- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why You Should Retain HMS Holdings (HMSY) Stock Now

HMS Holdings Corp. (NASDAQ:HMSY) is well poised for growth on the back of strong Payment Integrity Solutions and Total Population Management, as well as solid margins. However, intense competition remains a woe.

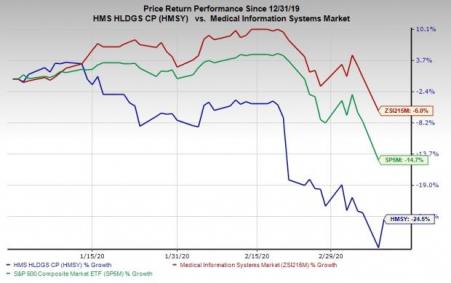

Shares of HMS Holdings have lost 24.5%, wider than the industry’s 6% decline on a year-to-date basis. The S&P 500 Index has declined 14.7% in the same time frame.

The company, with a market capitalization of $1.98 billion, offers cost-containment solutions in the United States. HMS Holdings also provides Coordination of Benefits services to the government and commercial healthcare payers. It anticipates earnings to improve 12% over the next five years. Moreover, it beat earnings estimates in the trailing four quarters, with the average being 14.1%.

Let’s take a closer look at the factors that substantiate the company’s Zacks Rank #3 (Hold).

What’s Weighing on the Stock?

The U.S. healthcare insurance benefits the cost containment industry via offering cost containment services, both directly and indirectly (through subcontracting). Competition is therefore robust in this dynamic industry as customers have many alternatives available.

Therefore, stiff competition continues to be a concern for HMS Holdings.

What’s Favoring the Stock?

HMS Holdings continues to benefit from promising and growing Payment Integrity Solutions. Payment Integrity (PI) has been gaining from greater throughput in the implementation process, expedited customer approvals for new PI edits, applied technology to simplify processes, increased coder productivity and accelerated revenue generation.

Per management, PI is anticipated to be a significant contributor to the Analytical Services wing in 2020.

In addition to PI solutions, Total Population Management (TPM) comes under HMS Holdings’ unique suite of Analytical Services. Notably, TPM has been gaining traction for a while now, which in turn has been contributing significantly to the top line.

Product-yield enhancements and process improvements are consistently bolstering HMS Holdings’ margins and profitability. The company has been diligently managing operating expenses and broadening the use of technology tools such as robotic process automation and ML.

With these initiatives, the company has been exhibiting strong margins for the past few years and the momentum is expected to continue in the near term.

Which Way are Estimates Headed?

For 2020, the Zacks Consensus Estimate for revenues is pegged at $709.1 million, indicating a rise of 13.2% from the prior year. The same for earnings stands at $1.23 per share, suggesting a decline of 6.8% from the previous year.

Stocks to Consider

Some better-ranked stocks from the broader medical space include Accuray Incorporated (NASDAQ:ARAY) , West Pharmaceutical Services, Inc. (NYSE:WST) and DexCom, Inc. (NASDAQ:DXCM) , each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Accuray has an expected earnings growth rate for the next quarter of 200%.

West Pharmaceutical has an estimated earnings growth rate for the next quarter of 3.4%.

DexCom has a projected long-term earnings growth rate of 36.7%.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Accuray Incorporated (ARAY): Free Stock Analysis Report

DexCom, Inc. (DXCM): Free Stock Analysis Report

HMS Holdings Corp (HMSY): Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.