- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

HPE Sinks Despite Q4 Beats, As Whitman Steps Down As CEO

Hewlett Packard Enterprise Company (NYSE:HPE) just released its fourth-quarter financial results, posting adjusted earnings of $0.29 per share and revenues of $7.8 billion. Currently, Hewlett Packard Enterprise is a Zacks Rank #3 (Hold), and is down over 7% to $13 per share in after-hours trading shortly after its earnings report was released.

HPE:

Beat earnings estimates. The company posted adjusted earnings of $0.29 per share, beating our earnings estimates of $0.28 per share.

Beat revenue estimates. The company saw revenue figures of $7.8billion, topping our consensus estimate of $7.71 billion.

The company, which spun off from HP in November 2015, saw its Q4 revenues jump by 5%. HPE’s non-GAAP earnings rose from $0.23 in the year-ago period.

For the full-year, HPE posted revenues of $37.4 billion. On top of that, HPE now expects to post non-GAAP diluted EPS in the range of $0.20 to $0.24 in the first quarter of 2018.

However, much of the news today will focus on the fact that CEO Meg Whitman will step down as the company’s chief executive.

“With strong top line revenue growth, earnings above our previous outlook and our second consecutive quarter of sequential margin improvement, our fourth quarter results are a reflection of the progress we have made over the past two years to transform HPE into a nimble, focused and innovative organization,” Whitman said in a statement.

“Today, HPE has a very strong balance sheet, an industry-leading product portfolio and a world-class leadership team ready to drive the next phase of shareholder value.”

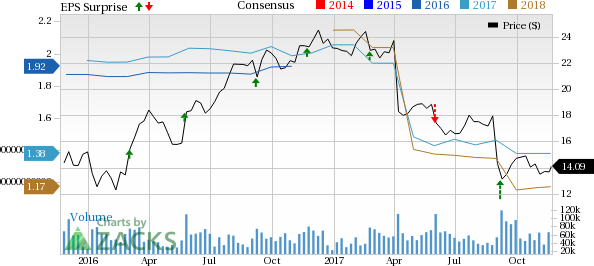

Here’s a graph that looks at HPE’s Price, Consensus and EPS Surprise history:

Hewlett Packard Enterprise Company was spun-off from the Hewlett-Packard Company (NYSE:HPQ) in November 2015. The company operates in four segments: Enterprise Services, Enterprise Group, Software and Financial Services. The Enterprise Group is the company's largest revenue contributor, accounting for more than half of total revenues.

Check back later for our full analysis on HPE’s earnings report!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.