- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

How to Avoid Losing 94% In Energy Service Stocks

Well, that’s a catchy title, no? Of course, please note that the title does NOT read, “How to Make Incredible Sums of Money in Energy Services.” This is an important distinction because making money in energy stocks has been a pretty tough thing to do since about 2008. Still, avoiding 94% losses is probably a good thing to know how to do. So, let’s proceed, shall we?

The Proxy For Energy Service Stocks

For our purposes we will use Fidelity Select Energy Services fund (ticker FSESX).

You will probably think I am kidding at first but, the way to avoid losing 94% in oil service stocks is simply to avoid investing in FSESX (or any security highly correlated to it) during the months of June through November.

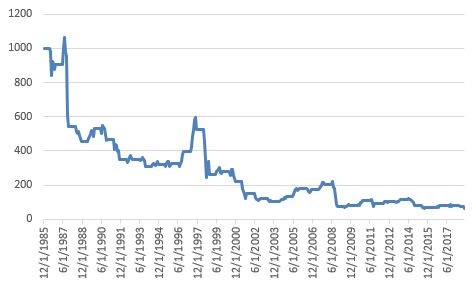

That’s it. Why, you might ask? Simple. Figure 1 displays the growth (Jay, that word “growth”, I do not think it means what you think it means) of $1,000 invested in FSESX ONLY during the months of June through November every year starting in 1986.

Figure 1: 12/31/1985-10/31/2018 (Source: PEP database from Callan Associates)

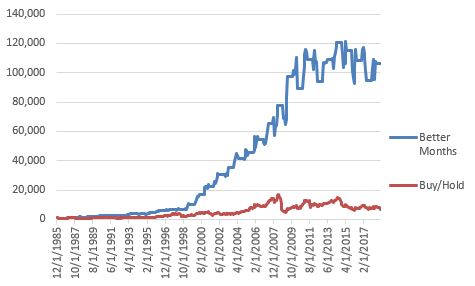

It’s not pretty. And it is a great thing to avoid. But here comes the not so great part. Figure 2 displays the growth of $1,000 invested in FSESX:

*Only during the months of December through May

*On a buy-and-hold basis

Figure 2: (blue) versus on a buy-and-hold basis (red); 12/31/1985-10/31/2018 (Source: PEP database from Callan Associates)

As I intimated earlier, even avoiding the “Bad Months” has not resulted in much in the way of capital appreciation in the last decade. But please remember the point of this article is essentially as follows: if you invest in Energy Service stocks between the end of May and the end of November and you expect to make money, you may be, um, disappointed. Or at least, that is what history strongly seems to suggest.

For The record

*$1,000 invested on a buy-and-hold basis grew to $6,800

*$1,000 invested only December through May each year grew to $106,300

*$1,000 invested only June through November declined to $64 (i.e., -94%)

Summary

If you want to know how to make 94% in energy service stocks you will unfortunately have to find another article. But for now, at least we know how to avoid losing 94%.

Hey, it’s a step in the right direction.

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.