- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

iFOREX Daily Analysis : November 16,2017

On Wednesday the US Dollar traded almost unchanged against a basket of major global currencies. The Japanese Yen traded over 0.5% stronger against the US Dollar after weaker GDP numbers (+0.3% vs. +0.4% expected) than expected. Some analysts attribute the move to the fact that Japan is a major creditor nation and would repatriate capital held abroad in case of a crisis back to Japan.

Gold was trading slightly lower after solid fundamental economic data from the US with Retail Sales and inflation being above estimates. Oil was trading higher but was far from making up the previous day’s losses. While the EIA oil stockpile numbers were up with 1.9 million barrels, this was less than what the American Petroleum Institute presented in its statistics on Tuesday (+6.5 million barrels).

US equity indices were lower as energy stocks were lower due to the decline of oil prices on Tuesday, while tech stocks were retracing as some traders were taking profits after a long successful run this year.

Bitcoin traded sharply up gaining over 10% and returning to the level it was one week ago before the sell-off during the weekend. Fintech payment processing company Square Inc (NYSE:SQ). is said to be working on integrating Bitcoin into its portfolio was seen as another move trying to bring the cryptocurrency to an even larger target group.

On Thursday the European Union publishes its Harmonised Index of Consumer Prices (HICP) data, while Italy publishes Merchandise Trade and France Unemployment Rate statistics. The United Kingdom publishes Retail Sales numbers and Canada Manufacturing Sales numbers. The United States will publish Jobless Claims, Import/Export Prices, Philadelphia Fed General Business Conditions, Industrial Production, Capacity Utilization and Housing Market Index statistics.

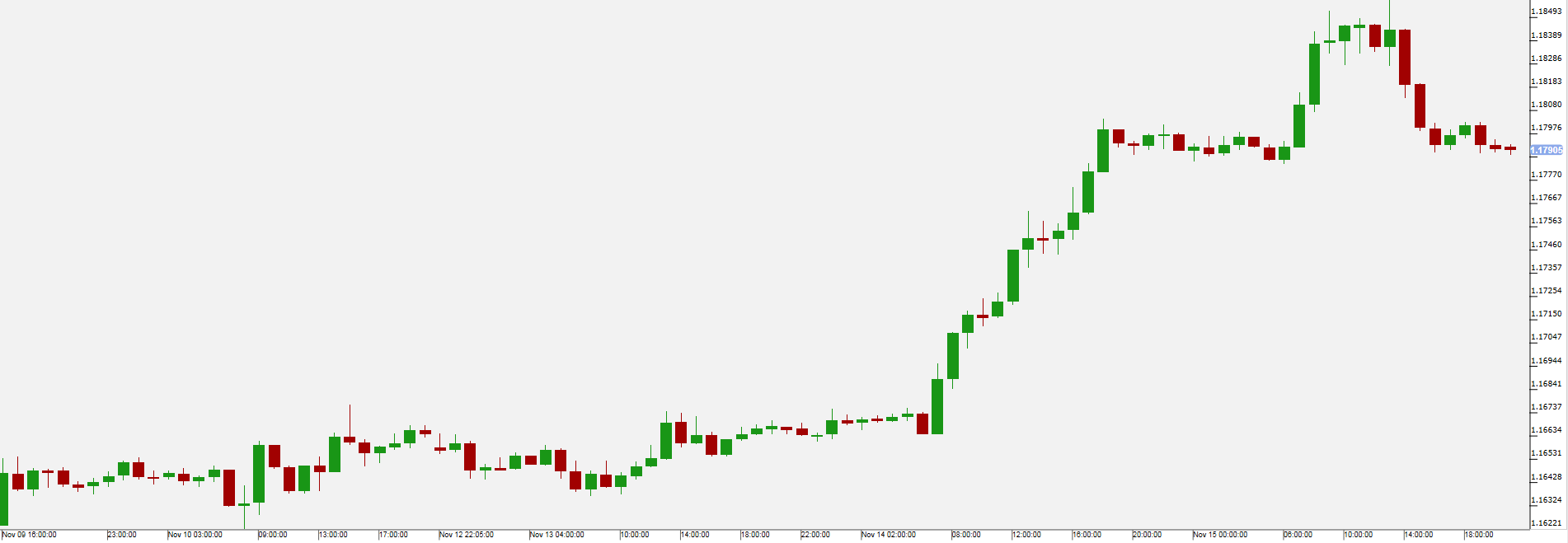

The EUR/USD traded unchanged on Wednesday. While the Dollar remained under pressure due to the uncertainty about the tax reform in the US, positive Retail Sales figures and slightly higher than expected inflation reduced the upside movement and made the Dollar end the day almost unchanged from the previous.

On Thursday the European Union publishes its Harmonised Index of Consumer Prices (HICP) data, while Italy publishes Merchandise Trade and France Unemployment Rate statistics. The United States will publish Jobless Claims, Import/Export Prices, Philadelphia Fed General Business Conditions, Industrial Production, Capacity Utilization and Housing Market Index statistics.

Pivot: 1.186

Support: 1.1775 1.175 1.168

Resistance: 1.186 1.188 1.19

Scenario 1: short positions below 1.1860 with targets at 1.1775 & 1.1750 in extension.

Scenario 2: above 1.1860 look for further upside with 1.1880 & 1.1900 as targets.

Comment: the RSI is mixed to bearish.

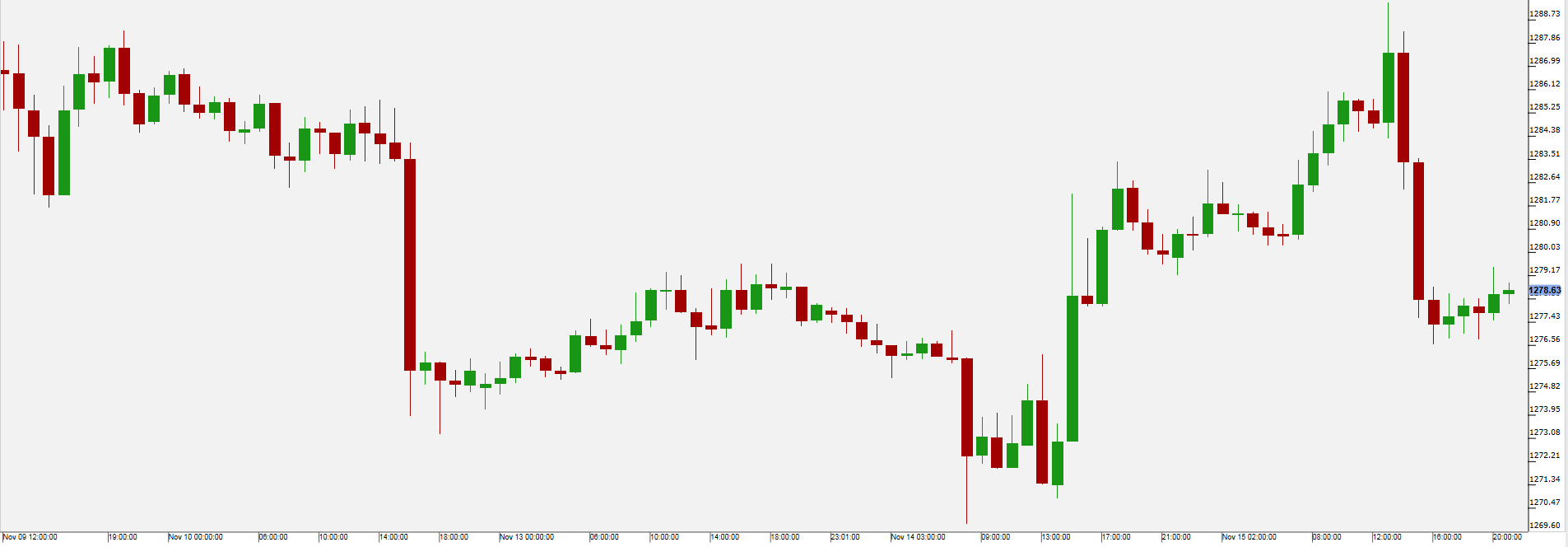

Gold

While initially trading higher, Gold closed lower on Wednesday just as the US Dollar rebounded from the day’s low. Positive US fundamental data such as better than expected Retail Sales statistics (+0.2% vs. +0.1 % expected) limited the upside for the safe haven metal.

Thursday’s US inflation, job market and industry data could give further insight into the condition of the US economy and be relevant for the movement of the gold price.

Pivot: 1283

Support: 1275.75 1274 1271

Resistance: 1283 1286.5 1289.5

Scenario 1: short positions below 1283.00 with targets at 1275.75 & 1274.00 in extension.

Scenario 2: above 1283.00 look for further upside with 1286.50 & 1289.50 as targets.

Comment: the RSI is bearish and calls for further downside.

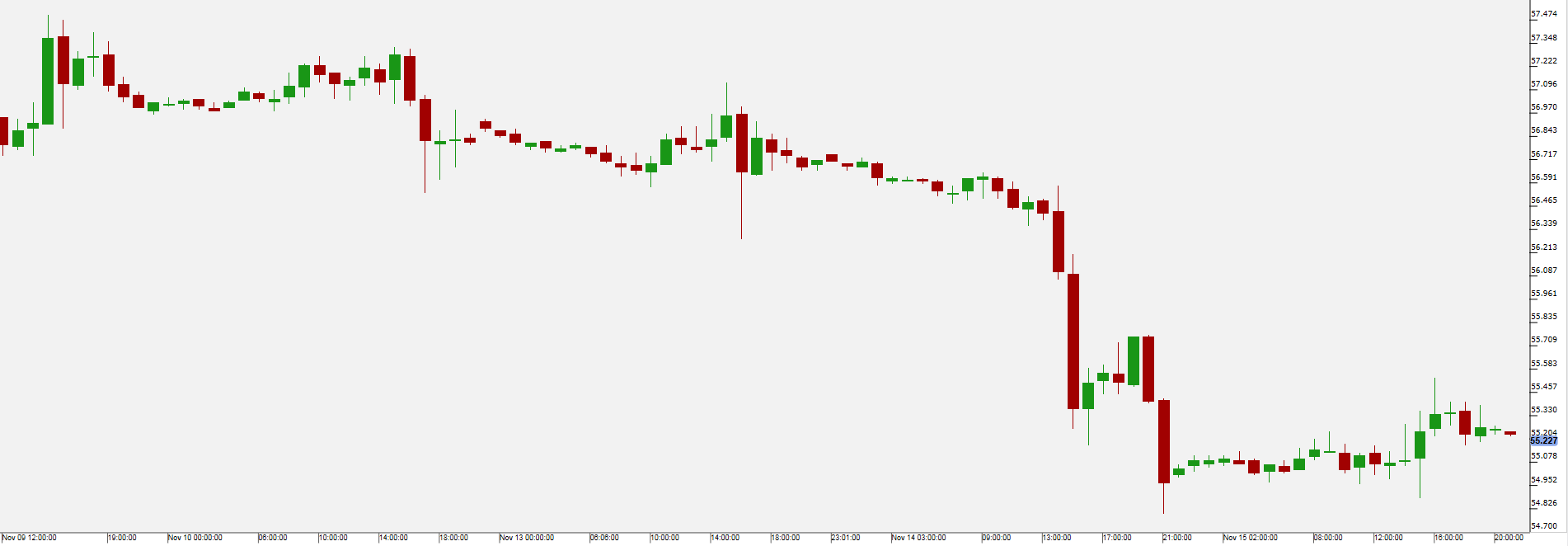

WTI Oil

Oil closed slightly higher on Wednesday after a major slump on Tuesday. Oil markets were concerned by Russia’s remarks that it is too early to announce extensions of OPEC production cuts. Russia is reluctant to commit to an agreement on productions cuts at the OPEC meeting at the end of November. Russia’s oil company Rosneft states that it is committed to the current output reduction regime but is also concerned that an exit from the OPEC deal would be a serious challenge. The Russian Ruble is currently at a 3-months low against the Dollar.

Crude oil inventories were up by 1.9 million barrels in the US according to the Energy Information Administration (EIA). On Friday the research company Baker Hughes releases current statistics on operating oil rigs in the US.

Pivot: 55.8

Support: 54.6 54.4 54.1

Resistance: 55.8 56.25 56.6

Scenario 1: short positions below 55.80 with targets at 54.60 & 54.40 in extension.

Scenario 2: above 55.80 look for further upside with 56.25 & 56.60 as targets.

Comment: the RSI is capped by a bearish trend line.

WTI Oil

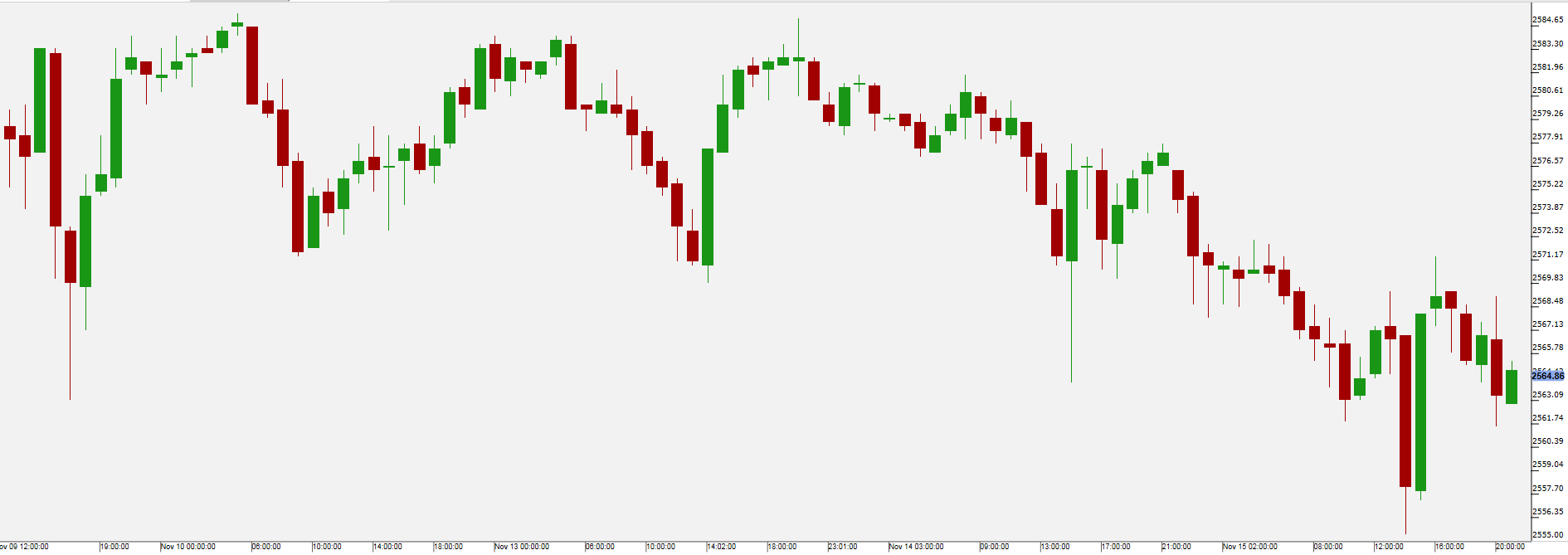

US equity indices traded on Wednesday lower for the third day in a row. Biggest losses were in the energy sector due to the falling price of oil (US Energy ETF (NYSE:XLE) -1.16%), while tech stocks were also in the decline (US Technology ETF -0.88%). Tech stocks were said to be falling as some investors were taking profits after them having performed very well this year so far. Bank of America (NYSE:BAC) was one of the best performing stocks that day (+2.36%) as investment legend Warren Buffet’s Berkshire Hathaway (NYSE:BRKa) had to disclose a higher amount of shares of Bank of America held. Cisco Systems (NASDAQ:CSCO) was at time up 4% after market close due to earning reports showing better results than anticipated.

On Thursday we will see from the United States Jobless Claims, Import/Export Prices, Philadelphia Fed General Business Conditions, Industrial Production, Capacity Utilization and Housing Market Index statistics. The retail company Wal-Mart (NYSE:WMT) is set to release its earnings on Thursday before markets open.

Pivot: 2572.5

Support: 2468 2466 2461

Resistance: 2477 2480 2483

Scenario 1: short positions below 2572.50 with targets at 2560.00 & 2555.25 in extension.

Scenario 2: above 2572.50 look for further upside with 2578.00 & 2585.50 as targets.

Comment: RSI is mixed with a bearish bias.

Related Articles

US Dollar Index is experiencing a very strong decline, a move we have been warning about for weeks. Since the start of the year, we have discussed potential dollar weakness, which...

An aggressive fiscal spending proposal by Germany has attracted bullish animal spirits into EUR/USD. A significant rally in the longer-end German Bund yields is likely to alter...

USD/JPY trades heavy despite widening yield differentials Non-farm payrolls loom large as traders focus on the unemployment rate. Mixed signals in data could see choppy trade,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.