- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why You Should Dump Enbridge Energy (EEP) Stock Now

On Nov 22, Enbridge Energy Partners, L.P. (NYSE:EEP) was downgraded to a Zacks Rank #5 (Strong Sell).

Key Factors

Over the last 30 days, the Zacks Consensus Estimate for fourth-quarter 2017 earnings has been revised down from 25 cents to 20 cents. Moreover, for 2017, the Zacks Consensus Estimate was revised downward from earnings of 77 cents to 72 cents over the same time period.

We are concerned about the huge debt burden as reflected by the partnership’s long-term debt of $6,291 million, as of Sep 30, 2017, which is significantly higher than $4,777 million as of Dec 31, 2013. On top of that, current debt of $400 million, as of Sep 30, 2017, escalated from no short-term debt, as of Dec 31, 2016.

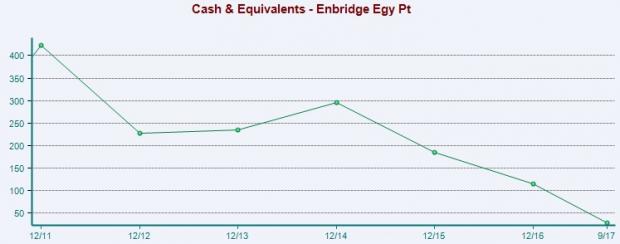

Also, cash balances have also reduced drastically. From $295 million as of Dec 31, 2014, cash balance slipped to $28 million, as of Sep 30, 2017. Hence, the rise in debt burden and decline in cash balance reflect the weakness in the partnership’s balance sheet.

On top of that, Enbridge Energy has not been able to generate healthy net operating cash flow. The trailing twelve-month free cash flow of $843 million, as of Sep 30, 2017, is way below $1,416 million reported as of Dec 31, 2016.

.jpg)

The third-quarter 2017 results of Enbridge Energy are not impressive. The partnership reported adjusted earnings of 24 cents per unit, which missed the Zacks Consensus Estimate by a penny. Also, total revenues were $616 million, down from the year-ago level of $1,120.6 million.

Enbridge Energy’s pricing performance fails to impress as well. Year to date, the partnership has lost 48.4%, underperforming the industry’s 22.8% decline.

Stocks to Consider

A few better-ranked players in the energy space are China Petroleum & Chemical Corporation (NYSE:SNP) , Northern Oil and Gas, Inc. (NYSE:NOG) and ExxonMobil Corporation (NYSE:XOM) . China Petroleum and Northern Oil sport a Zacks Rank #1 (Strong Buy), while ExxonMobil carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Headquartered in Beijing, China Petroleum is a leading integrated energy player. The company will likely witness year-over-year earnings growth of 59.1% in 2017.

Based in Minnetonka, MN, Northern Oil is an upstream energy player. The company’s 2017 revenues are estimated to grow almost 44%.

Headquartered in Irving, TX, ExxonMobil is the largest publicly traded energy firm. The company managed to beat the Zacks Consensus Estimate in three of the last four quarters, the average positive earnings surprise being 8.81%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

China Petroleum & Chemical Corporation (SNP): Free Stock Analysis Report

Enbridge Energy, L.P. (EEP): Free Stock Analysis Report

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Whenever Wall Street authoritative figures, such as a large institution or individual investor, decide to shift a view on a specific stock or industry, retail traders can...

Monster Beverage (NASDAQ:MNST) faces headwinds that make it a potentially scary buy, including weakness in the alcohol segment. With the alcohol business contracting in Q4 2024,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.