- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Horizon Pharma (HZNP) Tops Q4 Earnings, Provides 2018 View

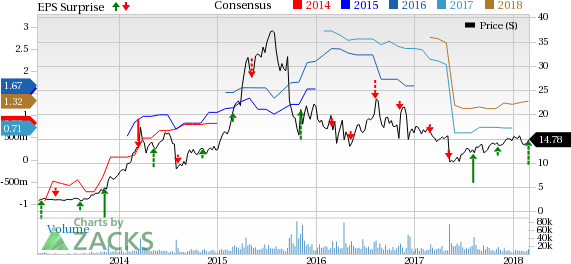

Horizon Pharma plc (NASDAQ:HZNP) reported better-than-expected results for the fourth quarter of 2017. Following the news, the company’s shares went up 1.4%. However, Horizon Pharma’s stock has declined 8.2% year to date against the industry’s fall of 6.9%.

The company reported fourth-quarter earnings of 29 cents per share which beat the Zacks Consensus Estimate of 22 cents but were down from 64 cents in the year-ago quarter.

Sales in the fourth quarter were down 12% year over year to $274.2 million but beat the Zacks Consensus Estimate of $267.58 million.

Quarter in Detail

The Orphan unit recorded revenues of $116.6 million, up 32% from the year-ago period. The strong performance was backed by solid net sales of Ravicti, which generated $51.9 million in the quarter, up 57% year over year, driven by continued conversion from older-generation nitrogen-scavenger therapies as well as the addition of treatment-naïve patients due to the recent label expansion. In April 2017, Ravicti’s label was expanded by including patients aging from two months to two years and older.

Additionally, Procysbi contributed to the performance with its net sales of $33.2 million, up 31% year over year. Actimmune sales in the reported quarter were $26.8 million, up 11% year over year.

The Rheumatology unit generated $61.4 million from sales, up 48% year over year. Also, Krystexxa sales in the quarter were strong and came in at $43.8 million, up 48% year over year, driven by strong and continued year-over-year vial demand.

Primary Care garnered revenues of $96.2 million, down 47% year over year. The decline in net sales was due to the implementation of a new contracting model, in order to secure broader inclusion of the company’s primary care medicines on formularies.

In the reported quarter, net sales of Pennsaid2%, Duexix and Vimovo were $50 million, $28.2 million and $16.6 million, respectively.

Research and development (R&D) expenses increased 28.8% to $15.3 million while selling, general and administrative expense was $126.5 million, down 16.6% year over year.

2017 Performance

Revenues for the full year were up 7.7% to $1.1 billion. However, the company reported earnings of $1.18 per share, down 45.4% year over year.

The Orphan unit recorded revenues of $116.6 million, up 32% from the year-ago period, driven by 445% growth in sales of Procysbi to $137.7 million. Procysbi was acquired in October 2016. The sales of Rheumatology unit also grew 50% mainly driven by sales of Krystexxa at $156.5 million, up 72% year over year. However, Primary Care unit sales were down 38% to $375.4 million.

The full year's R&D expense increased 270.6% to $225 million while selling, general and administrative expense was $677.4 million, 11.4% higher year over year.

2018 Guidance

Horizon Pharma provided its outlook for 2018. It expects sales in the range of $1.15-$1.18 billion, mainly driven by expected strong growth to continue in its orphan and rheumatology business units.

The company continues to invest in the expansion of Krystexxa into nephrology indication and expects sales growth of more than 50% in 2018. The guidance includes an assumption of lower net average and net realized price, beginning in the second half, primarily resulting from the U.S. Government's Health Resource and Services Administration's Final Rule on 340B drug ceiling price implementation scheduled for July 2018.

Horizon Pharma is significantly increasing investments in one of its key growth drivers, Krystexxa, and expects net sales for it to grow more than 50%. The company expects higher R&D and SG&A expenses in the first half of 2018.

Other Updates

In February 2018, the company filed a supplemental New Drug Application to expand the age range in the label of Raviciti from two months of age and older to birth and older.

In December 2017, a regulatory application, seeking label expansion of Procysbi to include children of one year and older living with nephropathic cystinosis, was filed with the FDA.

In October 2017, the company announced that the first patient was enrolled and infused in phase III confirmatory clinical trial evaluating teprotumumab for the treatment of thyroid eye disease or TED. We remind investors that the company acquired River Vision earlier and added its biologic candidate teprotumumab to its pipeline.

Meanwhile, the company is working on expanding Actimmune’s label. An investigator-initiated study at the Moffitt Cancer Center is underway and enrolling patients. The study is evaluating Actimmune in combination with Roche Holdings’ (OTC:RHHBY) Herceptin, Perjeta and Taxol in certain advanced breast cancer patients. A phase I study will evaluate Actimmune in combination with a Bristol-Myers Squibb Company’s (NYSE:BMY) Opdivo in kidney and bladder cancer. Actimmune is also being evaluated in combination with Merck & Co’s (NYSE:MRK) Keytruda to treat cutaneous t-cell lymphoma patients in phase II study.

The company also has plans to develop two next-generation uncontrolled gout development programs to maintain its market leadership.

Our Take

Horizon Pharma’s fourth-quarter results were impressive with the company beating on both the top- and bottom-line estimates. Moreover, the sales guidance for 2018 was encouraging as well. We expect Krystexxa, Ravicti and Actimmune to drive further growth.

The acquisition of teprotumumab has diversified the company’s portfolio.

Zacks Rank

Horizon Pharma currently has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

Horizon Pharma PLC (HZNP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.