- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why You Should Hold On To ARRIS (ARRS) Stock Now

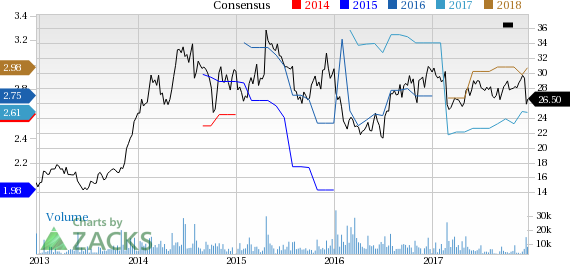

On Dec 20, we issued an updated research report on ARRIS International plc (NASDAQ:ARRS) . The stock has been downgraded to a Zacks Rank #3 (Hold) from a Zacks Rank #2 (Buy).

Positives

The company has an impressive earnings history, having surpassed the Zacks Consensus Estimate in each of the preceding four quarters with an average beat of 10%.

Moreover, we expect the company to perform well on the bottom-line front in the fourth quarter on its strong product portfolio. The company expects earnings (adjusted) between 74 cents and 80 cents in the fourth quarter of 2017.

We are impressed by the company’s recently inked deals to broaden its product portfolio. ARRIS recently completed the acquisition of Ruckus Wireless and ICX Switch units from Broadcom (NASDAQ:AVGO). The buyout is expected to be value accretive to its earnings in the first year.

The company’s efforts to reward shareholders through buybacks are also encouraging. ARRIS has bought back 5.7 million shares for $147 million so far this year.

On another positive note, the stock has seen the Zacks Consensus Estimate for current-quarter earnings being revised 1.3% upward in the last 30 days. Moreover, for 2017, the same has been revised 1.2% upward over the last 60 days.

The company has a VGM score of A, which further bolsters its attractive status. Here V stands for Value, G stands for Growth and M stands for Momentum.

In view of the above positives, we believe investors should retain the ARRIS stock in their portfolio now.

Key Picks

Some better-ranked stocks in the same space are Arista Networks, Inc. (NYSE:ANET) , SeaChange International, Inc. (NASDAQ:SEAC) and Westell Technologies, Inc. (NASDAQ:WSTL) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Arista Networks, SeaChange International and Westell Technologies have surged more than 100%, 60% and 53%, respectively, in a year.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

ARRIS International PLC (ARRS): Free Stock Analysis Report

SeaChange International, Inc. (SEAC): Free Stock Analysis Report

Westell Technologies, Inc. (WSTL): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

Original post

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.