- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Iconix Issues Soft Preliminary Numbers For Q3, Stock Falls

Shares of Iconix Brand Group Inc. (NASDAQ:ICON) fell 8.8% in yesterday’s trading session, as investors were dismayed by the company’s soft preliminary third-quarter 2017 results.

However, figures are yet to be reviewed and finalized by the company. Iconix expects filing third-quarter results in the upcoming days, post completion of impairment testing.

Let’s take a look into the current projections issued by the company.

Third Quarter Preliminary Results

Iconix expects licensing revenues for the quarter at approximately $53.2 million, down 12% from the prior-year quarter. The Zacks Consensus Estimate for the quarter is currently pegged in-line with management expectations.

The company expects selling, general and administration expenses to decline 28% to reach $21.5 million during the quarter. However, following the impairment testing of intangible assets and goodwill, the company expects charges worth $500-750 million associated with the women's segment.

Considering all factors, the company expects adjusted earnings of 24 cents per share during quarter, improving 33% from the prior-year quarter’s earnings of 18 cents. However, the Zacks Consensus Estimate for the quarter is currently pegged lower at 8 cents.

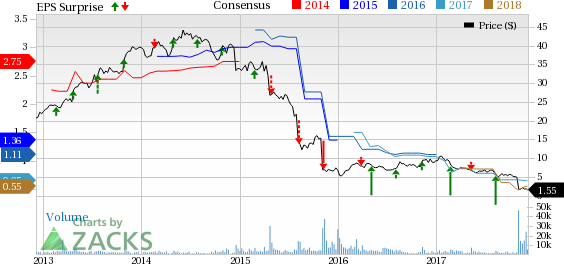

Iconix Brand Group, Inc. Price, Consensus and EPS Surprise

On a GAAP basis, the company expects a loss of 10 cents from continuing operations for the third quarter.

Factors Likely to Impact Third Quarter

Iconix has been struggling with men’s and women’s segments for a while, thanks to tough retail market conditions. This trend is likely to continue and hurt quarterly performance.

Additionally, the company’s performance is likely to be weighed down by debt. Iconix has a huge debt burden and resorting to various initiatives to reduce the same. To this end, the company has already divested non-core brands such as Sharper Image, Peanuts Worldwide LLC and Strawberry Shortcake.

Owing to such headwinds, shares of the company have lost 74.8% in the past six months against the industry’s gain of 13.8%.

However, we believe this Zacks Rank #3 (Hold) company’s strategic partnerships and consistent efforts toward international expansion will improve performance in the long run.

Do Consumer Discretionary Stocks Interest You? Check These

Investors interested in the same sector may consider stocks such as Michael Kors Holdings Ltd. (NYSE:KORS) , Deckers Outdoor Corp. (NYSE:DECK) and Ralph Lauren Corp. (NYSE:RL) . While Ralph Lauren and Deckers Outdoor sport a Zacks Rank #1 (Strong Buy), Michael Kors carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ralph Lauren came up with an average positive earnings surprise of 11.6% in the trailing four quarters. It has a long-term earnings growth rate of 15%.

Deckers Outdoor pulled off an average positive earnings surprise of 88.3% in the trailing four quarters. It has a long-term earnings growth rate of 10.7%.

Michael Kors delivered an average positive earnings surprise of 23.7% in the trailing four quarters. It has a long-term earnings growth rate of 7.5%.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Deckers Outdoor Corporation (DECK): Free Stock Analysis Report

Iconix Brand Group, Inc. (ICON): Free Stock Analysis Report

Ralph Lauren Corporation (RL): Free Stock Analysis Report

Michael Kors Holdings Limited (KORS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

Bitcoin has gained legitimacy as it has achieved mainstream status these days. Even the United States Securities and Exchange Commission (SEC) has acknowledged its legitimacy with...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.