- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why You Should Hold Alexandria (ARE) Stock Right Now

Alexandria Real Estate Equities, Inc. (NYSE:ARE) focuses on Class A properties concentrated in AAA innovation cluster locations, primarily for the life-science and technology entities. These locations are characterized by high barriers to entry, and a limited supply of available space. This highly dynamic setting adds to the productivity and efficiency of the tenants, which in turn, ensures steady rental revenues for the company.

As of fourth-quarter 2019, investment-grade or publicly-traded large-cap tenants accounted for 50% of annual rental revenues in effect. Furthermore, 76% of the annual rental revenues are from Class A properties in AAA locations. Weighted-average remaining lease term of all tenants is 8.1 years. For its top 20 tenants, it is 11.6 years.

High demand for Class A properties in AAA locations is boosting occupancy level The company is witnessing strong demand for space in key life-science markets. In fact, the company enjoys a solid 10-year historical occupancy rate of 96%. Such high level of occupancy is anticipated to continue in the upcoming quarters as well.

Moreover, during the October-December period in 2019, the company completed acquisitions of 23 properties for a total of $956.5 million. These acquisitions comprise 3.3 million RSF, including 2.1 million RSF of current and future value-creation opportunities.

Also, Alexandria has adequate financial flexibility to cushion and enhance its market position. The company had $2.4 billion of liquidity as of the end of fourth-quarter 2019. Its weighted average remaining term on outstanding debt is 10.4 years. The company has no consolidated debt maturities until 2023. Further, the company generates 95% unencumbered NOI, which is encouraging.

However, Alexandria has an active development and redevelopment pipeline. As of Dec 31, 2019, the company has 2.1 million RSF of Class A properties under construction. Moreover, it has 6.3 million RSF of near-term and intermediate-term development and redevelopment projects, and 3.8 million SF of future development projects.

Though this development pipeline is encouraging for long-term growth, it exposes the company to rising construction cost risks and lease-up concerns. Moreover, it has exposure to Canada and Asia through its subsidiaries, and is thus exposed to currency-fluctuation risks, while disruptions in global economy are concerns.

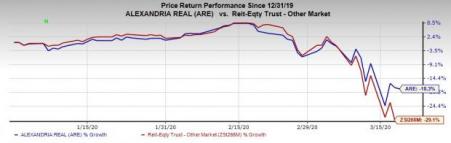

The market has been choppy reflecting uncertainty over the coronavirus outbreak. However, shares of this Zacks Rank # 3 (Hold) company have depreciated 18.3%, which is narrower than its industry’s decline of 29.1% year to date. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks to Consider

Highwoods Properties (NYSE:HIW) currently carries a Zacks Rank of 2 (Buy). The Zacks Consensus Estimate for the current-year FFO per share moved marginally upward to $3.63 over the past two months.

Plymouth Industrial REIT (NYSE:PLYM) carries a Zacks Rank of 2. The Zacks Consensus Estimate for the ongoing-year FFO per share moved 2% north to $2.08 over the past month.

Piedmont Office Realty Trust (NYSE:PDM) also carries a Zacks Rank of 2. The company’s FFO per share estimate for 2020 moved up 3.2% to $1.96 in two months’ time.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Highwoods Properties, Inc. (HIW): Free Stock Analysis Report

Piedmont Office Realty Trust, Inc. (PDM): Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE): Free Stock Analysis Report

PLYMOUTH IND RE (PLYM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

There are more than two reasons why NVIDIA’s (NASDAQ:NVDA) stock price can rally another 30% or more in 2025, but the two that underpin the others are data center and automotive...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.