- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Impax (IPXL) Q3 Earnings & Revenues Beat Estimates, Fall Y/Y

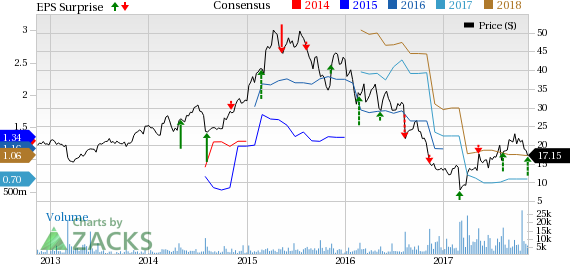

Impax Laboratories Inc. (NASDAQ:IPXL) reported third-quarter 2017 adjusted earnings of 23 cents per share, beating the Zacks Consensus Estimate of 19 cents. However, earnings were down 37.8% from 37 cents in the year-ago period due to higher costs and expenses.

Total revenues decreased 9.4% year over year to $206.4 million mainly due to lower Generic division sales.

Revenues, however, surpassed the Zacks Consensus Estimate of $203.66 million in the reported quarter.

Impax’s shares fell almost 4.5% on Thursday, following the earnings announcement. Nonetheless, year to date, Impax shares are up 29.5% against the industry’s decline of 31.5%.

Quarter in Detail

During the reported quarter, Impax Generic division revenues decreased 13.8% from the year-ago quarter to $151.1 million. The decrease in revenues was due to lower sales of metaxalone, fenofibrate, oxymorphone ER, partially offset by higher sales of epinephrine auto-injector, products acquired from Teva Pharmaceuticals and new product launches.

However, revenues from the Impax Specialty Pharma division were up 5.1% year over year to $55.3 million, largely due to higher sales of Rytary. Zomig sales were down 8.9% to $13.9 million.

Adjusted research and development (R&D) expenses fell 21% to $15.4 million in the reported quarter due to closure of research and development facility in Middlesex, NJ.

Adjusted selling, general and administrative expenses (SG&A) increased 5.5% to $50 million.

Other Details

In July, the company received approval for generic versions of two attention deficit hyperactivity disorder drugs – Novartis’ (NYSE:NVS) Focalin XR (25 and 35 mg) and Johnson & Johnson’s (NYSE:JNJ) Concerta (18, 27, 36 and 54 mg) – from the FDA. The approval of generic Focalin XR complemented its portfolio of generic Focalin XR, which included 5, 10, 15, 20 and 30 mg capsules. These are already marketed.

Concurrent with the earnings release, the company announced the completion of a phase IIb study on its Parkinson's disease candidate, IPX203. The candidate is an extended-release formulation of carbidopa-levodopa (CD-LD), which achieved an average 2.2 hours reduction in off time as compared to immediate-release CD-LD.

Subsequent to the quarter in October, Impax and privately held generic drug maker, Amneal Pharmaceuticals entered into an all-stock deal to merge and form a new publicly traded company, Amneal Pharmaceuticals Inc. The combined company will have a diverse pipeline with more than 300 products either filed with the FDA or in active stages of development. The deal, which is expected to close in the first half of 2018, will add to Impax’s standalone adjusted earnings in the first 12 months and generate double-digit revenues and earnings growth in the next three years.

Meanwhile, the FDA approved the company’s abbreviated new drug application seeking approval for Sanofi’s (NYSE:SNY) chronic kidney disease drug, Renvela.

2017 Outlook Updated

The company updated its full-year adjusted earnings expectation in the range of 60 cents to 65 cents per share (previously 55 cents to 70 cents per share.)

The company expects adjusted gross margin in the range of 47% (previously 47% to 49%).

Adjusted research and development expenses, including patent litigation expenses, across the generic and brand divisions are forecast to be in the range of $84 million to $88 million (previously $93 million to $97 million).

The company maintained its adjusted selling, general and administrative expenses estimate in the range of $190 million to $195 million.

Our Take

Impax’s generic division has been unfavorably impacted by pricing pressure prevailing in the U.S. markets. However, the company’s cost control initiatives announced early this year have improved margins and are expected to bring in more improvement. Moreover, its merger with Amneal will also bring in synergies. Moreover, approval for the full dose range of generic Concerta as well as generic Renvela is expected to have a positive impact on Impax’s revenues going forward.

Zacks Rank

Impax currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Sanofi (PA:SASY) (SNY): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Impax Laboratories, Inc. (IPXL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.