- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why You Should Hold Alexandria (ARE) Now

Alexandria Real Estate Equities, Inc. (NYSE:ARE) is experiencing high demand for its Class A properties in upscale locations, which is boosting its occupancy. Also, strong internal and external growth, robust cash flow and solid balance sheet are its strengths. However, disposition of non-core assets has a dilutive impact on its earnings. Further, a rise in the rate of interest and foreign currency fluctuations are the concerns before it.

Late January, Alexandria reported fourth-quarter 2017 adjusted funds from operations (FFO) of $1.53 per share, which missed the Zacks Consensus Estimate by a penny. Nonetheless, the figure came in higher than the prior-year quarter tally. The company also witnessed encouraging year-over-year growth in revenues, with full-year 2017 revenues exceeding $1 billion for the first time.

Alexandria focuses on Class A properties concentrated in urban campuses, primarily for the life science and technology entities. These locations are characterized by high barriers to entry and exit and a limited supply of available space. This highly dynamic setting adds to the productivity and efficiency of the tenants, which in turn, ensures steady rental revenues for the company. In fact, as of Dec 31, 2017, 55% of the annual rental revenues were derived from investment-grade tenants, whereas 80% of the annual rental revenues came from Class A properties in AAA locations.

Additionally, the company continues to execute and deliver strong internal growth. During fourth-quarter 2017, same-property cash net operating income (NOI) growth was solid at 4.5%. The quarter saw rental-rate growth of about 24.8% and on a cash basis, it was up 10.4%. In addition, robust external growth, in the form of development and redevelopment of new Class A properties in AAA locations, is likely to boost the company’s operating performance.

Nonetheless, Alexandria follows the strategy of recycling capital from high-value assets and the sale of non-core operating assets and non-strategic land parcels to finance pre-leased value-creation development and redevelopment projects. In fact, the company continues to look for opportunities to dispose non-core assets throughout 2018. The near-term dilution effect of such moves on earnings is unavoidable.

Further, the rise in interest rates is a challenge for Alexandria as the company has an exposure to long-term leased assets. Any rise in rates would increase the cost of financing acquisitions as well as investment and development activity expenses. Moreover, the dividend payout itself might become less attractive than the yields on fixed income and money market accounts.

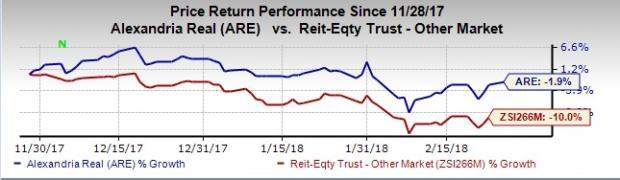

Alexandria currently carries a Zacks Rank #3 (Hold). In the past three months, shares of the company have outperformed the industry. While the stock has declined 1.9%, the industry has lost 10% during this period. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A few better-ranked stocks from the real estate space include CBRE Group, Inc. (NYSE:CBG) , FirstService Corp. (NASDAQ:FSV) and HFF, Inc. (NYSE:HF) . All three carry a Zacks Rank of 2 (Buy).

CBRE Group’s Zacks Consensus Estimates for 2018 earnings per share have been revised 6.4% upward to $2.98 over the past month. Its share price has risen 9.1% in three months’ time.

FirstService Corporation’s earnings per share estimates for the current year have inched up 11.8% to $2.65 in a month’s time. Its shares have gained 4.2% over the past three months.

HFF’s earnings per share estimates for 2018 have been revised upward 10.9% to $2.35 over the past month. The stock has gained 4.7% during the past three months.

Note: FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

HFF, Inc. (HF): Free Stock Analysis Report

CBRE Group, Inc. (CBG): Free Stock Analysis Report

FirstService Corporation (FSV): Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.