- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

HP (HPQ) Reports Strong Q4 Earnings, Falls On Soft Q1 View

HP Inc. (NYSE:HPQ) has come up with another quarter of stellar performance. The company reported better-than-expected results in fourth-quarter fiscal 2017 and revenues increased for the fifth-consecutive quarter after an extended period of decline. Also, the Personal Systems and Print segments have improved for the third-straight quarter after 2010.

In fact, the company’s outstanding results for the last few quarters substantiate that the spin-off from Hewlett Packard Enterprise Company (NYSE:HPE) coupled with restructuring initiatives is finally paying off for HP.

HP’s total revenues increased 11% year over year to $13.927 billion and outpaced the Zacks Consensus Estimate of $13.246 billion. The better-than-expected top-line performance was driven mainly by strength in the Personal System and Printing segments along with the successful launch of products.

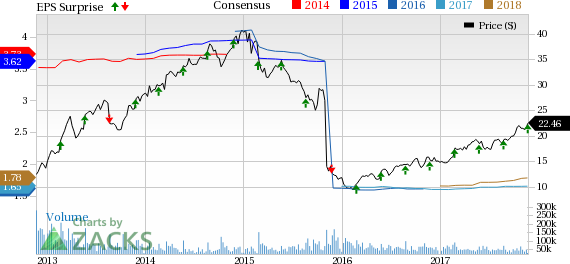

The company’s bottom-line results were also impressive, wherein its non-GAAP earnings from continuing operations of 44 cents per share matched the Zacks Consensus Estimate. The figure came toward the higher-end of management’s earlier guidance range of 42-45 cents. On a year-over-year basis, non-GAAP earnings improved 22.2%.

Despite reporting better-than-expected results and strong top-line growth, shares of HP have declined over 5.5% during yesterday’s after-hours trading. The downturn was owing to the company’s soft first-quarter fiscal 2018 non-GAAP earnings guidance range, which at mid-point is slightly lower than the Zacks Consensus Estimate.

Moreover, Meg Whitman, CEO of its sister company, HPE, announced her retirement yesterday. During her six-year tenure, she initiated a number of turnaround strategy but most of them failed to gain traction. We believe the news might have turned investors a little cautious.

Consequently, HP’s shares have underperformed the industry year to date. While the stock has been up 44.7%, the industry to which it belongs gained 46%.

Quarter in Detail

The Personal Systems segment generated revenues of $9.084 billion, up 13% year over year. While commercial revenues increased 11%, consumer revenues were up 18%.

Printing revenues were up 7% year over year to $4.877 billion, primarily owing to a 10% increase in supplies revenues. HP’s total hardware unit sales grew 3% backed by Consumer hardware units increase of 3%. Commercial hardware units, however, remained flat on a year-over-year basis.

Region wise, revenues from Americas were up 10% year over year. While revenues from Europe, the Middle East and Africa (EMEA) grew 11%, the same from the Asia Pacific and Japan region increased 16% year over year, all in constant currency.

However, gross margin contracted 20 basis points (bps) on a year-over-year basis to 18.1%, primarily due to elevated commodity costs of Personal Systems. This was partially offset by better margin in the printing segment backed by improved productivity and higher supplies mix.

Non-GAAP operating expenses increased 6% year over year to $1.5 billion.

Non-GAAP operating margin from continuing operations remained flat year over year at 7%. HP’s non-GAAP net income from continuing operations came in at $749 million compared with $614 million reported a year ago.

Balance Sheet and Cash Flow

HP ended the fiscal fourth quarter with cash and cash equivalents of $6.997 billion compared with $6.967 billion in the previous quarter. The company had long-term debt of $6.747 billion compared with $6.744 billion last quarter.

The company generated cash flow of $680 million from operational activities during the quarter. HP repurchased shares worth $501 million and paid dividends worth $221 million, in the same time frame.

During fiscal 2017, operating cash flow came in at $3.677 billion while the company paid $894 million as cash dividend and bought back shares worth $1.412 billion.

Guidance

HP raised its earnings guidance range for fiscal 2018. The company now anticipates non-GAAP earnings per share from continuing operations in the band of $1.75-$1.85 (previously $1.74-$1.84). The Zacks Consensus Estimate is currently pegged at $1.78 per share.

For the fiscal first quarter, HP projects non-GAAP earnings from continuing operations in the range of 40-43 cents per share (mid-point: 41.5 cents). The Zacks Consensus Estimate is pegged at 42 cents.

Our Take

We are impressed by the performance of HP’s PC segment, wherein the year-over-year increase can be attributed to growth in Commercial and Consumer revenues. Additionally, the company’s efforts to turn around its business have been commendable. Meanwhile, the company is working on product innovation, differentiation and enhancing the capabilities of its printing business to stabilize the top line.

The latest PC shipment data by IDC depicts that HP’s restructuring initiatives such as focus on product innovations, pricing, marketing and sales activities, divestment of non-core assets and cutting jobs to lower costs are paying off. Per the data compiled by IDC, the company witnessed year-over-year shipment growth for the sixth quarter in a row, after registering decline for five consecutive quarters.

With the start of shipping A3 multifunction printers to more than 80 countries, which covers all its key markets, HP is likely to revive its printing business and grab a bigger share in the inkjet printer market. Also, the acquisition of Samsung’s printing business is anticipated to support the development and manufacturing of printers.

However, macroeconomic challenges and tepid IT spending remain near-term concerns. Competition from the likes of International Business Machines (NYSE:IBM) and Apple (NASDAQ:AAPL) adds to its woes.

HP currently holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

HP Inc. (HPQ): Free Stock Analysis Report

International Business Machines Corporation (IBM): Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Whenever Wall Street authoritative figures, such as a large institution or individual investor, decide to shift a view on a specific stock or industry, retail traders can...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.