- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

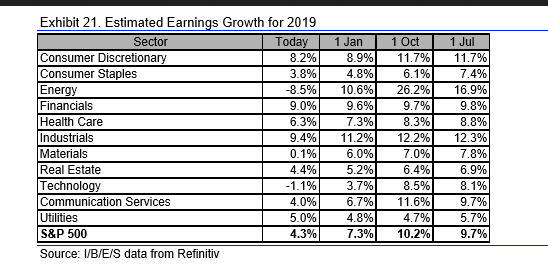

Expected 2019 S&P 500 Earnings Growth Has Changed

Energy and Basic Materials, as well as Technology—led by Apple (NASDAQ:AAPL)—have been the biggest drag on expected, full-year, 2019 earnings growth for the S&P 500.

Energy is the biggest drag, falling from an expected 26% growth rate on October 1 ’18 to today’s 8.5% decline. (clients have not owned any Energy for years, ever since the bounce failed to materialize in the sector following the Q1 ’16 bottom. Energy’s market cap as a percentage of the S&P 500 has fallen from 14%-15% in mid-2014 to just 5%-6% today. The sector is becoming less important to the benchmark over time, and for good reason.)

Surprisingly, the Financial sector’s expected full-year earnings growth looks surprisingly stable for the calendar year. Clients remain overweight Financials as they did in ’18.

Related Articles

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

As an ETF analyst, I’ve seen countless new fund launches, but rarely do I put my own money into them right away. Typically, I like to let a new ETF prove itself—watching its...

Six Best High Dividend ETFs: Main Similarities and Differences Dividend ETFs offer excellent protection for investors across volatile market cycles and provide great portfolio...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.