and PMM operating margins expanded 500 basis points (bps) and 320 bps, respectively. ATV and CCS operating margins contracted 140 bps and 70 bps from the year-ago quarter, respectively.

Consolidated operating margin expanded 130 bps on a year-over-year basis to 14.9%.

Guidance

For fiscal 2018, revenues are expected to grow almost 9% (+/- 2%). Segment margin is projected to be almost 17% at mid-point of the guidance.

ATV segment revenues are expected to grow above the company’s growth average, while IPC and PMM revenues are projected to grow below. CCS revenues are expected to remain flat compared with fiscal 2017.

Capital expenditure is anticipated at almost €1.1–€1.2 billion for fiscal 2018. Depreciation and amortization is expected at almost €880 million.

First-quarter fiscal 2018 revenues are expected to decline 2% (+/- 2%). At the mid-point of revenue guidance, the segment margin is expected at 15%.

Zacks Rank & Key Picks

Currently, Infineon has a Zacks Rank #4 (Sell).

NVIDIA Corporation (NASDAQ:NVDA) and Intel Corporation (NASDAQ:INTC) are stocks worth considering in the sector. These stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for NVIDIA and Intel is currently pegged at 11.2% and 8.42%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Tesla Inc. (TSLA): Free Stock Analysis Report

Infineon Technologies AG (IFNNY): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.