- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Indepth Look At The E-Commerce Landscape

The Electronic Commerce, or e-commerce industry is one of the most progressive sectors of the economy. The industry is evolving very rapidly, so data collection and evaluation are particularly difficult. Consequently, one has to rely largely on surveys by both government and private agencies.

According to the U.S. Census Bureau, the manufacturing sector is the largest contributor to e-commerce sales (49.3% of their total shipments), followed by merchant wholesalers (24.3% of their total sales). These two segments make up the business-to-business category.

Retailers and service providers generated just 4.7% and 3.0%, respectively of their revenues online, a slightly higher percentage than they were in the prior year. The Bureau categorizes these two segments as business-to-consumer.

This places the business-to-business category at 89% of total ecommerce sales, with the balance coming from the business-to-consumer category. The latest numbers from the Bureau suggest that the fastest-growing segments were retail and wholesale. [All the above data from the U.S. Census Bureau relate to 2011, as published in May 2013].

The U.S. Commerce Department estimates that ecommerce sales in the country grew 15.8% in 2012 to reach $225.5 billion.

Retail

Total retail e-commerce was 5.8% of total retail sales in the second quarter of 2013, up slightly from 5.5% in the first quarter, according to the quarterly retail trade survey by the Census Bureau. Forrester Research estimates that this share will go up to 10% by 2017.

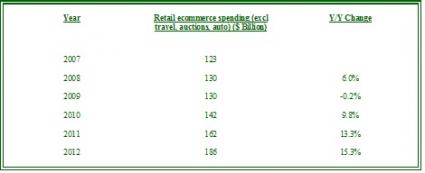

comScore data (as compiled in the table below) indicates that this segment recovered very quickly from the economic downturn and continued to grow at an accelerated rate over the last few years.

Key Drivers

Since the industry is in evolution, the drivers are changing. For instance, the initial push came from the time savings and convenience of online transactions. To this were added the benefits of comparison shopping and personal recommendations. As technology required for personalized recommendations developed, became more available and its benefits more evident, most e-tailers started adding the feature until it is now considered a must-have.

Today, the biggest driver of growth in the industry is the adoption of smartphones, tablets and other mobile Internet devices. In fact, trends indicate that consumers prefer mobile browsers when shopping, searching and entertaining themselves, while preferring apps for navigation and acquiring information. Call this "m-commerce."

comScore sees global mobile Internet users increasing very rapidly, with mobile as a percentage of total ecommerce sales (excluding travel) going from 11% in 2012 to 15% by the end of this year. The firm estimates that mobile represented 10% of total ecommerce sales for the first half of 2013.

eMarketer expects m-commerce to increase as a percentage of total ecommerce, with strong holiday sales this year taking its share of total ecommerce sales to 16%, or $41.7 billion (previous forecast was 15%, or $38.8 billion). This share is expected to go up to 26% in 2017 ($113.6 billion).

Smartphones and tablets accounted for 6.0% and 3.5% of total ecommerce sales in the first half of the year, according to comScore, with event tickets and apparel and accessories being the most popular items on mobile devices. eMarketer estimates that tablets will generate 65% of m-commerce sales this year, with smartphones accounting for the rest.

While smartphones are extremely convenient when on the move, tablets have several advantages of their own. In fact they are a boon to the ecommerce industry, since the larger screens offer better visibility of online stores and merchandise, thus facilitating purchases. Average spending per user on tablets is therefore 20% higher than on smartphones but since more people have smartphones, their overall share of ecommerce spending is lower. Given the unique advantages of smartphones and tablets, it appears that they are working in conjunction to boost total online retail sales.

Overall retail trade through smartphones and tablets grew 81% in 2012 and is expected to grow over 55% in 2013 (eMarketer Jan 2013). While growth rates will come down thereafter, they will remain in the strong double-digits range. At any rate, the inherent cost savings and convenience of “showrooming” ensures that the trend will continue.

Continued advancements in technology are improving navigation and customer experience on ecommerce sites, which is improving reviews and thus drawing more traffic to the sites.

The digital consumption of books, music, video and games all over the world is extending the reach of these goods and thereby boosting sales. Therefore, previously unconnected electronic goods, such as TVs and game consoles are now being modified to enable connectivity. On the other side of the fence, online versions of books, music, video and games that can be downloaded and consumed on a traditional computer or any other connected device are becoming available.

Since the shift in consumption patterns is resulting in multi-functional electronic gadgets that are no longer optimized for a particular activity, there is a great drive to develop technologies that could improve the quality of each experience.

Free shipping remains a major lure.

Top-Selling Items

The 10 hottest individual product categories in ecommerce are women’s apparel, books, computer hardware, computer software, apparel, toys/video games, video DVDs, health and beauty, consumer electronics and music.

Apparel is a huge market and although online sales are currently under 10% of total apparel sales, the category already generates the most dollars. Selling tools, such as zoom, color swatching and configurators are helping the process. Even primarily brick-and-mortar outfits like Macy’s (M) sees that consumers purchasing through multiple channels (online and offline stores) tend to spend more. This is encouraging traditional retailers to offer an online store to supplement their physical stores.

Online sales also show better conversions since searches usually draw consumers with a prior intention to purchase. eMarketer estimates that apparel will be the fastest-growing category over the next few years, making up around 20% of total retail ecommerce sales by 2016.

The increase in technology purchases over the Internet is driven by not only individual consumers, but also companies and governments. The efficient and timely processing of orders, choice of payment options, subscription-selling and sales under the SaaS model are all facilitators. eMarketer estimates that online sales of consumer electronics goods will nearly double over the next four years to touch $80.2 billion by 2016.

The Association of American Publishers says that ebook sales in the U.S. grew 34% in 2012, following triple-digit growth in the four preceding years. With a penetration of just 16%, scope for market expansion is present. However, the shift in preference from e-readers to tablets that offer other forms of entertainment, such as movies, games, songs and so on, is a deterrent (a Bowker Market Research survey and wsj.com).

U.S. players continue to see strength in international markets. Amazon (AMZN) and Apple (AAPL) are the primary channels facilitating international expansion, although Barnes & Noble (BKS), other smaller players and local companies in international markets are also playing a part.

Nearly 87% of the Internet-using audience in the U.S. watched videos in September. Google (GOOG) sites remained the forerunner facilitating online video consumption, with significantly higher unique viewers (UVs) than any of the others. Facebook (FB), which has moved up the ranks pretty fast, maintained the second position. AOL Media Network, Microsoft (MSFT) and NDN sites took the next two positions, with VEVO (in which Google’s YouTube recently acquired a stake) coming in at number six. AOL topped the list as far as ads viewed were concerned (helped by the Adap.tv acquisition) with Google close on its heels. [comScore estimates, Oct 2013]

The Cisco VNI initiative has forecast global consumer Internet video traffic to increase from 57% of total consumer Internet traffic in 2012 to 69% in 2017, with Internet TV increasing 5X by then and VoD tripling. This represents tremendous opportunity in terms of video content sales and ad revenues.

The digital consumption of music has grown greatly since Apple announced its first iPod. Amazon and others are also seeing their business grow. Nielsen estimates that in 2012, U.S. digital album sales increased 14%, with tracks up 5% and overall music shipments at an all-time high of 1.65 billion.

A recent IFPI report shows that digital music could finally bring a turnaround in the music business, which has been in the doldrums for many years. While piracy remains a major concern, licensed and ad supported music services are increasingly available now.

The gaming segment has suffered over the last few quarters, impacted by the economic slowdown that affected consumer spending. However, while this affected total gaming spend, it did not affect the online segment, which gained from the increasing digitization of games, the desire to play across multiple platforms and the availability of free-to-play games to draw customers.

As a result, sales through online channels continue to grow at the expense of traditional retail. The release of the new Play Station from Sony and Xbox from Microsoft will also help sales this year.

Since video, games and music are often social activities, they are increasingly being marketed on social platforms such as Facebook and Pinterest.

Facebook’s SocialStore, as it is called, uses MarketLive's Intelligent Commerce Platform that enables marketers to display product information, promotions/discounts, shopping carts and check-out options. Both comparative shopping and comparative pricing are possible. The basic advantages of the system that are currently being touted are that it allows easy brand building, creates meaningful commercial relationships and makes use of account-holders’ social connections to attract new buyers.

An E-tailing Group study reveals that of 100 U.S. consumer product merchants with e-commerce websites surveyed, 98 had a Facebook account. Around 90% of these redirected the user to the merchant’s own page, 96% had loaded brand-building videos, 56% had product-oriented videos, 44% had store locators and 38% had promotions.

According to recent research from comScore, Facebook led the social networking space in Dec 2012, with 83% of total time spent on social networking platforms, followed by Tumblr, Pinterest, Twitter (TWTR), LinkedIn (LNKD) and others. However, Pinterest and Instagram are growing in popularity, going by the strong growth in unique visitors. A more recent ranking from eBizMBA places Facebook in the first position with the highest number of unique monthly visitors, followed by Twitter, LinkedIn, Pinterest and MySpace. Despite recent growth, Google+ didn’t make it to the top 5.

Selling discount coupons is also helping retail. Groupon (GRPN) is the leader here, which along with its closest rival LivingSocial offer discount coupons with a very low shelf life from local players looking for sales. The company offers huge discounts to attract buyers and collects a percentage of the sales thus generated. This kind of business is very competitive, since it has very low barriers to entry.

As a result, not just Amazon and Google, but also a host of other much smaller parties have started doing some business in this format. Technology investments are also required in order to serve customer needs effectively. Considering the prospects, we don’t see the platform as a major contributor to e-commerce sales in the near term.

Forecast for 2013

U.S. e-commerce spending is expected to increase 13.4% this year to touch $262 billion, according to a recent report from Forrester. Online spending (excluding travel) will increase at a 10% CAGR to reach $370 billion by 2017. Western Europe is expected to increase 14.3% this year and grow at a CAGR of 11% to 2017.

Since ecommerce entails the buying and selling of goods or services over electronic systems, it includes companies that are totally dependent on these sales, those that are gradually moving to it, as well as those that want to use it partially. Therefore, the biggest sellers or the ones growing the strongest are not necessarily those that are solely dependent on the Internet. The following diagrams seek to explain the position of companies primarily dependent on the Internet for the distribution of their goods and services in the context of the Zacks Industry Rank.

Two (Retail/Wholesale and Computer & Technology) of the 16 broad Zacks sectors are related to the ecommerce industry as depicted below.

We rank the 264 industries across the 16 Zacks sectors based on the earnings outlook and fundamental strength of the constituent companies in each industry. To learn more visit: About Zacks Industry Rank.

The outlook for industries positioned at #88 or lower is 'Positive,' between #89 and #176 is 'Neutral' and #177 and higher is 'Negative.'

Therefore, Internet Commerce and Internet Services – Delivery being in the 32nd and 95th positions, respectively are in positive territory, with Internet Services (166th position) being neutral.

So it is not surprising that the average rank of stocks in the Internet Commerce industry is 2.65, for Internet Services – Delivery, it is 2.94, while for Internet Services it is 3.06. [Note: Zacks Rank #1 denotes Strong Buy, #2 is Buy, #3 means Hold, #4 Sell and #5 Strong Sell].

Earnings Trends

The broader Retail/Wholesale sector, of which Internet Commerce is a part, is not expected to do too well in the third quarter, considering the fact that both the estimated revenue and earnings beat ratios are 38.9%. The calculated earnings beat ratio based on companies that have reported thus far is just slightly higher at 40.9%.

Total earnings for the sector are estimated to increase 4.9% in the third quarter on revenue growth of 3.8%, indicating escalating costs and sluggish growth. This contrasts with an earnings growth of 9.3% on a revenue base of 6.9% in the preceding quarter.

The other companies we are discussing in the e-commerce outlook (Part 2) fall under the broader Technology sector. Here we estimate a fairly strong earnings beat ratio of 71.2%, partially supported by a revenue beat ratio of 57.7%.

While the estimated revenue beat ratio is consistent with the 57.7% in the previous quarter, the estimated earnings beat ratio is lower than the 75.0% calculated for the second quarter. The earnings beat ratio of companies that have reported thus far is 76.5%, better than the estimated numbers.

Total earnings in the sector were up 4.0% year over year compared to a 9.6% decline in the second quarter. Total revenues did slightly better, increasing 2.4% from last year, up from 0.6% in the second quarter.

Earnings estimates for 2013 and 2014 indicate better growth prospects in both years for Retail/Wholesale. Technology is expected to be even stronger.

Market Position

comScore estimates that Amazon remains the leading Internet retailer based on unique visitors (UVs) in the second quarter, followed by eBay (EBAY), Wal-Mart Stores (WMT), Apple, Target Corp. (TGT) and Best Buy (BBY), in that order. The top 3 have a much higher penetration on both Android and iOS platforms.

OPPORTUNITIES

When discussing opportunities, a couple of stocks stand out. The first is Netflix (NFLX), which is seeing positive momentum in the business due to better-than-expected subscriber additions, particularly in international markets. The longer-term growth prospects are also improving because of its growing library of original content.

Of course, it does have its own share of problems, such as the high content acquisition costs and the possibility of broadband suppliers moving to a usage-based tariff plan. But the positives outweigh the negatives at this point and estimates are trending up as a result.

We also see estimates for Autobytel (ABTL) going up, attributable to a refocusing of its business and a demonstrated ability to deliver a solid lead generation business. The company has not done too well in the last few years due to its dependence on macro factors particularly with respect to the automotive industry. It also needed to trim its operating structure. With this out of the way, Autobytel should be able to generate steadier returns.

WEAKNESSES

Because of the gradual receding of boundaries between online and physical store retailers, traditional retailers are increasingly entering the space.

Nearly all the Internet retailers have issues at present. That’s because Internet retailing requires proper fulfillment and a solid technology platform to be successful and both these factors become difficult as the companies grow. Moreover, the pursuit of growth in international markets is an absolute necessity, because stealing business from traditional retailers can only take them so far. Besides, traditional retailers have become wiser and many have developed their own e-tailing platform.

Amazon has pulled ahead of the pack with its international push. The company spent a good part of 2011 as well as most of 2012 setting up its international fulfillment centers and is now poised to benefit from it. It has also been launching its Kindle platform in some of these markets to spur digital sales. But Amazon has a very aggressive pricing policy in an attempt to pick up market share. This is taking a toll on its profitability.

eBay is still playing catch-up in the retail segment, but is way ahead of others in the payment segment. eBay’s recent push to grow its international business means the company is moving in the right direction. It has already strengthened its position in India, tied up with weaker players in China and set up a think tank in Russia. But the company may be expected to continue investing in the business, which may impact near-term returns to shareholders.

Original post

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.