- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why You Should Steer Clear Of TransDigm (TDG) Now

Premium engineered aircraft components provider, TransDigm Group Incorporated (NYSE:TDG) reported fourth-quarter fiscal 2017 results last week, wherein earnings once again surpassed estimates. Despite recording year-over-year growth, net sales in the quarter trailed the Zacks Consensus Estimate.

We anticipate that a continuous rise in interest expenses, weakness in revenues related to business jets, helicopters and freighters, and persistent concerns about the commercial transport industrywill thwart growth for the company in the upcoming quarters.

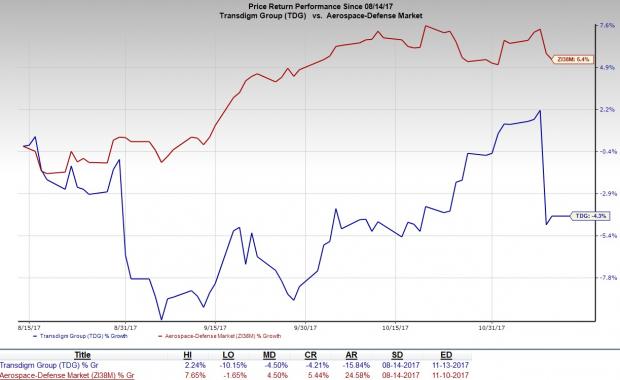

Further, the stock has put up a dismal show in recent times. Over the past three months, TransDigm has lost 4.2%, as against the industry’s gain of 5.4%. Also, the Zacks Consensus Estimate for 2017 earnings has moved south over a couple of months from $13.42 to $13.23, indicating bearish analyst sentiment.

Read on to find the major factors denting the company’s growth and why it may be prudent to avoid this Zacks Rank #4 (Sell) stock at the moment.

Factors Troubling TransDigm

TransDigm’s business remains highly vulnerable to risks associated with macroeconomic conditions. Currently, the company is witnessing some weakness in revenues related to business jets, helicopters and freighters, and expects the adverse trend to persist in near future as well. In addition, weakness in the global macroeconomic conditions is affecting air travel, adding to the company’s woes. Further, the company has some persistent concerns about the commercial transport industry in the upcoming quarters as well.

TransDigm has been suffering from prolonged weakness in some of its major end markets, which has thwarted the company’s growth momentum. Softening discretionary retrofits, interior retrofits and weaknesses in jet and helicopter markets have impacted the company’s top line in recent times. TransDigm’s commercial transportation business is plagued by inventory management issues from OEM customers, much of which appears due to rate reductions on wide-body platforms. Also, softness in this market can be traced to a decline in various fleet refurbishment projects.

The company expects that its gross margins will be pressured in the upcoming quarters due to increase in interest expenses, which have been trending upward for the last few quarters. In fact, TransDigm expects its debt servicing costs to rise almost 24% year over year to around $600 million in fiscal 2017. Thus, we believe that rising interest expenses will continue to restrain the company’s profits, going forward.

These apart, major acquisitions like SCHROTH, DDC, PneuDraulics, Franke and Breeze involve significant integration-related costs, and might also take some time to be properly integrated into the company’s existing business, which further increases costs.Other factors like environmental liabilities and failure to successfully integrate acquisitions also add to the company’s risks.

Stocks to Consider

Some better-ranked stocks in the industry are Teledyne Technologies Incorporated (NYSE:TDY) , Rockwell Collins, Inc. (NYSE:COL) and Curtiss-Wright Corporation (NYSE:CW) . While Teledyne Technologies sports a Zacks Rank #1 (Strong Buy), Rockwell Collins and Curtiss-Wright carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Teledyne Technologies has an average positive earnings surprise of 37.2% for the trailing four quarters, having surpassed estimates thrice.

Rockwell Collins managed to beat estimates thrice in the trailing four quarters, at an average earnings surprise of 2.6%.

Curtiss-Wright has an average positive earnings surprise of 11.8% for the trailing four quarters.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Rockwell Collins, Inc. (COL): Free Stock Analysis Report

Transdigm Group Incorporated (TDG): Free Stock Analysis Report

Teledyne Technologies Incorporated (TDY): Free Stock Analysis Report

Curtiss-Wright Corporation (CW): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.