- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

High Volumes, KapStone Buyout Aid WestRock Amid Weak Pricing

On Mar 10, we issued an updated research report on WestRock Company (NYSE:WRK) . The company is well-poised on gains from higher volumes, aided by growing demand in e-commerce, processed food and protein. Its sound capital-allocation strategy and cost synergies, and performance improvements from the KapStone Paper acquisition also bode well. However, lower prices are likely to impact WestRock’s results in fiscal 2020.

Q2 Guidance Weak Due to Higher Maintenance Downtime

For second-quarter fiscal 2020, the company has scheduled 118,000 tons of maintenance downtime in the Corrugated Packaging segment, whereas 94,000 tons were reported in the prior-year quarter. For the Consumer Packaging segment, maintenance downtime is estimated at 17,000 tons, whereas the prior-year quarter’s downtime was 54,000 tons.

For the quarter, WestRock expects adjusted segment EBITDA of $680-$710 million, whereas it reported $757 million in second-quarter fiscal 2019. Seasonal volume increases across the Corrugated Packaging and Consumer Packaging segments will likely be offset by price reductions of $10 per ton for domestic linerboard and $15 per ton for the domestic medium. Productivity improvements and lower sequential healthcare costs will likely be offset by higher sequential wage costs and the payroll tax reset that occurs at the beginning of each calendar year.

The Zacks Consensus Estimate for second-quarter fiscal 2020 earnings is currently pegged at 61 cents, indicating a year-over-year decline of 23.8%.

Pricing to Impact 2020 Results

WestRock expects net sales of $18.0-$18.5 billion for fiscal 2020. The mid-point of the range suggests a year-over-year decline of 0.2%. The guidance reflects declines in North American container board and craft paper index pricing, and the full-year impact of market pricing declines that have been witnessed in export container board, craft paper and market pulp.

Adjusted EBITDA for the fiscal year is anticipated to be $3-$3.2 billion. The mid-point of the guided range suggests a year-over-year decline of 4%, considering the impact of pricing declines, and ongoing inflation in wages, benefits and other non-commodity cost categories.

WestRock reported per-day organic box shipment growth of 2.5% in fiscal 2019, ahead of the industry’s 0.5%. For fiscal 2020, box volumes are expected to be up 1-2% on a per-day basis. In first-quarter fiscal 2020, North American Corrugated Packaging box shipment growth was noted at 4.5% on a per-day basis, aided by growth in e-commerce, processed food and protein. Consumer Packaging volumes are expected to be up 1% for fiscal 2020.

The Zacks Consensus Estimate for fiscal 2020 earnings is currently pegged at $3.23, indicating a year-over-year decline of 18.8%. The consensus estimate for revenues is pegged at $18.16 billion, suggesting a year-over-year drop of 0.7%.

KapStone Acquisition to Aid

During 2019, WestRock completed the acquisition of rival KapStone Paper and Packaging Corp. The integration is on track, and the company anticipates cost synergies and performance improvements of more than $200 million by the end of fiscal 2021.

KapStone’s corrugated packaging operations will likely enhance WestRock’s North America corrugated packaging business and provide complementary products. The acquisition will likely help the company strengthen presence in the Western United States and compete better in the growing agricultural markets in the region. It also fast-tracks its target to improve margins of its North America corrugated packaging business. The company continues to evaluate potential acquisitions.

Capital Allocation Strategy on Track

WestRock generated $1.044 billion of adjusted free cash flow in fiscal 2019 — the fourth consecutive year of more than $1 billion of free cash flow. The company expects adjusted free cash flow to be more than $1 billion for the fifth consecutive year. It has a capital expenditure target of $1.1 billion for fiscal 2020 and $900 million to $1 billion for fiscal 2021.

In fiscal 2019, WestRock completed capital projects at its Porto Feliz corrugated box plant in Sao Paulo, Brazil; and in Cottonton, AL; and Covington, VA mills. The projects to be completed this fiscal year include the Florence paper machine in the North Charleston mill. As these projects ramp up, these are expected to contribute an additional $85 million in EBITDA at the end of the fiscal fourth quarter and $175 million in EBITDA by the end of fiscal 2021.

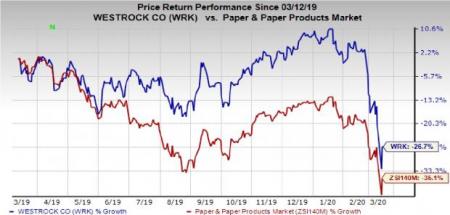

Price Performance

Shares of WestRock have slumped 26.7% over the past year compared with the industry’s decline of 35.1%.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold)

Some better-ranked stocks in the basic materials space are Daqo New Energy Corp (NYSE:DQ) , Sibanye Gold Limited (NYSE:SBSW) and Impala Platinum Holdings Limited (OTC:IMPUY) , each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Daqo New Energy has an expected long-term earnings growth rate of 29%. The company’s shares have surged 73.2% in the past year.

Sibanye has an expected long-term earnings growth rate of 20.4%. Its shares have soared 109.5% in a year.

Impala Platinum has a projected long-term earnings growth rate of 26.5%. The company’s shares have appreciated 125.3% over the past year.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Impala Platinum Holdings Ltd. (IMPUY): Free Stock Analysis Report

DAQO New Energy Corp. (DQ): Free Stock Analysis Report

WestRock Company (WRK): Free Stock Analysis Report

Sibanye Gold Limited (SBSW): Free Stock Analysis Report

Original post

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.