- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why Zumiez's (ZUMZ) Q4 Earnings Likely To Increase

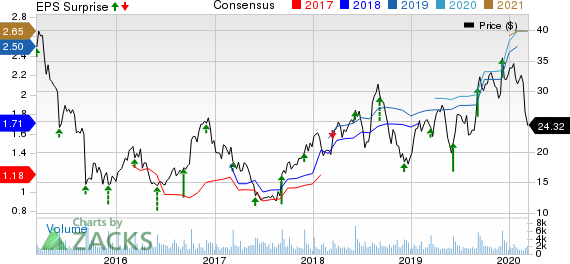

Zumiez Inc. (NASDAQ:ZUMZ) is scheduled to report fourth-quarter fiscal 2019 results on Mar 12, after the closing bell. In the trailing four quarters, the company’s bottom line outperformed the Zacks Consensus Estimate by 64.1%, on average. In the last reported quarter, the company beat the consensus mark by 27.1%.

The Zacks Consensus Estimate for fourth-quarter earnings has been stable over the past 30 days at $1.36 per share. This suggests a rise of 15.3% from the year-ago quarter’s reported figure. For revenues, the consensus mark is pegged at $326 million, indicating an increase of 7% from the figure reported in the year-ago quarter.

Key Things to Note

Zumiez has been gaining from its differentiated assortments, store base expansion and implementation of advanced technology to augment customers’ shopping experience across diverse channels. Further, it has been boosting competitiveness by making investments in logistics, planning and allocation.

Also, the company has been expanding e-commerce and omnichannel capabilities to provide consumers with the facility of quick and easy access to its products and brands. The company considerably improved customers’ experience by integrating its physical and digital networks. This, in turn, allows customers to access inventories through all channels alongside availing facilities like buy online, pick up in store, among others. These factors have been aiding the company’s top-line performance.

This is evident from the company’s upbeat performance during the holiday season, which coincides with the fourth quarter. The company reported 6.8% growth in comparable sales (comps) for the nine-week period ended Jan 4, 2020. This prompted management to provide an encouraging comps and earnings per share view for the final quarter.

Management guided fourth-quarter comps growth of around 6%. Moreover, adjusted earnings per share are anticipated in a band of $1.34-$1.38. This suggests growth of 13-17% from $1.18 per share earned in the same quarter last fiscal.

What the Zacks Model Predicts

Our proven model does not conclusively predict an earnings beat for Zumiez this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Although Zumiez carries a Zacks Rank #2, it has an Earnings ESP of 0.00%.

Stocks Poised to Beat Earnings Estimates

Here are a few companies you may want to consider, as our model shows that these have the right combination to post an earnings beat:

Noodles & Company (NASDAQ:NDLS) has an Earnings ESP of +25.00% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Children's Place (NASDAQ:PLCE) has an Earnings ESP of +1.16% and a Zacks Rank #3.

RH (NYSE:RH) has an Earnings ESP of +1.61% and a Zacks Rank #3.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

RH (RH): Free Stock Analysis Report

The Children's Place, Inc. (PLCE): Free Stock Analysis Report

Noodles & Company (NDLS): Free Stock Analysis Report

Original post

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.