- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why You Should Hold Onto Chemours (CC) Stock Now

The Chemours Company (NYSE:CC) is poised to benefit from increasing adoption of its Opteon platform and its productivity actions amid certain challenges including illegal imports of refrigerants.

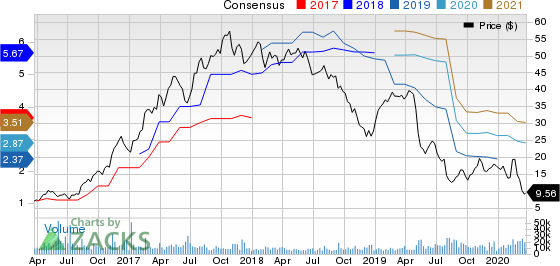

Shares of this chemical maker are down 73.8% over a year, compared with the 56.6% decline of its industry.

Let’s find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

What’s Working in CC’s Favor?

Chemours is benefiting from continued customer adoption of Opteon refrigerants. It is seeing strong adoption of Opteon for mobile applications. Chemours remains committed to drive Opteon adoption. It expects sustained adoption in the automotive segment this year. The company will also continue to ramp up the new low-cost Corpus Christi Opteon facility in Texas in 2020. The facility has tripled the company’s Opteon capacity allowing it to meet future demand.

The company also stands to gain from its actions to manage costs and drive productivity. Its productivity and operational improvement actions across its businesses are expected to support margins in 2020. For 2020, Chemours projects adjusted EBITDA of $1.05-$1.25 billion, up 13% year over year at the midpoint, factoring in the benefits of its productivity actions and improved operating performance.

The company also remains committed to return value to shareholders leveraging healthy cash flows. It generated strong free cash flow of $304 million in the last reported quarter, a nearly three-fold year-over-year increase. Chemours also returned $486 million to its shareholders in 2019.

Chemours expects to generate free cash flow of more than $350 million in 2020, more than doubling from $169 million in 2019, driven by lower capital spending. The company expects to use a significant portion of this to drive shareholder value this year.

Headwinds Remain

Chemours is facing headwinds from illegal imports of HFC (hydrochlorofluorocarbon) refrigerants into the European Union from China, which is hurting sales and margins in its Fluoroproducts segment. These illegal imports are hurting pricing and volumes of refrigerants. The headwind is expected to continue over the near term. Weakness in global automotive and electronics markets is also likely to affect volumes in the Fluoroproducts unit.

Moreover, Chemours is seeing pressure on Ti-Pure TiO2 (titanium dioxide) pigment volumes. The company witnessed lower volumes for these products during 2019 due to customer destocking. Softness is likely to sustain in the first quarter of 2020 amid a still challenging market environment. Weaker volumes are likely to continue to impact sales of the Titanium Technologies segment in the first quarter.

Stocks to Consider

Some better-ranked stocks in the basic materials space are Franco-Nevada Corporation (TSX:FNV) , NovaGold Resources Inc. (NYSE:NG) and Daqo New Energy Corp. (NYSE:DQ) .

Franco-Nevada has a projected earnings growth rate of 24.2% for 2020. The company’s shares have rallied roughly 45% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NovaGold has a projected earnings growth rate of 11.1% for 2020. It currently carries a Zacks Rank #1. The company’s shares have surged roughly 83% in a year.

Daqo New Energy has a projected earnings growth rate of 336.1% for 2020. The company’s shares have gained around 20% in a year. It currently carries a Zacks Rank #2 (Buy).

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Franco-Nevada Corporation (FNV): Free Stock Analysis Report

DAQO New Energy Corp. (DQ): Free Stock Analysis Report

Novagold Resources Inc. (NG): Free Stock Analysis Report

The Chemours Company (CC): Free Stock Analysis Report

Original post

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.