- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

HSBC To Pay $353 Million To Settle French Tax-Fraud Probe

HSBC Holdings (LON:HSBA) plc (NYSE:HSBC) will be paying 300 million Euros ($353 million) to settle a criminal investigation initiated by the French government for allegedly helping its affluent clients to evade taxes.

It was found that HSBC helped customers in concealing their assets from the French tax authorities via the use of offshore tax havens. Per a Paris court judge, the fine levied upon the bank, includes a penalty of approximately 158 million Euros and damages and interest of about 142 million Euros.

The Swiss bank finally admitted of being guilty in early 2015. In response to media reports, which accused the bank of aiding wealthy clients to evade taxes and obscure assets worth millions of dollars, HSBC said, "We acknowledge and are accountable for past compliance and control failures." The bank was under scrutiny in 2006-2007.

France initiated an investigation against the private bank after Herve Falciani, an ex-employee in the information technology department at the firm, stole client account information from the Geneva office in 2008 and passed them to the French government.

These files described incidents where HSBC‘s Swiss private banking unit regularly allowed its clients to withdraw a large amount of cash (mostly in foreign currencies), marketed schemes that enabled wealthy clients to avoid European taxes and colluded with clients to hide clandestine accounts from domestic tax authorities. The HSBC files, covering the period 2006–2007, shed light on some 30,000 accounts holding assets worth roughly $120 billion (£78 billion).

The bank expressed their joy and said, "HSBC is pleased to resolve this legacy investigation which relates to conduct that took place many years ago.”

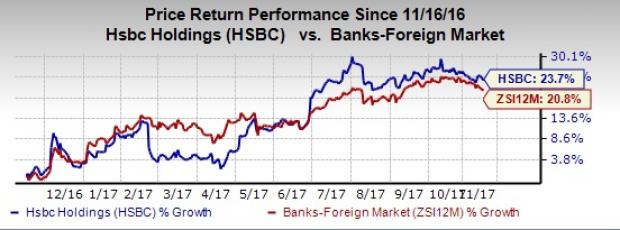

Shares of HSBC have gained 23.7% over the last 12 months outperforming 20.8% growth recorded by the industry.

Currently, HSBC carries a Zacks Rank #3 (Hold).

Swiss bank, UBS Group AG (NYSE:UBS) faced a similar allegation and has not agreed to a settlement yet. The company will be facing a trial in France for apparently clients in the country to evade taxes. Notably, a five-year probe into such allegations was closed last year.

Some better-ranked stocks in the same space are KB Financial Group (NYSE:KB) and Erste Group Bank (OTC:EBKDY) , each sporting a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

KB Financial has witnessed an upward earnings estimate revision of 10.1% for 2017, over the last 30 days. Its share price has risen 44.6% over the past 12 months.

For Erste Group, over the last 60 days, the Zacks Consensus Estimate has been revised 16.6% upward for 2017. Its share price has increased 48.4% over the past 12 months.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

UBS AG (UBS): Free Stock Analysis Report

KB Financial Group Inc (KB): Free Stock Analysis Report

Erste Group Bank AG (EBKDY): Free Stock Analysis Report

HSBC Holdings PLC (HSBC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.