- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why You Should Retain LHC Group (LHCG) Stock Now

LHC Group, Inc. (NASDAQ:LHCG) is well poised for growth backed by broad array of services and commitment toward inorganic expansion through strategic acquisitions and joint ventures. However, intense competition continues to remain a concern.

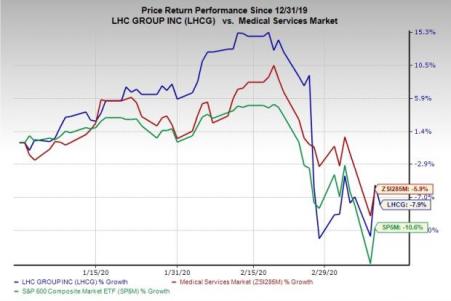

Shares of LHC Group have lost 7.9%, compared with the industry’s decline of 5.9% on a year-to-date basis. Meanwhile, the S&P 500 Index fell 10.6% in same timeframe.

The company, with a market capitalization of $4 billion, serves as a post-acute care partner for hospitals, physicians and families in the United States. It anticipates earnings to improve 13% over the next five years. Moreover, it has beat estimates in the trailing four quarters by 8.1%, on average.

Let’s take a closer look at the factors that substantiate the company’s Zacks Rank #3 (Hold).

What’s Deterring the Stock?

The home health care market is highly fragmented. Notably, LHC Group faces stiff competition from MedTech bigwigs like Amedisys (NASDAQ:AMED) and Chemed (NYSE:CHE) , which have greater resources and better access to capital. Even local and regional providers of home health service pose stiff competition.

What’s Favoring the Stock?

LHC Group has been offering a wide array of services through its diverse business segments, which have also been instrumental in driving the top line.

Within home health services arm, nurses, home health aides and therapists work closely with patients and their families to design and implement individualized treatment plans in accordance with a physician-prescribed plan of care. Increased acquisition activities in this space has helped the company gain a competitive edge.

LHC Group has long been focusing on acquisitions and joint ventures for inorganic expansion. From 2019 to so far in 2020, the company acquired 27 home health, 11 hospice and three home and community-based services locations, and one Long Term Acute Care (LTAC) hospital in 13 states and the District of Columbia, the majority of which are hospital joint ventures. These buyouts account for $114.3 million in annualized revenues.

Given the current environment, LHC Group is positioned to exceed the aforementioned annualized revenues in 2020 and 2021, per management.

Which Way are Estimates Headed?

For 2020, the Zacks Consensus Estimate for revenues is pegged at $2.15 billion, indicating an improvement of 3.6% from the year-ago period. The same for earnings stands at $4.70, suggesting growth of 5.2% from the year-ago reported figure.

Stock to Consider

A better-ranked stock from the broader medical space is Accuray Incorporated (NASDAQ:ARAY) carrying a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Accuray has an expected earnings growth rate of 200% for third-quarter fiscal 2020.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Amedisys, Inc. (AMED): Free Stock Analysis Report

Accuray Incorporated (ARAY): Free Stock Analysis Report

LHC Group, Inc. (LHCG): Free Stock Analysis Report

Chemed Corporation (CHE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Whenever Wall Street authoritative figures, such as a large institution or individual investor, decide to shift a view on a specific stock or industry, retail traders can...

Monster Beverage (NASDAQ:MNST) faces headwinds that make it a potentially scary buy, including weakness in the alcohol segment. With the alcohol business contracting in Q4 2024,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.