- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why You Should Offload Fresenius Medical Stock Now

Fresenius Medical Care (NYSE:FMS) has had a dismal run on the bourses of late. Over the last three months, the company has added 4.4%, underperforming the broader industry’s gain of 5.2%. The current level is also lower than the S&P 500’s return of 5.5%. A rapidly changing healthcare environment in the United States, a sluggish third quarter, tough regulatory environment, difficulties in collecting trade receivables in foreign legal paradigms and competition in the niche markets have been posing significant challenges to the company. The stock has a Zacks Rank #4 (Sell).

Here we take a sneak peek at the major issues plaguing Fresenius at the moment:

Q3 Debacle

Fresenius ended the third quarter on a dismal note, missing the Zacks Consensus Estimate on both the counts. The misses were led by lackluster performance of the renal pharmaceutical segment, which primarily marred Latin-American revenues. We note that the Health Care Services segment at the region declined 1% year over year.

Stiff Competition

Fresenius has a number of competitors in the field of health care services as well as dialysis products. Tough competition from MedTech majors like DaVita Inc. (NYSE:DVA) is likely to impede the company’s sales opportunities and dent market share.

Unfavorable Regulatory Environment

Fresenius has a solid hold in the markets of North America, Europe, Asia Pacific and Latin America. Thus, the company faces the brunt of stringent regulations in almost every country in which it operates. Furthermore, Fresenius has to fulfill specific legal requirements that include tough antitrust regulations. Violating healthcare or other regulations under public law can result in serious legal repercussions.

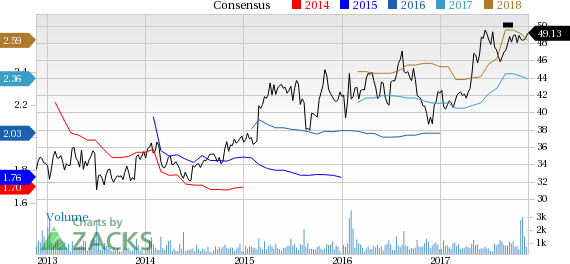

Overall, the estimate revision trend for Fresenius has been declining. For the current quarter, one analyst moved south compared to no movement in the opposite direction over the last two months. For the full year, two analysts moved down compared to no upward movement. As a result, the Zacks Consensus Estimate for current-quarter earnings declined by 3.2% to 61 cents. Full-year earnings estimates dropped 1.3% to $2.36 per share.

However, acquisitions have been a key catalyst for the company. In an initiative to boost its long-term strategy or the ‘Growth-Strategy 2020’, Fresenius Medical Care recently signed an agreement to acquire all outstanding shares of NxStage Medical (NASDAQ:NXTM) for $30 a share.

Meanwhile, a better-ranked stock in the broader medical sector is PetMed Express (NASDAQ:PETS) , with a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The company has a long-term expected earnings growth rate of 10%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Fresenius Medical Care Corporation (FMS): Free Stock Analysis Report

NxStage Medical, Inc. (NXTM): Free Stock Analysis Report

DaVita HealthCare Partners Inc. (DVA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.