- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why You Should Hold Avanos Medical (AVNS) Stock Now

Avanos Medical, Inc. (NYSE:AVNS) is likely to gain from a solid fourth-quarter show, while sluggishness in the Acute Pain business is a concern.

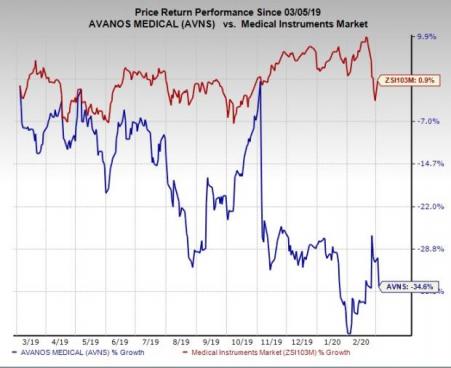

Shares of this company have declined 34.6% against the industry’s 0.9% rise in a year’s time. The current level also compares unfavorably with the S&P 500 index’s 9.6% rise over the same time frame.

This $1.56-billion medical technology company currently has a Zacks Rank #3 (Hold). Avanos’ earnings are expected to grow 13.3% in the first quarter of 2020. Also, the company has a trailing four-quarter positive earnings surprise of 0.1%, on average.

Let’s take a closer look at the factors that are working in favor of the company right now.

Q4 Earnings & Positive Developments

Avanos reported adjusted earnings per share (EPS) of 34 cents in fourth-quarter 2019, which rose by a penny year over year.

Revenues totaled $189.8 million, up 11.7% on a year-over-year basis.

Notably, the core Chronic Care segment recorded revenues of $113.4 million, up 15.5% year over year. Per management, the upside can be attributed to positive organic sales growth.

Additionally, the Pain Management arm reported net revenues of $76.4 million. The metric improved 6.6% on a year-over-year basis.

That’s not all. Management is optimistic about the FDA clearance of its new 80-Watt COOLIEF Radiofrequency System for neurological lesion procedures. Moreover, the upcoming launch of the company’s next-generation enteral feeding tube Mic-Key is likely to boost the Chronic Care unit.

Management at Avanos confirmed that the company expects lower foreign currency impact in 2020 in comparison to 2019.

Deterrents

Avanos continues to see pressure in its Acute Pain business, which saw a soft fourth quarter. Per management, ON-Q sales declined low-single-digits globally in the quarter. Also, in North America, sales declined low single digits.

Estimates Picture

For 2020, the Zacks Consensus Estimate for revenues is pegged at $739.1 million, indicating an improvement of 6% from the year-ago quarter’s reported figure. For adjusted EPS, the same stands at $1.13, suggesting growth of 5.6% from the year-ago reported figure.

Key Picks

Some better-ranked companies in the broader medical sector include Stryker Corporation (NYSE:SYK) , Accuray Incorporated (NASDAQ:ARAY) and IDEXX Laboratories, Inc. (NASDAQ:IDXX) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker’s long-term earnings growth is expected at 11.9%. The stock has a Zacks Rank #2.

Accuray’s fiscal fourth-quarter earnings is expected to skyrocket 200%.

IDEXX Laboratories’ first-quarter earnings growth is projected at 5.1%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Stryker Corporation (SYK): Free Stock Analysis Report

Accuray Incorporated (ARAY): Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.