- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why You Should Add Fortive (FTV) To Your Portfolio

Fortive Corporation (NYSE:FTV) is currently a well-performing technology stock and a rise in share price and strong fundamentals signal its bullish run. Therefore, if you haven’t taken advantage of the share price appreciation yet, it’s time you add the stock to your portfolio.

The company has performed extremely well so far this year and has the potential to carry on the momentum in the near term.

Here are a few reasons why the stock is worth considering

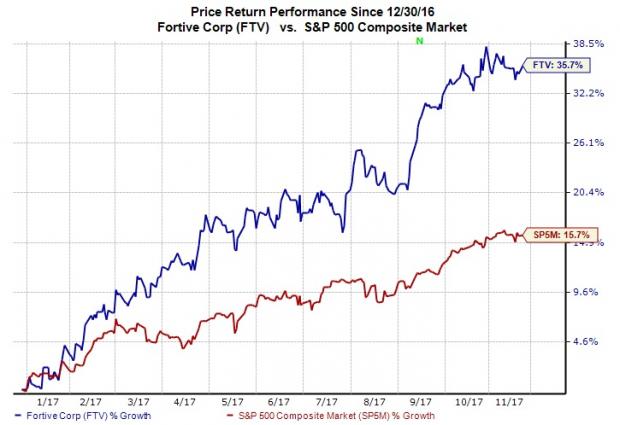

An Outperformer

A look at the company’s price trend reveals that the stock has had an impressive run on the bourse year to date. Fortive has gained 35.7%, significantly outperforming the S&P 500’s rally of 15.7%.

Solid Rank & VGM Score

Fortive carries a Zacks Rank #2 (Buy) and has a VGM Score of B. Our research shows that stocks with a VGM Score of A or B when combined with a Zacks Rank #1 (Strong Buy) or #2 offer the best investment opportunities to investors. Thus, the company appears to be a convincing investment proposition at the moment.

Northward Estimate Revisions

For the current year, 10 estimates moved north over the past 30 days versus no southward revisions, reflecting analysts’s confidence in the company. Over the same period, the Zacks Consensus Estimate for the current year increased 1.8%.

Positive Earnings Surprise History

Fortive has an impressive earnings surprise history. The company outpaced the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average positive earnings surprise of 3.8%.

Strong Growth Prospects

The company’s Zacks Consensus Estimate for 2017 earnings of $2.85 reflects year-over-year growth of 13.4%. Moreover, earnings are expected to register 12.3% growth in 2018. The stock has long-term expected earnings per share growth rate of 10.1%.

Solid Growth Drivers

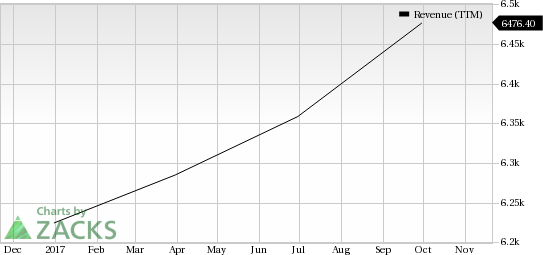

Fortive has a well-diversified product portfolio, which consists of professional and engineered products, software and services. These products are sold to a variety of end markets with secular tailwinds such as communications & networking, sensing, traffic management, and franchise distribution, among others. This ensures consistent top-line performance and indicates potential for improvement. Fortive’s recently reported third-quarter 2017 revenues surged 7.5% year over year.

Fortive Corporation Revenue (TTM)

Fortive’s foray into the Cloud computing segment is very encouraging. The recent acquisition of eMaint Enterprises by its subsidiary, Fluke and the acquisition of Global Traffic Technologies has accelerated Fortive’s push into the rapidly growing cloud computing market. The deal provides cloud/SaaS solutions for asset and equipment management mainly for industrial applications.

Fortive is quite active on the acquisition front. It closed acquisitions of Industrial Scientific, Orpak and Landauer during the third quarter. These acquisitions are expected to strengthen Fortive’s product technology expertise and boost recurring revenues, going forward. In the third quarter, acquisitions contributed 1.8% to top-line growth.

Management is focused on improving gross and operating margins. The company is making efforts to improve its existing portfolio and acquire businesses over time that will aid its top- and bottom-line trajectory.

The company’s Fortive Business System (“FBS”), which is a set of tools that include voice of the customer, value stream mapping, Kaizen basics, lean conversion, accelerated product development, daily management and problem solving, is aimed at expanding its operating margins.

Other Stocks to Consider

Other stocks worth considering in the broader technology sector include Activision Blizzard (NASDAQ:ATVI) , Applied Materials (NASDAQ:AMAT) and Alibaba (NYSE:BABA) , each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings per share growth rate for Activision, Applied Materials and Alibaba is projected to be 13.8%, 16.9% and 30.7%, respectively.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them? Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Fortive Corporation (FTV): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.