- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

High Yield Credit In Focus After The FOMC Announcement

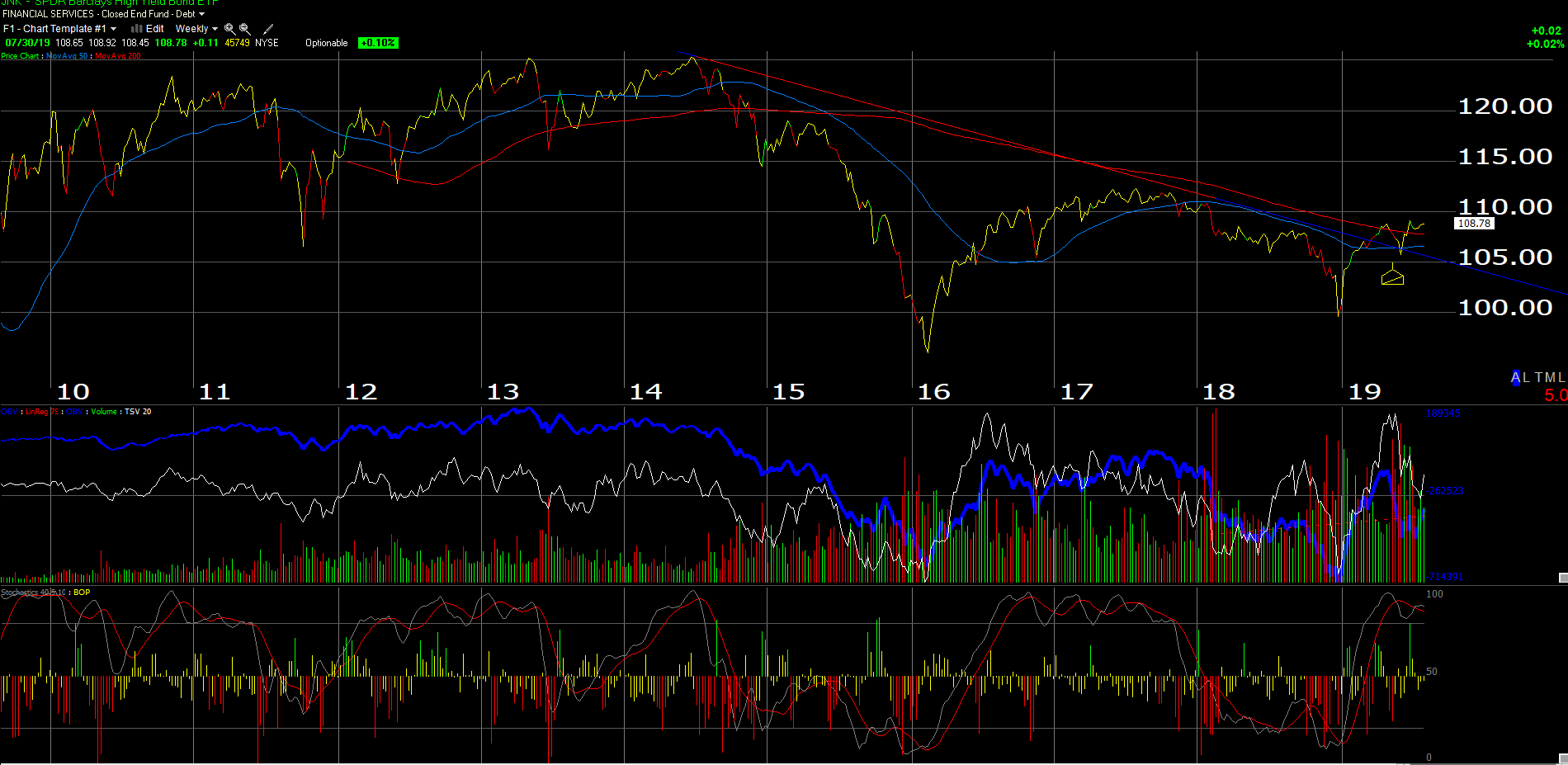

The JNK high-yield ETF looked like the best of our three charts yesterday, already having transcended the downward sloping trend line off the 2014 peak.

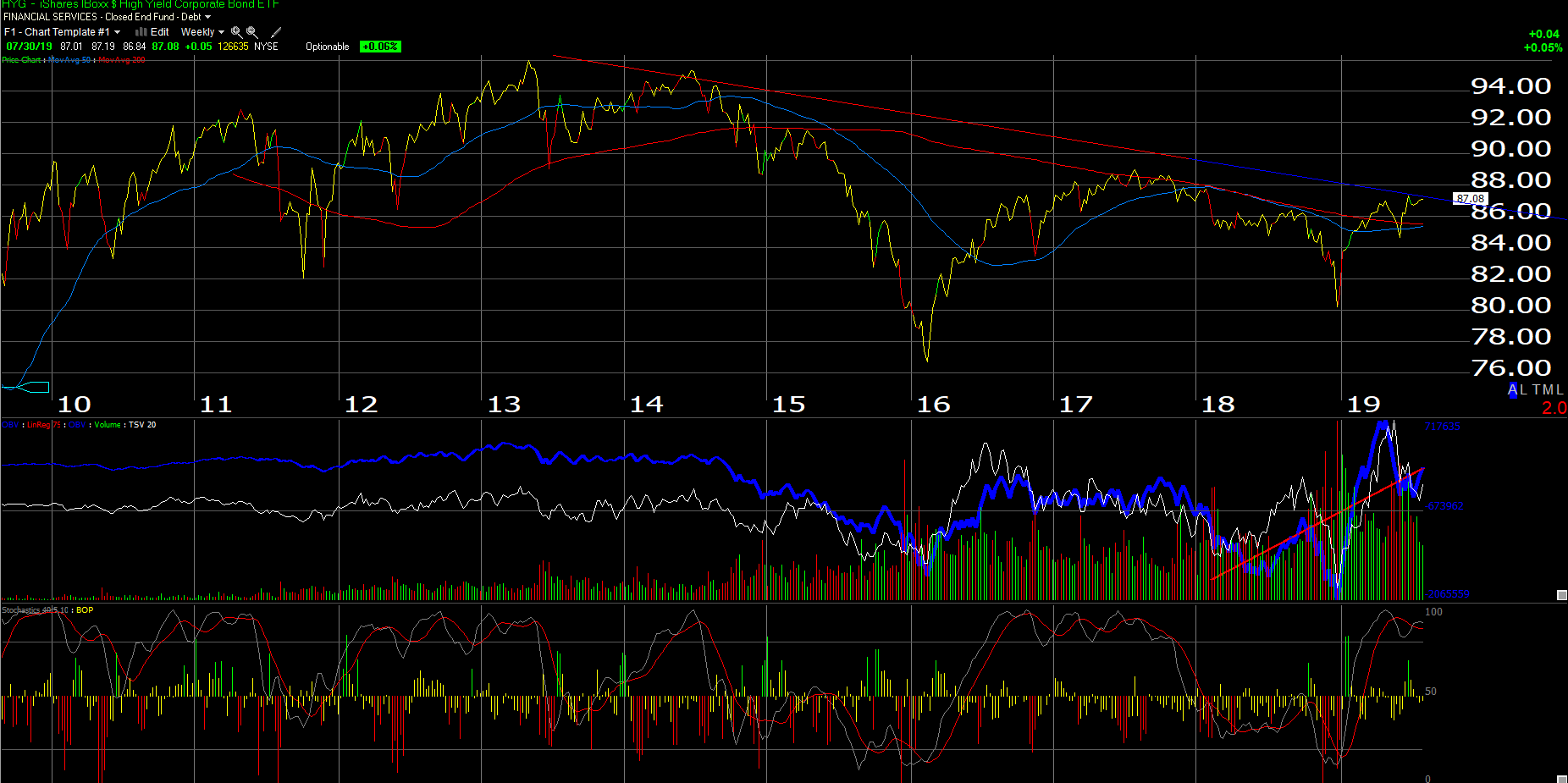

The HYG is sitting just above resistance at the downward sloping trendline off the 2014 top as well. Like JNK it’s not yet a convincing breakout.

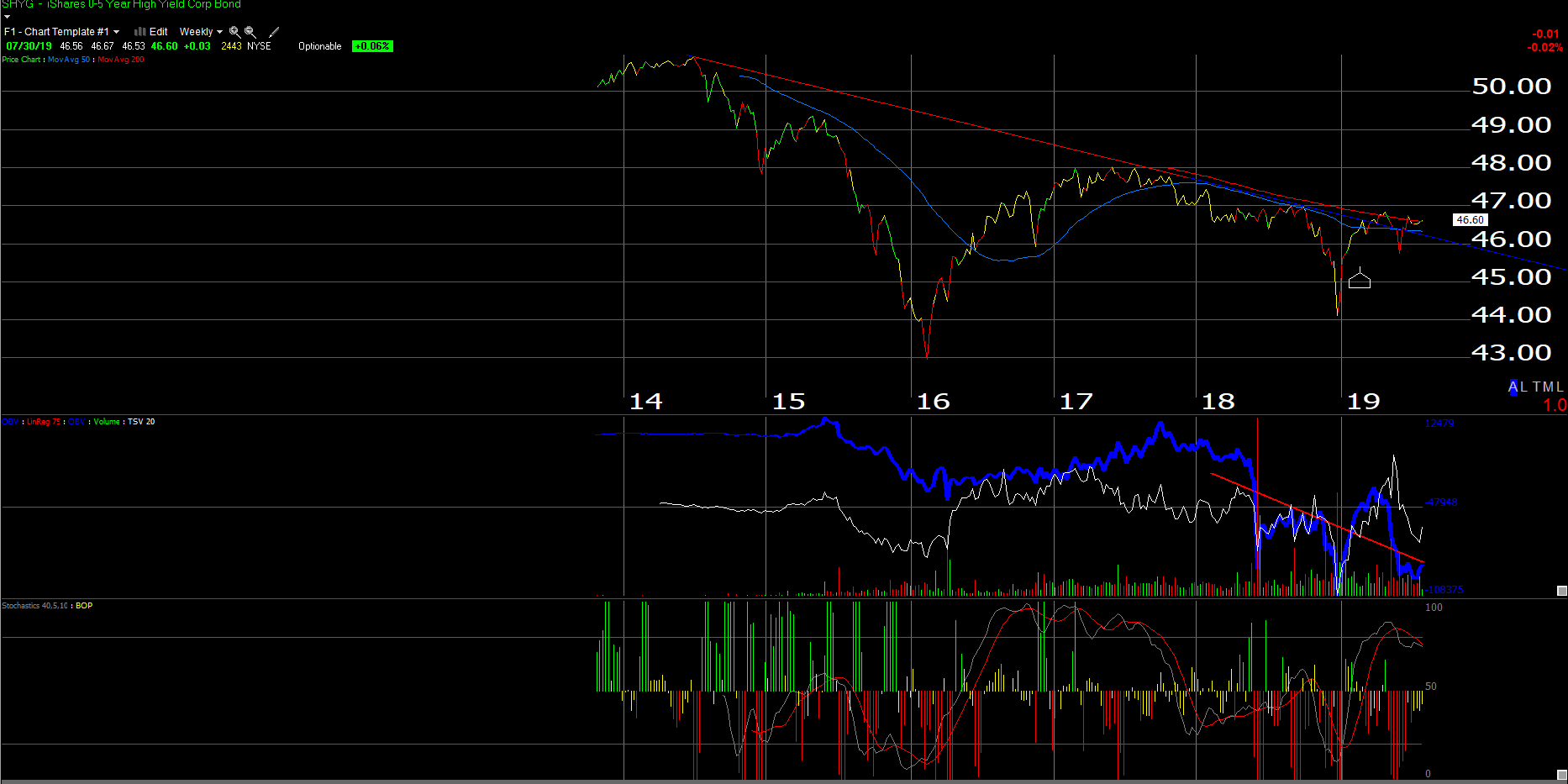

The short-term high-yield ETF (SHYG) is trying to trade above its 200-week moving average, but like the longer-duration high-yield ETF’s HYG and JNK, it hasn’t yet broken out convincingly.

Summary / conclusion:

When the FOMC announces their decision on July 31, 2019 at 1 PM central time, I would expect the S&P 500 and the major equity indices to respond positively to the 25 basis point reduction, unless the U.S. economy is already in a recession, which would be hard to believe given jobless claims, a 3.6% – 3.8% unemployment rate, and a U.S. consumer as strong as they are at present.

What I’ll be paying attention to is to see if these high-yield ETF’s can solidly break above these various resistance levels and sustain the moves even though all three are overbought.

Liquidity is good for credit typically, so if the high-yield asset class sells off tomorrow and the days following the FOMC announcement, it will be an important sign.

The interesting action might be in the short-end of the Treasury curve and the Treasury curve itself.

Looking at the YTD returns for corporate high-grade credit and corporate high-yield credit, YTD returns are almost identical (both just over 10% as of last Friday) thus that tells me corporate high-grade has benefited greatly from falling interest rates (i.e. longer duration) as much as the credit spreads.

I wonder if we don’t see that reverse a little bit starting Wednesday afternoon and high-yield start to show better relative performance than corporate high-grade.

Related Articles

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.