- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

A.O. Smith Rolls Out Energy-Saving Water Heaters For Homes

Buoyed by the stellar demand for its residential water heaters, A. O. Smith Corporation (NYSE:AOS) rolled out an innovative condensing gas water heater called the Polaris High Efficiency.

A.O. Smith’s dominant foothold in the North American water heater market, along with thriving prospects in residential and commercial boiler markets have consistently stoked top and bottom-line growth over the past several quarters. The company believes the latest product will help fortify its foothold further in the domestic heating marketplace.

Polaris, touted to operate at a cost-saving thermal efficiency of up to 96%, can easily be installed with recirculating systems and domestic space heating systems. Other notable features of the latest product include corrosion-resistant stainless steel heat exchanger, user-friendly touch screen display and front-access panels.

The product also comes with a noise-reducing blower and burner, and can be paired with an optional concentric vent kit. The latest model comes with a 10-year limited tank warranty and is available in 34 and 50-gallon models. A.O. Smith believes Polaris can achieve significant cost-saving options and is well-equipped to address multiple hot water needs of residential customers.

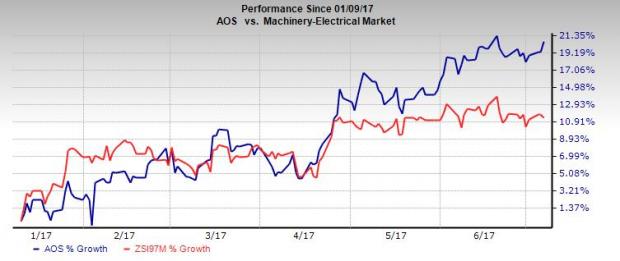

In the past six months, the company shares recorded a return of 20.7%, outperforming the Zacks categorized Machinery Electrical industry’s average gain of 11.4%. Going forward, A.O. Smith remains bullish about its prospects in key markets. It expects the U.S. residential water heater volumes to shoot up by approximately 200,000 units on the back of sturdy demand. Furthermore, impressive demand for U.S. commercial heaters is also expected to support growth.

The company’s sales of residential and commercial boilers are largely driven by innovation by Lochinvar. Lochinvar-branded products have benefited from the transition from lower-efficiency to higher-efficiency boilers, new product introduction and market share gain. During first-quarter 2017, Lochinvar-branded products grew 5%, led by strong demand for water heater and modest growth in boilers.

For 2017, the company projects Lochinvar-branded products to grow over 8%. This apart, presidential directives and executive orders in favor of price reduction of raw materials like steel, iron, coal, energy and related materials are likely to boost the company’s cost savings. We believe solid demand in end markets and favorable industry trends will continue to boost growth of the Zacks Rank #2 (Buy) company.

Other Top-Ranked Stocks

Other top-ranked stocks in the industry include Barnes Group Inc. (NYSE:B) , ACCO Brands Corporation (NYSE:ACCO) and Ingersoll-Rand Plc (NYSE:IR) . Each stock carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Barnes Group has a solid earnings surprise history for the trailing four quarters, having beaten estimates each time for an average of 8.9%.

ACCO Brands has a positive average earnings surprise of 79.7% for the last four quarters, beating estimates all through.

With three beats over the trailing four quarters, Ingersoll-Rand has a positive average earnings surprise of 3.6%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Smith (A.O.) Corporation (AOS): Free Stock Analysis Report

Ingersoll-Rand PLC (Ireland) (IR): Free Stock Analysis Report

Barnes Group, Inc. (B): Free Stock Analysis Report

Acco Brands Corporation (ACCO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.