- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why You Should Get Rid Of CenterPoint Energy (CNP) Now

CenterPoint Energy, Inc.’s (NYSE:CNP) operations are subject to the impact of weather patterns. Toward this, the Hurricane Harvey that hit the city of Houston in August 2017 disrupted the company’s operations during the third quarter of 2017.

The company estimates that as a result of Hurricane Harvey, total costs to restore the electric delivery facilities damaged will range from $110 - $120 million, while that for restoring natural gas distribution facilities damaged will range from $25 - $30 million.

Surely this impacted the company’s third quarter results as is evident from the 4% decline observed in the operating income of its Electric Transmission & Distribution segment. Moreover, CenterPoint’s total expenses during the third quarter increased 13.3% year-over-year.

Coming to its earnings performance, the company’s third-quarter 2017 earnings missed the Zacks Consensus estimate by 4.9%. Quarterly earnings also declined 4.9% on a year-over-year basis.

Additionally, the company is subject to severe regulatory and judicial proceedings along with fluctuating commodity prices. Any adverse decisions in pending regulatory cases can affect CenterPoint Energy’s earnings substantially.

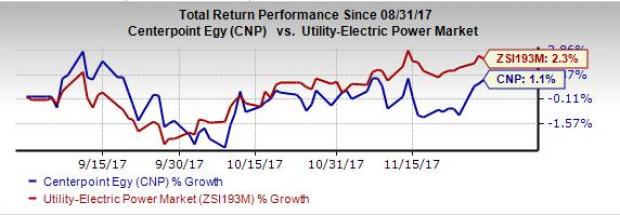

These may have led the company's shares to underperform its broader industry in last three months. Evidently the company gained 1.1% in the last three months, compared with the broader industry's growth of 2.3%.

Zacks Rank & Key Picks

CenterPoint Energy currently carries a Zacks Rank #4 (Sell). Investors can consider better-ranked stocks in the same industry such as PNM Resources, Inc. (NYSE:PNM) , IDACORP, Inc. (NYSE:IDA) and UNITIL Corporation (NYSE:UTL) , all of which carry Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

PNM Resourcesposted positive earnings surprise of 9.41% in third quarter of 2017. Additionally, its current year estimates have increased to $1.86 per share from $1.85 per share in the last 60 days.

IDACORP posted positive earnings surprise of 8.43% in third quarter of 2017. Additionally, its current year estimates have increased to $4.08 per share from $4.00 per share in the last 60 days.

UNITIL Corporation reported positive earnings surprise of 45.45% in the third quarter of 2017. Its current year estimates have increased to $2.03 per share from $1.98 per share in the last 60 days.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report

IDACORP, Inc. (IDA): Free Stock Analysis Report

UNITIL Corporation (UTL): Free Stock Analysis Report

PNM Resources, Inc. (Holding Co.) (PNM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.